Spread Bet on Standard Chartered plc Shares

Standard Chartered plc is an international bank and financial services company, head-quartered in London. It operates in more than 70 countries, and most of its profits come from Africa, Asia, and the Middle East, perhaps because of its origins. The bank was formed in 1969 from a merger of The Chartered Bank of India, Australia and China and the Standard Bank of British South Africa. Its primary listing is on the London Stock Exchange, where it ranks 13th, but it also has listings on the Hong Kong Stock Exchange and the National Stock Exchange of India.

The Chartered Bank was founded in 1853, and opened branches in India, China, Hong Kong, and Singapore. The Standard Bank was founded in 1862 in South Africa, and its business was helped by the development of diamond and gold extraction in that country. In 1962 the bank changed its name to Standard Bank Limited. When the banks merged in 1969, they looked towards expanding their network into Europe and the United States, and made several minor acquisitions.

There were some scandals in the 1990s, resulting in some losses and selloffs, and things did not truly stabilize until 2000, when Standard Chartered expanded its operations by purchasing Grindlays Bank. This action meant that Standard Chartered became the largest foreign bank in India. There was a succession of acquisitions, including Indonesia, Thailand, Pakistan, Taiwan, and other Asian countries.

Standard Chartered is focused primarily on emerging markets and has benefitted from Asian financial growth, which could be set for a hard landing. Barclays has seen considerable reputation and financial damage over the LIBOR and PPI mis-selling scandals. Investors have learnt that payment protection insurance (PPI) was sold much more widely than they first thought. Industry insiders have long known, however, that PPI was being sold not just in bank branches but alongside second charge mortgages, through obscure subsidiaries motor finance and anything with long-term personal borrowing. This has been reflected in the adjusted provisioning.

Lately Standard Chartered plc has been caught in a scandal where the bank was accused of having conducted business dealings with Iran by US regulators. Particularly on 6th August 2012 it was alleged that Standard Chartered had concealed 60,000 transactions with Iran between 2001 and 2010 totalling $250 billion for Iran institutions that eventually led the UK bank to pay a $340m fine. The bank was branded as a ‘rogue institution’ by USA regulators and its state banking license in the USA was in jeopardy and consequently its stock fell as much as 30% in the following two days of trading. Luckily, for spread betters, it is possible to make profits from both shares rising or falling in value or traders could take a short position on Standard Chartered shares if they wanted to.

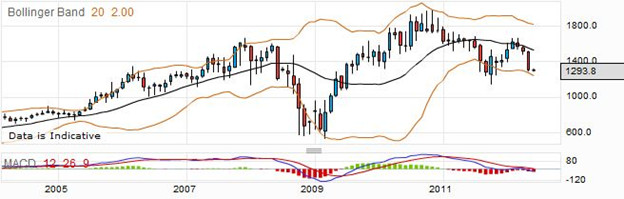

Looking at the monthly price chart above, you can see that Standard Chartered was not affected by the global economic recession at its start, but then plummeted in value, as many other financial services companies did. It showed some strength in coming back and in 2010 achieving new highs. It is an obviously volatile stock, and therefore is recommended for those who have some experience in spread trading, who may find that the volatility allows them to make good profits.

How to Spread Bet Standard Chartered Shares: Rolling Daily

Standard Chartered is a large international bank, and is ranked 13th company in size on the London Stock Exchange. The current price for a rolling daily bet is 1290.2 – 1292.8. As the stock price shows some volatility, you must be cautious when spread betting on the shares. If you think that the shares will go up in price, you could open a long bet at the buying price of 1292.8, staking perhaps £3.50 per point.

Assuming that the price goes up as you hoped, then you might find that you would close the position and take your profits when the quotation went to 1406.3 – 1408.9. To work out how much you have won, first you must calculate how many points you made. The long bet opened at 1292.8, and it closed at the selling price of 1406.3. The difference between these prices is 113.5 points. You staked £3.50 per point, which means that you would win £397.25.

Of course, the price might have gone down instead of up, and you should be prepared to accept your loss. Perhaps the price went down to 1185.4 – 1188.0, and you decided to cut your losses and close the spread trade. The starting price for your bet was the same, at 1292.8, but this time the bet closed at 1185.4. 1292.8 minus 1185.4 is 107.4 points, and multiplying this by your stake you find that you have lost £375.90.

Many traders use stop loss orders to help control their losses. These orders close the spread bet when a certain level of loss which you define is reached. Perhaps using a stoploss order your bet would have been closed at 1236.5 – 1239.1, and this would have reduced your loss. 1292.8 less 1236.5 is 56.3 points. For your chosen stake, this would amount to a loss of £197.05.

Standard Chartered Futures Bet: Standard Chartered Shares

To take a slightly longer view of the market than you have with a rolling daily bet, you might use a futures based bet. These are usually for three different time periods, the near quarter, mid-quarter, and far quarter. The current quotation for the far quarter is 1293.8 – 1305.8. Feeling bearish about the prospects for Standard Chartered plc, you could take out a sell or short bet for £2.50 per point.

If your decision was correct, you might find that the price went down to 1089.6 – 1101.2, and you could close your trade and collect your winnings. As this was a short bet, the starting price would be the selling price of 1293.8, and the bet would close at the buying price of 1101.2. Taking one away from the other, you find that you have gained 192.6 points. If you multiply this times your stake, your winnings work out to £481.50.

You should not expect to always place winning bets. Even the best of spread betters have their share of losing bets, and perhaps in this case the price would go up to 1456.1 – 1467.2 after you placed your short bet. You close your bet to prevent further loss. The starting price was 1293.8, as before, and this time the closing price was 1467.2. The difference between these of 173.4 points count against you, as the price went up, not down, as you had bet. Therefore you lose 173 times £2.50, which is £433.50.

You could use a stop loss order to help you keep losses to a minimum. The stoploss requires your spread betting provider to close the bet, if the losses reach a level that you set in advance. Using this, perhaps your bet would be closed at 1405.6 – 1416.8. Looking at how much this losing bet has cost you, the difference in points is 1416.8 minus 1293.8, a total of 123 points. For your chosen size of stake, you have lost £307.50.

Join the discussion