A Trading System

A trading system is essential to every trader. I cannot stress how important it is, purely for the reason that a decent trading system will help eliminate FEAR and GREED, the two ogres of bad trading. With a trading system you simply have to follow the signals, and with some decent good money management skills you’ll already be ahead of the majority of speculators.

The key to understanding the markets in not rocket science. I only say this because if a method looks too complicated and requires a lot of judgment on the part of the trader then it is more than likely that it will not work. Above all, the method should never require the trader to make decisions about where the market will go, the method should tell you in a very simple and clear manner when to buy/sell. All you need to know is a simple mechanical system that tells you when to buy and when to sell. The method should be based on well founded mainstream scientific principles.

The Elements of a Trading System

A trading system is basically a number of rules controlling how you trade. It is the mechanism which a trader bases himself on to make trading decisions. Having an appropriate trading system which you can rely on is essential. In reality most ‘sound’ trading systems are fairly similar in that they all mostly follow good money management principles, controlling losses, pyramiding and letting winners ride and most are based on longer timeframes. A good system will be compatible with a trader’s own personal beliefs and as such will be complete in every manner. Good sytems automate the entire decision-making process so as to remove any subjective emotions from coming into play. Such a trading system will boost your confidence, consistency and discipline which are critical to every trader’s success.

A suitable trading system for you would be one that you can follow without too many problems. As such it shouldn’t be surprising that when thinking about a trading system for you, this should start with an understanding of your own personal beliefs. What exactly do you want from the markets? Fast profits? Many people are driven to trading by this hope but very few traders are consistently profitable in the long run. Most veteran traders often have other purposes than just making money.

If you want to consistently achieve outstanding returns from your trades, craft a system that is a reflection of your own personality and beliefs. If you can do this, and truly fine-tune a system that is uniquely you, you will gain your own superior edge in trading the markets.

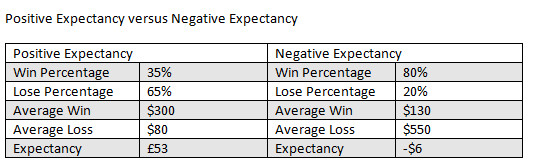

Key to trading successfully is to have a winning edge and this is where having a positive expectancy trading system comes into place. If you knew that for every pound you risked, you would ultimately be getting a pound plus a little bit more you would likely trade with more confidence. Expectancy is all about extracting profits from the market on a consistent and steady way.

A positive expectancy trading system is about make sure that the trades you get right are earning you more than your losing trades.

To calculate expectancy:

(Percentage win x Average win) – (Percentage loss x Average loss).

Adhering to this simple formula can help save you thousands in wasted trades.

Of the two trading systems illustrated above, the positive expectancy system makes on average $53 per trade while the negative expectancy one loses $6 on average on each trade.

Please note that irrespective of whatever money management system you employ, a negative expectancy trading system will end up wiping out your account.

Elements of a Complete Trading System.

1. Your Philosophy:

Why do you want to be a trader? What exactly do you want to achieve from trading the markets. What are some of the things apart from money you think being a trader will bring you?

2. Goals and Objectives:

Set goals and keep your goals in focus. You need to remain concentrated on where you’re going and what you are trying to achieve. Decide what returns you are aiming in the short, medium and long term.

3. Markets to Trade:

Which markets do you intend to trade. Different markets tends to attract different kind of speculators. Try to find one that matches your trading style.

4. Position Sizing / Money Management:

How much are you prepared to risk per trade. Position sizing is one important area that you cannot afford to ignore as it affects both diversification and money management.

5. Entry Strategy:

Define how you will enter trades. Good entries are important if you are to keep losses small even when the trades move against you.

6. Stop Loss:

Exit losing positions. If the trade moves against your position, you need to have an exit plan. You need to know exactly at which point you will exit, before you even enter the trade.

7. Exit Strategy:

At which point will you exit trades? Very few traders plan an exit strategy but you need clear rules to follow. At the end of the day trade exits will determine whether you are profitable or not.

Remember, “always trade with structure”. Design and trade with a system of your own rules that you will be comfortable with

How often do you have to be right in order to make a profit?

When I was first asked this question I said 50%, and that was a long time ago, before I started trading for the bank. I find that most people still give a percentage answer. The correct answer, however, is….once. Think about it. Don’t be fooled by people selling trading systems that are right 80% of the time. If it’s a good system they’ll give you real past data of profits. I don’t care how often I’m right, as long as I make money. I can make 100 points on one trade, then have 20 losing trades of 1 point, I’ll still be 80 points up.

Don’t touch any trading systems unless you have seen data from REAL TRADES. And don’t buy a system unless you have been shown genuine past trades – NOT PAST THEORETICAL DATA. Anybody can make up a trading system with hindsight, and that’s what the majority of system sellers on the internet have done. You’re not an idiot – you want a system that has been around for at least a few years, and has been traded for real, not on a theoretical basis.

If you want to demonstrate how easy it is to make up a trading system according to past data, get a copy of metastock and backtest various indicators. You’ll find you can easily get annualised returns of several hundred percent. If you were to trade this with spread betting or CFDs, or anything that will leverage this up, you could then quite legitimately claim you had invented a trading system which ‘returns several thousand percent per year! Proof of returns every month since 1986!’

If you don’t look after your money – who will?

It’s time to get organised. Your trading system should have the following characteristics -:

- The trading system must be as mechanical as possible. This means you shouldn’t have to think about whether you go long or short. The system should tell you when to enter and when to exit – you never need to decide anything for yourself. When you start deciding by yourself you WILL get clubbed by the two ogres of trading – FEAR and GREED.

- The system should not just tell you when to enter a trade. Most amateur traders are obsessed with when to enter. Your system should make clear when you plan to exit a trade. Even more importantly, the system should make money management absolutely clear. Larry Williams, one of the most successful traders alive, says that money management is the single most important variable in any trading system. Get that right and you WILL make money.

- The system must have real trading results that take into account commission, slippage, and isn’t simply a backtested strategy that anyone can create with some charting software..

- The system must have a low drawdown. Drawdown is the amount that a trade will go against you before it moves in your favour. It sounds great to buy at 100 and sell at 110, right? but it’s no good if you buy at 100, it falls to 15, and then goes up to 110. You will have been stopped out ages ago! and think of the stress all the way down! Two aspects to consider is the percentage drawdown, and the length of time of the drawdown – ideally you want to minimise both.

- The system should show market direction independence. This isn’t an essential quality but will increase your annual returns. You should be able to make money in an up and and down market – this is one of the advantages of spread betting and CFDs.

Join the discussion