Reaccumulation

Indifferent relative strength kept us out of WMT during 1992, even though the stock’s nominal price moved up over that period. As 1993 gets underway there is little evidence of organized distribution, apart from increased volatility. There is no good reason to make a trade in the stock, long or short, so we remain neutral.

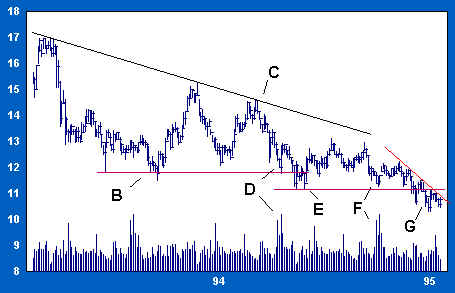

However, flagging relative strength was a sign that the stock’s advance was weakening, and shortly after the new year, WMT begins to slide. The initial drop is precipitous, but encounters support around 13. WMT trades irregularly lower before a shakeout at B sets up a sharp recovery.

After rallying from B, WMT immediately gives back most of the gain before a weak rally tests the downward sloping trendline of both nominal and relative prices at C (see below). The stock is set up for a short sale. There is ample evidence of weakness, and the recovery into overhead supply offers a low-risk opportunity to test the short side.

But the trade is less than compelling. By the beginning of 1994 technical indications for WMT are mixed. The weakness of the stock is offset by evidence of support around 12, and from the beginning, signs of organized distribution have been paltry. Despite these reservations, we decide to take the short, but we trade small and with a close stop.

From C WMT declines into an area of support at D (see chart below). From the sharp increase in volume as support is approached we conclude that weak traders are selling into the bag en masse.

The rally from D is short-lived, however, and price declines again, this time below all previous support. Given signs of support at D, the new low at E might be a bear trap, but at this point, a bullish interpretation is tenuous. Our commitment to our short position is weak enough and our suspicions of a shakeout strong enough that we decide to cover on any reversal of the downward trend.

WMT rallies back above support around 12. The sharp rally slams the trap shut. It now appears that the break was indeed a shakeout and that strong hands are taking control near the lows. We cover our small short position at the market.

WMT rallies, then hovers between 12 and 13 for several months, before testing support again on a decline to F (see below). Volume increases, spread narrows, and price churns. It is becoming clear that strong hands are taking all offers below 12. But the volume on this retest of support remains relatively high, a sign that sellers are still numerous.

More dull trading. Then the stock shatters all previous support on the decline to G. Volume, however, does not reach the same high levels it did at F or, earlier, at D. Sellers may now be exhausted. Again we suspect a shakeout. Still, there is no evidence of strength, so we remain neutral.

If this is a shakeout, potential overhead supply has been frightened out low in the range. As a result, any subsequent rally is likely to encounter lighter selling than would otherwise have been the case.

To the casual observer, the tape over the last two years has offered little bullish encouragement. The stock has been weak, and volume has increased on declines. But the price-volume character of liquidation and accumulation are very similar. In either case, volume expands on declines, and, even during accumulation, price action may continue weak. The quality of trading around the lows of the range is key to detecting accumulation.

As noted in our earlier study of GE, increased volume accompanied by high-low compression at trading lows is an early sign that shares are being accumulated. The tendency of the price to consistently rally out of new lows is another sign that strong hands are taking advantage of shakeouts to gather in shares from weaker traders.

Over the last 18 months, WMT has progressed through a series of shakeouts within a relatively narrow price range, from 12 to 10. Multiple shakeouts and high volume toward the bottom of the range indicate that a battle is being waged around the lows, where strong hands are most active during accumulation. Under cover of weakness, strong hands are taking in shares.

We want to take an initial long position as close to friendly support as possible, but our discipline requires some indication that the stock is on the threshold of markup. A rally back above recently broken support around 11 1/2 will be our cue to take an initial long position at the market.

Join the discussion