Shakeout

The shakeout was a tactic often employed by trading pools. Harriman, in particular, favored the shakeout as a device for forcing traders to part with shares cheaply. His method was to first gather in all the ready supply within a trading range. The stock was held to a narrow range for weeks at a time so that traders became frustrated by the lack of action. Then one or more false downside breakouts were engineered to drive out weak holders who either had placed stops under the market or could be frightened off by a sign of weakness. His method, in short, was to wear them out, then scare them out.

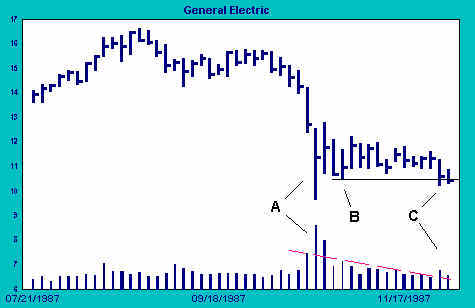

By early December, there are still traders of GE sitting with losses. Their hope is to get out even, or at least to recover part of their losses by selling into a rally. Selling will dampen any rally, so before a tradable advance can begin, these weak sellers must be dislodged.

If the previous low at B is broken, nervous traders might conclude that another downwave is about to begin, that it is better to get out now rather than to wait for a rally which might not come. The more daring might even add to selling on the break by selling short.

Downside shakeouts, sometimes referred to as “bear traps” are bullish setups because they are effective in reducing overhead supply. Overhead supply is created by sellers who take advantage of short-term rallies to unload. Overhead supply impedes the ability of a stock or an index to rally.

But bear traps radically alter that supply-demand dynamic. A bear trap forms when important support is broken. The break forces sellers overhead to sell the break instead of waiting for the next rally, washing out weak hands on sell stops. That forced selling reduces the number of shares now for sale at higher prices, thus weakening overhead supply. Once the trap closes, that is, once price rallies convincingly off the low, sold-out bulls and trapped shorts are forced again to act, but this time as buyers. These sellers-turned-buyers are joined by other buyers to produce solid rallies which often carry beyond established resistance.

Of course, there’s a catch. You can’t tell you’ve got a bear trap for sure until it closes, until there is a convincing rally off the lows.

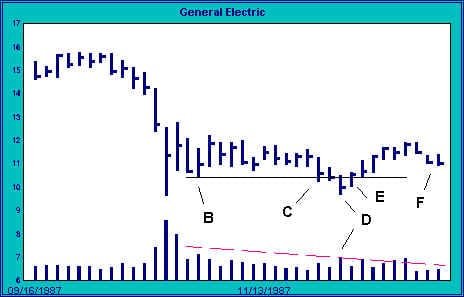

Up until now, indications have been very positive that strong hands are providing support for the stock. As GE breaks below support at B, we must be alert for the possibility of a shakeout. If the action at C through D turns out to be a shakeout, there is a good chance that the high of the trading range, at a price of about 12, will be breached to the upside.

At point D, volume rises to its highest level in weeks. The battle between frightened sellers and bargain-hunting buyers is heating up. The next period’s action (E) shows that buyers have once again taken control. Volume on the rally at E is light. This should not be interpreted bearishly. Sellers have been squeezed out, and the stock is now “light”. With little supply to impede the advance, moderate buying is enough to close the stock back above support at E (see support line).

We recognize the downside breakout as a shakeout. Sellers and short-sellers have been trapped. We now have every reason to expect that a strong rally will close the trap quickly.

Knowing that buyers are now in control, we take an initial long position at 10 1/2. By buying so close to support, we limit our risk. Should our immediate expectations not pan out, we are ready to jettison our position quickly and take a small loss. But we also know that a successful shakeout can produce a good rally which has a chance of carrying well beyond resistance around twelve.

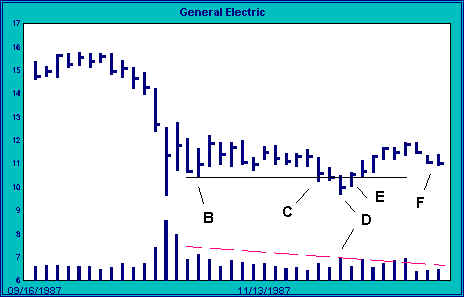

As expected, a rally challenges supply around 11 3/4. We note that volume increases at that point. Buyers are running into increased selling at that level, but price action remains positive. Our bet is that supply has been sufficiently reduced by the shakeout to allow a move above 12, so we maintain our initial long position. But supply is strong enough to repel a first attempt to break out, and the price reacts to F. We remain long, but alert.

Join the discussion