Cycles Within Cycles

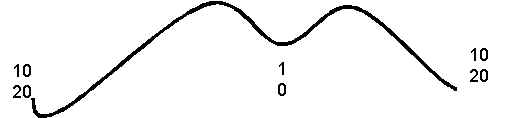

The key to trading with cycles is an understanding of the interplay of cycles within cycles. Almost all trading cycles have a ½ trading cycle (see following illustration). A 20-day (bar) trading cycle has within it two 10-day (bar) cycles. One 10-day cycle begins as the 20-day cycle begins and bottoms halfway into the 20-day cycle. As the first 10-day cycle ends the second 10-day cycle begins, and it ends as the 20-day cycle bottoms. Therefore, a 20-day trading cycle always begins and ends with a 10-day cycle.

Two 10-day (Bar) ½ Cycles With a 20-Day (Bar) Trading Cycle

Awareness of the ½ cycles makes it easier to accurately identify and trade the 20-day trading cycle. Once you identify the low of the first 10-day cycle you know the next 10-day cycle bottom will most likely be the bottom of the 20-day as well. Important to know, because the accuracy of identifying 10-day cycles with the RSI3M3 mechanical buy signal averages 85% in daily charts, and is often as high in intra-day charts. In most markets the accuracy of identifying the 20-bar trading cycle is only 60% to 70%. Knowledge of the ½ cycles can greatly increase your accuracy in buying bottoms and selling tops of the trading cycle.

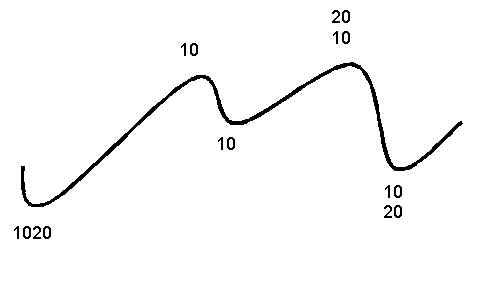

Right Translation Bull Markets

In bull markets showing right translation, the top of the 20-day cycle is most often the top of the second 10-day cycle. Right translation shows in the time periods for bottoms and tops of the trading cycle. On average the move from bottom to top will be three weeks, and the move from top to bottom, one week. Knowing this makes it easier to hold a long position through the decline into the bottom of the first 10-day cycle, or even add on to the long position, expecting to take profits as the second 10-day cycle tops, often with a mechanical sell signal.

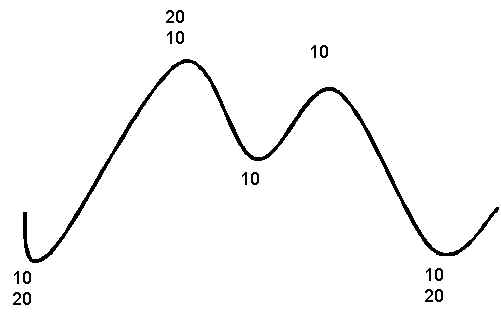

Left Translation Bear Markets

In a bear market with left translation the top of the 20-day cycle is most often made as the first 10-day cycle tops. Left translation shows in the time periods for bottoms and tops of the trading cycle. On average the move from bottom to top will be one week, and the move from top to bottom, three weeks. Knowing this can give you the confidence to hold a short position through the rise into the high of the second 10-day cycle, or add on to the short position expecting to take profits as the 20-day and 10-day cycles bottom with a mechanical buy signal.

At times the 10-day cycle will show up very distinctly. At other times it may seem to disappear, or it can be a combination of a short cycle and a long cycle. For example, the first ½ trading cycle may contract to seven days and the second may stretch to 13 days. Or the first ½ trading cycle may stretch while the second contracts. The 20-day cycle also contracts and expands, and as the dominant cycle its activity will affect lengths of the two ½- trading cycles.

If the 20-day cycle contracts to 15 days, the 10-day cycle may seem to disappear, or there may be two smaller cycles close to the same length such as seven and eight days. There can also be an extreme of a short and a long, such as a four and 11. If it stretches to 28 days, the ½ trading cycles are likely to be longer as well.

With cycles stretching, contacting and disappearing they can be hard to identify at times, and the lows and highs of the sensitive RSI3M3 detrend oscillator is a big help in identifying and trading the 10-day (bar) cycles and also the 20-day (bar) cycles.

Join the discussion