Trendlines 2

The most important thing to keep in mind about any trendline you draw is this: you are not the only trader drawing it. For that reason, the action of a stock in the area of a well-placed trendline reveals much about the quality and character of other traders active in the issue.

Trendlines are a popular device among “geometers” and other relatively unsophisticated traders. These traders are often drawn into a position as a trendline is approached, only to be shaken out once the trendline is broken. The breaking of trending support or resistance is as significant to the observant trader as a shakeout above or below stationary support or resistance.

The Counter-Trend Shakeout

The chart of Applied Materials below is good example of a counter-trend shakeout.

After peaking in mid 1997, AMAT retreated before building a base of accumulation from late-1997 to mid-1998. A terminal shakeout in the fall of ’98 not only broke below stationary support but also broke below the long-term trendline drawn from important support points in 1991 and 1996. Sell-stops placed below the trendline were triggered on the break, forcing weak hands to sell into the bag held by strong hands. So thoroughly was supply cleansed by this “double shakeout” maneuver that little resistance was encountered as price rallied directly to a new high.

Shakeouts above down-trending resistance produce a similar effect. The chart of Newmont Mining below shows a break above a well-defined supply line, drawn along several resistance points. First, shorts are encouraged as the price rallies to test this trendline in late ’97. On the breakout above the trendline, weak shorts were forced to cover, increasing the urgency of the rally. This apparently positive action drew in additional breakout buyers. Once the rally stalled, buyers realized their error and began selling in earnest, causing a collapse.

If technical conditions otherwise warrant a position in the direction of the trend, then, as a general rule, a counter-trend shakeout above or below a well-established trendline provides an excellent opportunity to take on or add to a position.

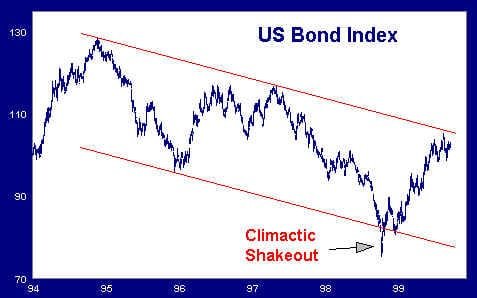

The Climactic Shakeout

Another version of the trendline shakeout is one in the direction of the trend. A climactic shakeout breaks through a trendline at the end of a sustained move, and is attended by a sharp price reversal, usually within one or two sessions, on very heavy volume, following an acceleration of price in the direction of the trend.

The climactic shakeout in the chart of the US Bond Index above is typical. (This chart shows bond rates, and the direction indicated by the chart is the inverse of the direction of bond prices.) The drop in rates accelerated in late 1998, breaking below the support trendline of the downward-sloping trend channel. This climactic shakeout resulted in a quick reversal. After an automatic rally and a test of support at the trendline, rates rallied strongly through the trend channel to the supply trendline descending overhead.

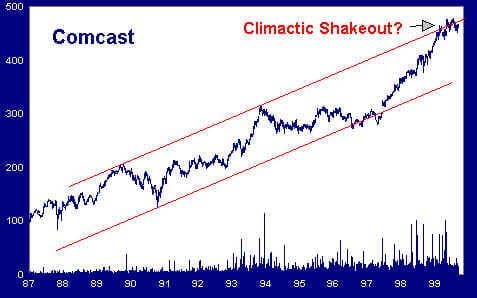

In the chart below, note that Comcast has consolidated for more than three years, beginning in 1994. This may be a base of accumulation from which a new leg up will begin. Nevertheless, overhead supply is apparent at the upper level of the three-year trading range. A shakeout would improve the technical condition of the stock by removing sellers near the lows.

Our trendline study of Comcast begins by first drawing a trendline along ascending supply. Normally we would draw a first trendline along support in the case of a rising trend, but in this case we reverse the procedure.

Next, a parallel trendline is drawn, anchored at the low support point reached in 1990.

We see immediately that price broke the support trendline in 1996, creating an oversold condition in the stock. This break may be enough to shake out weak traders and set the stage for a new rally. The question will only be resolved once the stock makes a new high, but we are encouraged by the strong long-term uptrend and the basing action over the last three years. The counter-trend shakeout offers an opportunity to take a position with the long-term trend.

The next chart shows that our analysis was correct. The price of Comcast gaps to an interim high, then rallies strongly.

As of this writing, Comcast has broken above the supply trendline and, as a consequence, is now overbought. Note the heavy volume on the break above trend. Is this a climactic shakeout?

Join the discussion