Binary Bets (‘Yes’ or ‘No’)

Another one of the newer forms of trade that we can make is a ‘binary bet’ (mainly available from Binary.com).

Binary betting represents another viable way of speculating on the financial markets that is a simple alternative to financial spread betting and in contrast to spread betting with binaries your risks are limited to the point that you know exactly how much you stand to gain or lose when you open the binary bet. These trades can be placed on Shares, or FX (Foreign Exchange – money to you and me) quotes.

Instead of being priced directly in relation to the underlying financial instrument, a binary bet is priced using options pricing criteria and values can thus be computed in a way that is more reminiscent of a traditional fixed odds bet. So in this respect a binary is similar in workings to a fixed-odds bet, but where odds are quoted on a scale between zero and 100 rather than in a fraction such as 4-1.

Binary betting sees a speculator able to place a bet on any stock, commodity, or forex. A price is offered and it can either be backed to come in higher after a fixed time (a Call), or lower (a Put). So as you can see binary betting is similar in style to that of fixed odds with the ability to limit your risk with a fixed return on particular outcomes to that trade, such as the FTSE to be down on the day or the DJIA (Dow) to be lower at the close. As with most trades you can close the trade early whenever you like.

Binary betting combines skill and strategy while bringing in an element of fun into the equation and the simplicity and quick-fire buzz renders this product somewhat unique.

How Binary Bets Work

It’s actually relatively simple as there are only ever two outcomes, which are either ‘true’ or ‘false’, or depending on your way of thinking, ‘yes’ or ‘no’. As with spread betting, a correct prediction will result in profit for the speculator, whilst an incorrect prediction will result in a loss. Let me explain.

Say you open a binary bet for the FTSE to close up (be higher than its opening price) on the day (close of business at 4.30pm), there are two outcomes as follows:

- The FTSE closes up on the day, the bet will settle at 100

- The FTSE fails to close up on the day, the bet will settle at 0

So as you can see with a binary, the value of the bet expires at either zero or 100 depending on whether or not a predefined condition is met within the allotted time frame. You either win or lose, with binaries there is no grey area of making a few points of profit, or indeed a spread. If at the end of the lifetime of the binary trade, the market level exceeds that of the start date (irrespective if by 1pt or 50pts), the binary bet will settle at 100. Should the closing price at expiry end up lower, the binary bet will settle at 0. So the closer the market price to 100 when the binary bet is opened, the shorter the ‘odds’ that the market will close at a higher price than the day before.

The key difference between making a binary bet as opposed to making a fixed odds bet, is that you can close the binary bet when YOU want. With fixed odds you do have to wait for that trade to expire. Which means you will be either able to cut your losses or take profit early without having to wait for the market to close. As the spread betting company, or broker or bookmaker – depends what you want to call them, tend to quote a continuous price, similar to that of spreads.

The binary ‘price’ is constantly fluctuating reflecting market sentiment at any particular point in time and the probability of the outcome materialising. As the prices are quoted continuously you can decide to go Long or Short on any price that is quoted. Binary bets tend to fluctuate quite a lot, especially prior to expiry but you are safe in the knowledge that you know your risk exposure and your possible reward.

Binary Betting Example:

It might be best to demonstrate the workings of binary betting by an example. Suppose you have noted that the FTSE 100 has retraced from its opening level, but you believe that it will rise back later in the afternoon. The binary price for the FTSE 100 to rise before the markets close is presently trading at 31 to 35. If you reckon that the FTSE 100 is likely to finish up at the end of the trading day, then you could buy at 35 for a determined amount per point, let’s say £30. On the other hand, if you believe that the FTSE 100 is likely to finish down you would sell at 31.

Your gains are computed by taking the closing price minus the opening price level multiplied by the stake per point. So, in the instant that you placed a £30 per point on the FTSE 100 to rise before market close; if you were correct then you would stand to win £1,950 [(100 minus 35) x £30]. However, if the FTSE 100 had finished down, then your losses would have amounted to £1,050 [(0 minus 35) x £30].

Let’s suppose that after the next few hours of placing your ‘buy’ binary, the FTSE 100 market remains fairly static but hovering up by about 40 points. The FTSE 100 ‘Up Binary Bet’ now is being quoted at 80.2 – 84.2. You decide to take your profits before expiry by selling £30 at 80.2 (a 45.2-point movement from 35 in your favour). Or you might decide to hold out until the close of trading to see if the bet settles at 100.

Betting in a Trendless Market

Incidentally, an advantage of utilising binaries over other trading products is that binary betting provides you the opportunity to take advantage of non-volatile markets and ranging markets, as well as markets that are constantly rising and falling. Spread betters of indices for instance would ideally like the markets to take a definite direction, either up or down to make easy money. The thing with spread betting is that unless a market is trending, there is little benefit to anyone holding the position – not so with binaries.

One of the main differences between spread betting and binary bets is that with binaries your maximum profit and loss are always known at the outset (before placing the bets). This is so because the binary market cannot rise above 100 or fall below 0 – as opposed to spread betting, in which there is no cap on your profit and loss potential beyond the deposit you provide. Another difference is that with binary betting, prices are not based on the underlying price of the asset in consideration, but instead these depend on the probability of the market closing higher or lower than a particular fixed point in time. That’s why the buy/sell price of a binary bet is always quoted between 0 and 100.

The type of binary Bet that you can place are as follows:

Up/Down

Quite simple really, you either decide if the market is going to be up or down on the close of business that day. So for instance, a FTSE up bet might have a price of 52 – 55. If the condition is met i.e. the FTSE close closes higher on the day – then the bet will expire at 100 (otherwise the bet will expire at 0).

Range Forecast

Range bets simply have two prices that create a lower and an upper range which will create one out of two possible outcomes.

I have taken the following from IG Index’s website as it’s a good example of how a binary bet works. Other sites have tended to make it sound too complex.

Example: ‘Buying’ a FTSE 0/–10 Binary.

It is 4.17pm, and the FTSE 100 Index currently stands 11.6 points higher than the previous afternoon’s official closing level. You are not confident that the FTSE will be able to hold on to the day’s gains, and see that our price for a binary bet on the FTSE finishing down by 0 to 10 index points is 6.6/9.2.

So you buy the FTSE 0/-10 Binary for £20 at 9.2.

At this point you know precisely what your maximum potential loss is: if you are wrong and the binary makes up at 0 you will lose 9.2 x £20 = £184. You also know that if you are right your return on the bet will be (100 x 9.2) x £20 = £1816. This represents nearly a 1000% return on your risk, decided in the next fifteen minutes.

Eight minutes later, the FTSE has dropped back slightly to 2.4 down on the day, and our quote for the FTSE 0/ñ10 Binary has risen by over 40 points. You think there may be some more market shifts to come, and decide to take your profit now. You close out your bet at our bid price of 48.8.

Your profit on the trade is:

Closing level 48.8

Opening level 9.2

Difference 39.6

Profit: 39.6 x £20 = £792

You were right to be concerned, as the FTSE returns to positive territory in the final minutes of trading, closing 6 points up. The FTSE 0/+10 bet settles at 100 while all remaining binary bets in this package settle at 0. By taking your profit early you have made a 430% return on your risk, and all in the space of a few minutes.

Custom Bets

IG has expanded the concept of the binary bets further by introducing ‘Custom Bets’ which are essentially binaries where the client retains full control over the paramaters of the bet.

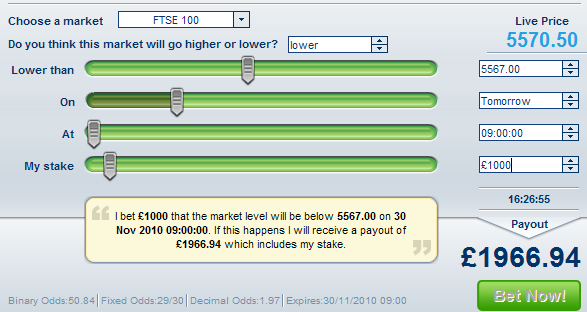

The pricing system uses graphical sliders so that clients can easily change the parameters on each bet. You can easily adjust bet pricing variables such as to the time to expiry, stake and the extent of the market move required to trigger the payout. Binary.com have also been offering these type of bets for years, and remain our provider of choice due to the vast range of different binary options they offer. One word of warning here; stay away from unlicensed binary providers as this area is littered with rogue companies.

As with binaries, custom bets aren’t limited to simple up/down bets either -:

One possibility is to go for a no-touch bet, whereby you will bet that the market won’t reach a particular level till the expiry date.

The fast money bet consists of a simple up/down bet on a limited range of market instruments where you have to bet on whether the price will be higher or lower in a specified time frame ranging from just 3 minutes right up to the close of the trading session.

Types of Binaries and Custom Bets

Binaries don’t need to be simple up/down bet propositions -:

High Target: This is a binary bet speculating that the market will end up in a positive range, say the Dow up by 50-60 points.

Low Target: This is a binary bet speculating that the market will end up in a negative range, say the FTSE down by 40-50 points.

Ladder: A binary bet that the market will close above or below a pre-determined level.

No Touch: A binary bet that the market doesn’t breach a pre-determined level at some point before the bet’s expiry date.

One Touch: A binary bet that the market hits (i.e. touches) a specific level at some point before the bet’s expiry date.

Binary bets and custom bets do have a place in our trading arsenal and are a welcome addition to the products that we can market as they offer great flexibility.

Predominantly binary trades are good for trading ‘bounces’, I will be explaining what a bounce is much later in the course, but for now, a bounce is simply where a stock reaches an excessive position whereby we can judge to a good degree when the stock will ‘bounce’ up from a position, or down from a position. This style of trading is best suited to volatile stocks, trading over a very short term period. Mostly less than a day.

It is worth noting here that similar to spread bet returns, binary betting profits are also tax-free although the providers offering these products are not regulated by the FSA (they fall under the ‘Gambling Commission’). Binaries and financial betting as such are still relatively new offerings and companies keep improving their fixed odds betting offerings in an attempt to encourage further take-up of the product by inexperienced and sophisticated traders alike.

One thing to keep in mind is that products like binaries and custom bets require more dealer intervention with pricing models having to be adjusted constantly to take into account fundamental changes in the underlying market. I will be explaining more later in the course and showing you how to take advantage of all the differing tools that you have at your disposal As well of course, as covering our techniques that we use to spot the trades in the first place.

Join the discussion