So what is Financial Spread Betting?

Financial spread betting is a highly geared bet on the future price of a product (can be anything) either going up or down. Simple really. The real money making power lies in the leverage. With spread betting, because you don’t have to pay the full value of any position you take up – just a modest deposit (margin) – you can leverage up to 20 times your initial capital outlay.

⇑ ⇑ ⇑ ⇑ Listen to Money Talk from the The Motley Fool: David Kuo talks to Robbie Burns about spread betting.

With financial spread betting you choose which way you believe the movement of an asset will be and there is just as much profit to be made out of a stock collapse as there is out of a share suddenly soaring in value.

So what is a spread bet? Let’s suppose that you’re down the pub with a work colleague, waiting for a friend to turn up. He says I bet he’ll be 15 minutes late.’ You say ‘No, he told me he was already on his way, so he should be here in much less than that.’ Now, you both happen to be fairly stubborn types, so you believe it might be a good idea to put your money where your mouth is and challenge your colleague – but as opposed to just a late-or-not proposition, you decide that for every minute after 15 minutes that your friend is missing, you’ll pay him a pound. For every minute ‘early’ he is up to 15 minutes, he’ll pay you a pound. In the circumstance that he ends up showing 25 minutes late, your colleague wins £10. If he rocks up on time, he pays you the same amount. That’s the basic workings of financial spread betting – except that bookies retain a little margin for themselves, the actual ‘spread’. Thus, they’ll offer XYZ stock at a spread of 134p-135p, their ‘fee’ being the penny in the middle.

Spread Betting Workings

The value of any underlying instrument is quoted as a bid/offer spread (which in practice amounts to the difference in price at which you can buy or sell a market). Spread betting permits you to place a bet of a certain value against market movement, either up or down measured in £s per point. As such when the market moves 1 tick, you stand to make or lose the number of £s per point you traded. For instance, if you bet £1 per point on the Dow Jones (US30) and this moves from 16500 to 16501, you will make or lose £1. Normally, you are permitted to bet on multiples or fractions of £s per point e.g. £0.10, £1.60, £3, £5, £20 per point…etc

To close an open trade you place the opposite bet in the instrument you are dealing at the same value per point. (for a BUY bet you sell at the present price and for a SELL bet you buy at the present price).

Let’s look at an example in more detail:

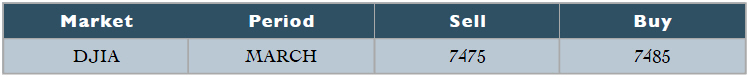

We believe that the Dow Jones Industrial Average Index (DJIA) is going to go up in the next few days. We have analysed the charts and can see that there are various key pointers that suggest this. So we go to our trading account and look at the DJIA and receive the following quote:

Don’t worry about the (March) comment just yet. So we think that the price is going to exceed the current quoted price. We therefore trade say £10 on the DJIA going up in the short term. This is known as GOING LONG. You are opening a trade where you expect the value of that trade to increase.

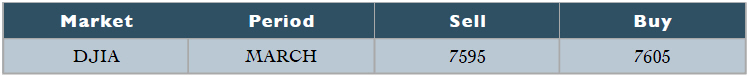

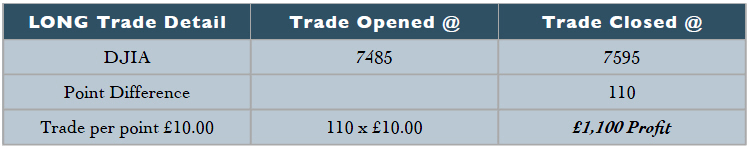

So we have traded £10 per point on the DJIA (March) going up in the short term. The next time we look at the DJIA it has reached 7595 (up 110 points) so we decide to cash in. We are closing a buying position and it is called Sell to Close – because we have already bought, we need to sell to release the equity in the contract. We go to the spread betting provider’s Internet site and get a quote of:

We Sell to Close that releases the following profit from the trade:

Not bad for making a few quick choices. I will talk more in depth about protecting your deposit by using Stop Loss Orders and ways of locking in profit. I just want to cover the very basics to begin with. Then we can look at using tips and tricks to limit your risk and increase your profits.

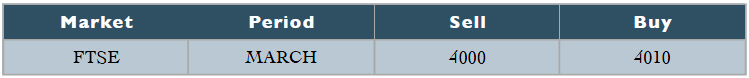

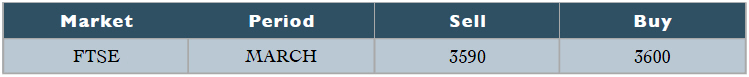

The next trade we look at is the FTSE100. We have looked at the charts and also feel that there is added strength in the argument that the FTSE100 will fall, from all the other data that we have quickly analysed. So we go to our spread betting provider’s website and get a quote on the FTSE100 as follows:

From our judgment we believe that the FTSE100 will fall much lower than the current quote of 4000. So we go SHORT (SELL) the FTSE100 @ £10 per point. We have opened a trade where we expect the value to go down in value.

We wait a few days and the FTSE100 drops even lower. So we go to the spread betting provider’s website and get a new quote on the ‘Footsie’. We get quoted the following price:

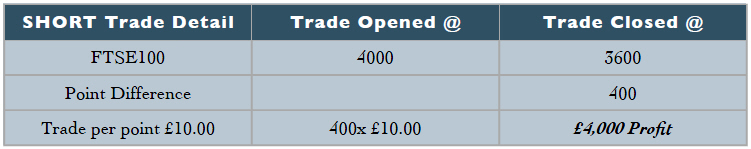

Now this is a key thing to remember. We have opened a contract on selling at 4000 so to close the contract we need to BUY. So we BUY to Close @ 3600. making you a massive tax free profit of £4000.

We have just covered the very basics of making a simple LONG trade (upward – Bull trade), and the basics of going SHORT (downward Bear trade). To close a Long trade we Sell to Close and to close a Short trade we Buy to Close. Please be aware of using the word sell. It would be natural to assume that when we have traded either Long or Short, to close that trade we sell it. This would seem quite natural to think that way. However, should you trade with your Financial Bookmaker (FB) over the telephone or the Internet, this would lead to a great deal of confusion.

For example say we have opened the previous Short FTSE100 trade prior to calling our spread betting provider looking to Close the this trade. We call the FB and get a quote and if we said, “I wish to Sell FTSE100” this wouldn’t close your previous position, it would ADD to your previous Short contract. The FB would ask, “What is the size of your trade sir?” and this would cause you even greater confusion. So remember:

When we expect the price to go up, we go LONG and we: SELL TO CLOSE to release any profit.

When we expect the price to fall, we go SHORT and we: BUY TO CLOSE to release any profit.

Join the discussion