In a previous article titled Trade Exits: What’s Your Way Out?, I suggested that many retail investors and spread bettors focus solely on their entries — i.e., which instruments to trade and when — without giving much thought to their exits. The issue, however, goes beyond just the entry and exit points. Many traders fail to consider what happens in between; they neglect the life of a trade.

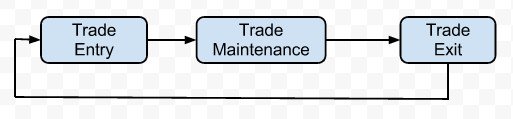

We can break down the life of a trade into a lifecycle comprising three key stages: Entry (what to buy and when), Maintenance (how to manage an open trade), and Exit (when and why to close the position).

Trade Entry and Exit

Let’s explore each of these stages in turn:

Trade Entry

Traders and investors enter trades for various reasons. For day traders, the decision is often based purely on technical analysis. For investors, it might hinge on fundamental factors, while position traders might use a mix of both. An entry can take the form of a live trade at the current market price or an order to buy (or sell, in the case of a short trade) when the price rises or falls to a specific level.

At the time of entry, the trader must decide on an initial position size and should already be planning their exit (discussed shortly).

Trade Maintenance

Except for very short-term day trading, financial trading isn’t just about entries and exits. Longer-term strategies, such as position trading and investing, require traders to consider how to manage their positions during the time between entry and exit.

The position size you establish at entry doesn’t have to remain static. For example:

- If the price falls and your trade shows a paper loss (but hasn’t hit your stop-loss), should you add to the position by averaging down?

- If the price rises, should you pyramid — reinvesting some of your profits into the same position?

What do you mean, you’ve never asked yourself these questions?

If you have a stop-loss order in place, should you trail it to “lock in” some of the accrued profit as the price rises? If so, at what distance?

I can’t offer one-size-fits-all answers to these questions, but I can at least prompt you to think critically about trade maintenance.

Trade Exit

At some point during your trade, you’ll need to consider when to exit, right? Wrong! As I suggested in Trade Exits: What’s Your Way Out?, you should have thought about your eventual exit when you entered the trade.

In most cases, you should attach a stop-loss order to your trade as soon as you open it, or limit your stake through prudent position sizing. With a stop-loss in place, your exit becomes automatic and unemotional. You’re free to make discretionary or partial exits at any time, but having a default exit strategy is essential.

When you open a trade, you might also attach a profit-taking limit order to wholly or partially close the position when a predetermined profit level is reached. Again, this approach ensures that your exit is automatic and unemotional.

When your trade eventually exits, you’ll have cash to begin the lifecycle again.

The Life of a Trade and Different Trading Styles

For day traders, trading may be all about entries and exits, with little focus on trade maintenance. In longer-term strategies, however, maintaining a trade to maximize profits over time can be just as important — if not more so — than the initial entry and eventual exit.

As a position trader, I know my strategy is working when I spend more time maintaining my trades than entering or exiting them.

Next Time You Trade…

Before rushing to buy (or short-sell) a hot stock, commodity, index, or currency pair, stop for a moment and ask yourself two questions:

- How will I maintain this trade after entering it?

- What is my plan for exiting the trade?