FSB: Tell us a little about Spread Co and its founders.

Ian, Spread Co: Spread Co was founded by the former CFO of CMC markets who wanted to fill certain gaps in the online retail trading space. The concept was to create a platform that was both sophisticated and simple to use, and saw tremendous potential in offering this high quality trading platform worldwide.

FSB: Who owns Spread Co and how long have you been in business?

Ian: We are a privately owned company which means we have the independence to grow and react to market conditions and trends in a more agile fashion. Spread Co was formed in 2006 and is expanding at a rapid pace.

FSB: How big is Spread Co? How many people work at your company?

Ian: As mentioned above, we are expanding rapidly at the moment and having seen significant growth in all areas of the business we plan to increase our 50 strong team by year end.

|

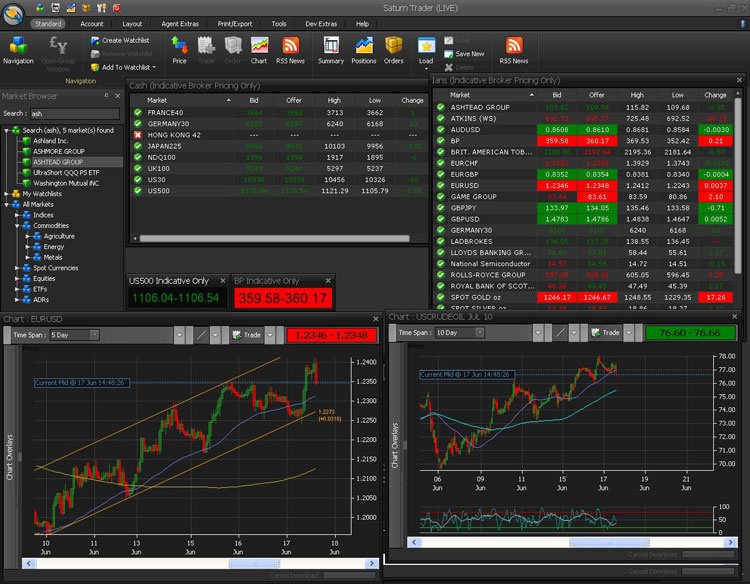

FSB: Tell us about your Saturn Trader Platform and the technology behind it. It is our understanding that your trading platform has been created and is maintained in-house, tell us more about it.

Ian: We believe our technology is second to none. Spread Co's trading systems have been built by some of the leading specialists in the field and are specifically designed to overcome some of the constraints you may find with some of our competitors' technology. Our technical team has a combined 35 years experience in building real time trading platforms. We pride ourselves on our superior trading platform and delivering a great trading experience for our clients.

The downloadable platform offers complete customisability, allowing clients to create a professional trading environment across one, two or more screens. Multiple charts, trade tickets, watchlists, order books etc can be opened and arranged to suit.

FSB: You are unique in the sense that you offer forex, CFDs and spread betting; all integrated into one single platform. Are international clients able to choose between whether to open a CFD trading account or a spread betting one?

Ian: Our International clients have the same choice as our UK Clients, as long as the local laws permit one form of account or the other. The only difference is a small one – internationally we refer to spread betting as spread trading, as the word 'Betting' often has different connotations outside of the UK. For our Indian based clients we have created a product called Premium Securities which is currently patent pending and which is compliant with local regulations.

FSB: For a prospective user located in the UK in what circumstances should one consider spread betting over CFDs and vice-versa?

Ian: The key difference for choosing spread betting over CFDs is that you do not have to pay Capital Gains Tax on your profits with a spread bet. The advantage of CFDs over spread betting is it more closely resembles the actual contracts in the market, therefore creating more familiarity for a trader who is relatively new to the concept of trading with leverage.

FSB: How does forex spread betting differ from conventional forex spot trading?

Ian: When you trade spot FX you buy the currency in sizes of 'Lots'. So for example, I may buy $10,000 dollars against the Euro. When you spread bet, you are simply staking per one point movement in the currency pair. So If I buy £10 a point when the market is at 1.2210-1.2212 and sell at 1.2232-1.2234. I will make £200: £10 x 20 (points movement in the market).

FSB: How do margins work on spread betting?

Ian: When you trade with margin your capital can be spread more effectively over a wider portfolio. You only need to put down a percentage of the total value of your trades and that percentage or 'margin' depends on what type of financial instrument you are trading. For example, the margin required for foreign exchange and index trading are based on a fixed cost per currency unit per point (e.g. GBP 30 for a GBP 1 per point trade on the FTSE100), whilst margins for equity trading might range between 5 and 20% depending on the equity. These values are known in Spread Trading as the 'Notional Trading Requirement' or 'NTR'.

|

A peek at the Spread Co Platform

FSB: What types of accounts are offered at Spread Co?

Ian: At Spread Co we offer two types of accounts for spread betting. We have the Standard Spread Betting Account or the Limited Risk Account. The majority of our clients trade with the Standard Account, where you can put in your own stop losses at whichever point you feel most comfortable, and elect to place a regular stop, or for a small premium, a guaranteed stop.

The Limited Risk account allocates a guaranteed stop on every trade you place. The client that uses the Limited Risk Account tends to be more risk averse and maybe fairly new to trading, although it does not limit the number of products you can trade on.

For CFDs you have a choice of two types of accounts:

The "Consolidated Account" allows for consolidated position keeping and provides you with a netted open position view.

The "Single Positions" trading account allows you to keep each position in a given instrument open separately without positions being netted off unless you specifically choose to do so.

FSB: What is the procedure for opening an account? How much do I need? Is there a minimum/maximum deposit?

Ian: The easiest way to open an account is to log onto our website www.spreadco.com and complete the simple and quick online application form. In fact, we have recently completely redeveloped our online application form to make it a much quicker and more pleasant experience. The amount the client decides to deposit is entirely up to the individual but we do have a minimum deposit of £100 for spread betting and £500 for CFDs. At the other end of the scale, the sky is the limit for the maximum deposit!

FSB: What is the difference between the web-based version and the downloadable version of the trading platform?

Ian: Spread Co's two platforms are both extremely efficient and have been widely praised by our clients. The major difference between the two is that the charting on the downloadable version is more advanced and obviously the downloadable version runs quicker as it's not web based. We always advise our clients to use the downloadable version when trading at home but to use the web based platform when on the move such as at work maybe or when popping into an internet café.

FSB: Do you offer telephone dealing?

Ian: At Spread Co we pride ourselves on our customer service and have a fully operational 24 hour dealing desk. So if a client was to have a fault with their computer, or were simply out and about, they could just as easily trade over the telephone with one of our dealers as they could in front of the screen, where the stakes, spreads and margins are all exactly the same (minimum stake is £1).

FSB: I believe you offer a demo account to trial your platform; may I ask why this expires after 30 days? Can it be extended by request?

Ian: We offer a 30 day demo trial as we feel after that the client should feel comfortable with the Spread Co platform and should be ready to step up to a live account. If however they do not we would be more than happy to extend their Demo experience, within reason, until they feel totally at ease.

FSB: Tell us about the Quick Trade functionality?

Ian: The Quick Trade functionality is a very easy way for the client to trade his or her preferred markets. You can set this up so that if you trade a handful of favourite markets they will always be located on your screen for easy access and speed of trade. This functionality is only available on the web version.

FSB: What kinds of orders are available on Spread Co´s trading platform?

Ian: We have a number of different orders available which our clients use effectively to maximize profits and minimize loses. We have: Stop Loss Orders, Limit Profit Orders, Contingent Orders, Guaranteed Orders, OCO Orders

FSB: Are there limits on how far a stop loss order can be placed from the entry price?

Ian: It varies from product to product; on indices it is 5 pips whereas with crude oil you are looking at 12 pips. The majority of the products we offer will fall in between the 5-12 pip remit and that's where you can start to place your stop loss. You will need to adhere to the NTR rules per product, so say for the example above, you will need 30 pips worth of NTR in your account to place an index trade, but you can place a stop loss order much closer.

FSB: Do you allow clients to move stop loss orders when the markets are closed?

Ian: At present Spread Co does not offer this service although it is something we are considering and hope to implement in the very near future.

FSB: How easy is it to calculate the financing rolling charges over a set period (say 3 weeks of rolling charges on a share)? Do you offer CSV statements?

Ian: It is fairly easy for a client to calculate their rolling charges. But for complete control and transparency of charges etc., Spread Co send a daily and monthly e-mail with all trades, including any rolling charges that may have occurred. Charges vary depending on interest rates.

FSB: Any other perks or account benefits which our readers should be aware of?

Ian: Spread Co offers online tutorials and webinars and is more than willing to give one-on-one guidance to anyone who is keen to learn more about our platform. If they are looking for a perk look no further than opening a live account through financial spread betting and take advantage of our £150 'Beat the Trader' promotion!

FSB: Do you allow trading on FTSE 250 stocks / FTSE 350 stocks? Do you envisage expanding the shares coverage further in future?

Ian: Spread Co covers the FTSE 100 and FTSE 250 stocks at present and we are looking into expanding this further down the line. As a company that thrives on catering to our clients, needs we make an effort to add specific products if a client requests them.

FSB: What markets are most popular with your clients?

Ian: The most traded products are typically (in order of most traded) Gold, Euro/ US Dollar, FTSE and Dow Jones. Although Spread Co has around 2500 different products we find clients from all over the globe will venture into different areas.

FSB: What is the average holding period?

Ian: How long is a piece of string? It is totally down to the individual. Some clients hold positions for a matter of minutes others for months. So there is no right or wrong way to do this as it entirely depends on the client's strategy.

FSB: What types of client do you aim to attract?

Ian: We do not target a specific type of customer and our client base is varied from those who trade £1 a point to high net worth individuals who might trade well in excess of that! Each client at Spread Co is treated with exactly the same excellent customer services and we are finding that we are attracting a lot of clients who currently trade elsewhere and are not satisfied with the level of service they are getting or the systems/platforms they are using to trade.

FSB: Please describe your typical client. How sophisticated do you need to be to get involved?

Ian: As stated above, we don't really have a typical client. Whilst we have some clients who work in the City, most clients do not have any professional working knowledge of any of the markets we offer. What we do think is very important is that clients are aware of the risks involved with margin trading, and we encourage them to start small and use our tutorials and guides to help them get started. .

FSB: What is growing faster at the retail level – Spread Betting or CFDs? And why?

Ian: Spread betting is growing at a much faster pace than CFDs due to the fact it's an easier area to understand and it has the added bonus of being tax free. It could also get another boost over CFDs with the possible raising of CGT in the upcoming budget.

FSB: Which typically is your busiest month of the year? Tell us of some of the busiest periods you have experienced over the years (could be elections…etc) you have been in business.

Ian: There isn't typically a month that stands out amongst others; the end of each quarter is always a fairly busy time due to the contracts for options and futures being reset. The initial announcement at the fall of Lehman's and the start of the economic downturn was a fairly hectic schedule with people shorting everything in sight. Recent market turmoil in the euro, the 'Flash Crash' of May and subsequent market correction and gold hitting new highs has made the start to 2010 particularly busy though.

FSB: What's your view on the future of spread betting in general?

Ian: We still see growth in the UK for spread betting and internationally we are seeing an increasing number of enquiries. As more and more countries become familiar and accepting of CFDs worldwide we see tremendous opportunity and already have many partnerships in places such as India, Pakistan, UAE, Canada and Europe.

FSB: Do you envisage that there will be major regulatory changes with regards to spread betting in the future?

Ian: As spread betting becomes more popular it is inevitable that the FSA will keep a closer eye on what is happening but we do not feel there are going to be any regulatory changes in the near future. The increase in CGT will have an effect on CFDs, possibly pushing more people from CFDs to spread betting and even from traditional share trading to spread betting. This may encourage the government to rethink the tax free status of spread betting, but we are obviously hoping it doesn't.

FSB: Do you see any differences in trading when the stakes are raised? How do experienced traders behave in such situations vis-a-vis speculative traders?

Ian: The biggest difference/advantage experienced traders with deeper pockets have over smaller, speculative traders is the ability to take a view on something, place a large trade and ride out the short term volatility by having sufficient capital to place deep stop losses. Smaller, more speculative traders tend to allocate a smaller portion of funds to a trade, have to set tighter stop losses and are thus more exposed to short term volatility.

FSB: What instruments might be better suited for beginners? Indices, equities, shares, forex?

Ian: The average beginner tends to start trading on Indices and also fairly solid shares such as Vodafone, pharmaceuticals etc as you see the least volatility in these areas. Forex has become more and more popular over the past number of months as retail forex trading is being promoted widely. Currencies are all over the business stories at the moment and we are seeing a lot of beginners start with FX straight away.

FSB: Please describe some interesting strategies which your clients are using to spread bet the markets.

Ian: We are seeing a lot of clients who have jumped on the 'short EURUSD trade' since the start of this year and have done very well out of it. We see a number of shrewd clients who dip in and out of gold at key levels, such as buying it recently around $1080 and selling at $1250, key support and resistance levels. Other clients are jumping in and out of hot stocks such as BP etc trading the news.

FSB: What differentiates you from other competitors?

Ian: At Spread Co we feel we offer a small company service with a large company product offering and high quality trading platform. In that I mean that very often with larger companies you can get substandard service and attention to detail. At Spread Co we listen closely to our clients and pride ourselves in the quality of our service and products. On the product front, we have the lowest Equity CFD commission in the market at 0.075%, we have lower margins than most on almost all our products and we do not charge to roll a short position overnight, something our competitors have quietly introduced in the recent past. Our trading platform offers unrivalled flexibility in terms of customisation and speed.

FSB: We know that most if not all spread betting providers provide a market maker platform (i.e. quote driven platform). What are the advantages of this platform as opposed to dealing directly on the market (i.e. direct market access). And the disadvantages?

Ian: The main advantage is that most clients will be able to trade in the size they want at the price that is on their screen in front of them. Sometimes trying to trade in large size on an underlying share with low volume can result in you trading at a much different price to the original price quoted. The disadvantages are ones that affect all clients at one time or another – in extremely busy markets, a price that is moving very fast can lead to trade rejections or requotes. At Spread Co we try to honour as many quotes as possible but in times of extreme volatility slippage will occur.

FSB: The growth of the spread betting and CFD markets are sometimes blamed for making traditional stock markets increasingly volatile. Do derivatives really amplify the share moves?

Ian: For most shares this is nonsense to blame spread betting on amplifying share moves as the volume in the underlying market usually dwarfs the effect spread betting might have. There can be problems though with small cap/AIM type stocks when a client may have taken a large position in a thinly traded, illiquid stock. A spread company will offset their risk in the underlying market and if a client needs to get out of a position quickly or indeed is stopped out of a trade, unwinding the hedge in an illiquid stock can have an effect on the underlying market.

FSB: How safe are client funds? What is the situation regarding our funds deposited at Spread Co? In particular are funds segregated from the company's own funds and where are client funds held?

Ian: If you are a retail client, your money will be treated as client money in compliance with the FSA Rules. This means that your trading funds will be segregated from Spread Co´s money and will not be used by Spread Co in the course of business. The funds are held in a segregated client money trust account at an approved bank in the EEA.

FSB: Have you any parting words for our readers?

Ian: Remember folks, spread betting can be high risk but it can also be great fun and very profitable if you do it right and control your risks. Only spread bet with what you are comfortable losing and start small. Learn from your mistakes and try not to repeat them. Don't always try to go for the 'home run' trades and don't be afraid to take a profit off the table if you feel things may be about to change.

FSB: Thank you for your insight and time, Mr Ian O'Sullivan

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.