February turned out to be another good month for our trading with Gold, Copper, Sugar, FTSE 250, and the German DAX all hitting new highs. Many of the shares mentioned in this column over the last few months are really starting to take off especially those relating to mining and natural resources. The question that everyone is asking is, how long will this Bull Run last and is it too late to buy now?

The first answer is, no one knows and I certainly don't! Anyone that tries to predict a market or sell you a system that claims it will pick you a top or a bottom is a charlatan. All I can say is that if something is trending up as most indices are, then you have to be a buyer and go with the flow. Over the years I have seen many private traders commit financial suicide trying to buck the trend. Of course at some stage these markets will reverse, but as long as you have a decent exit strategy such as a trailing stop, you have nothing to worry about. If you take a look at the FTSE250, hitting around 9,500 as I write, is this the top? We could have said the same a few months ago when it was at 8,000 and we could be saying the same in a few weeks when it hits 10,500.

The second question is, is it too late to buy? Again, if something is trending up or down (to go short) you have to take the view that until something tells you otherwise, that's the trend you need to follow.

One of my trading techniques which I teach is buying 52 week highs and selling shares that are hitting 52 week lows. For most traders this seems a strange thing to do, after all should I not buy low and sell high? Well maybe the text book may say this, however, in the real world I have made a lot of money buying new highs and selling them higher. When a share/market clears a new 52 week high or an all time high we can take the view that something good must be happening. My experience shows that these markets and shares also tend to continue moving higher.

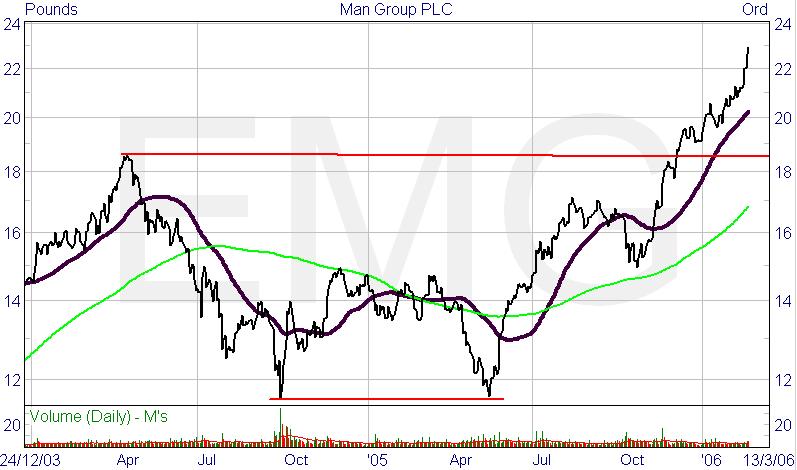

If you take a look at the price graph below of financial company Man Group (EMG) which is a FTSE100 company you will see the price clears the 52 week high towards the end of November 05 around the £18.40 mark. Since then the price has moved up to the £23.00 mark and still looks strong. A smaller company in a similar field is hedge fund manager RAB Capital (RAB) currently trading around 70p and has good growth potential.

|

MAN Group, with a 50 day and 200 day moving average. Showing excellent strength.

In last months column I noted the strength in the major mining shares including Lonmin which has recently announced it could be subject to a takeover and is up over 25% on the news. Even if nothing does transpire it just demonstrates how strong the mining sector remains and it would be crazy to try and call a top in these shares.

Overall markets should continue to move higher this month. We do have March Futures and Options expiration on the 17th of the month. For those that don't know all futures and spread bets have a closing date. You can close your bet before this date but if you wish to continue your trade after this date you would have to roll over your bet, which means you would close the March bet and reopen the next contract which would normally be June. Any money owed to a financial bookmarker has to be paid at this time. As large funds close and open futures positions, you do tend to see higher volatility and choppy trading.

Regular readers know that not only do I follow trends in markets, I also look at seasonality patterns. You can find seasonal charts at www.seasonalcharts.com The charts plot the gain or loss of a market or commodity over a certain period for 15 to 20 years. Looking at the seasonal trends the Dow Jones and S&P are still seasonally strong until the 3rd week of March, then we see some weakness before moving higher and peaking out around May/June. Good tools to track stock market seasonality is the UK Stock Market Almanac (£16.99) and the US Stock Traders Almanac (£18.99), both can be purchased from www.tradersbooks.com.

It's certainly true that patterns do repeat themselves in the stock market and in the commodities markets and you can profit from these.

The main theme continues to be mining and oil again. I have also spotted some strength in commercial property companies such as Land Securities (LAND) and Great Portland Estates (GPOR) which continues to trend up nicely.

Until next month, wishing you lots of success with your trading.

YOU SHOULDN'T SPEND MORE THAN GBP500 TO ATTEND A WORKSHOP OR SEMINAR NOT EVEN IF THEY PROMISE YOU GOLD FOR ATTENDING

The "Ads by Google" are just ads and help support the free information aspect of this site. You'll have to do your own research to decide whether those companies are reliable or not.The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.