The Supply/Demand Cycle

When stocks are low in their cycle, shares move from weak hands to strong hands. Strong hands are accumulating shares; weak hands are still liquidating losing positions.

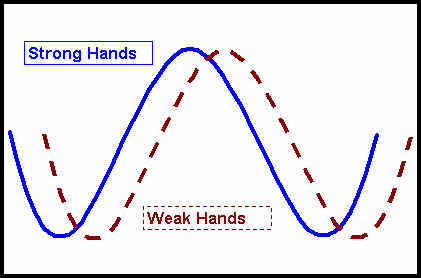

This suggests that the buy-sell cycle of strong hands (SH) leads that of weak-handed traders (WH), as shown in the chart below.

Cycle Low: After the market has declined, a new SH buying cycle begins while the news and fundamentals are still poor. WH selling continues.

Uptrend: Once WH begin to buy, the combined buying cycles of SH and WH create a new rising trend.

Cycle High: As the upward trend matures, SH begin to take profits while WH are still buying enthusiastically. The market’s trend is strong and background fundamentals are positive. Late-cycle buyers are entering the market for the first time, and their eager buying offers SH plenty of takers for offered shares.

Downtrend: SH have unloaded the substantial portion of their shares, and the market begins to sag. WH become net sellers but find few buyers, and prices decline. SH sell their remaining shares or sell short, adding to the downward pressure. The combined selling cycles of both SH and WH produces a declining trend.

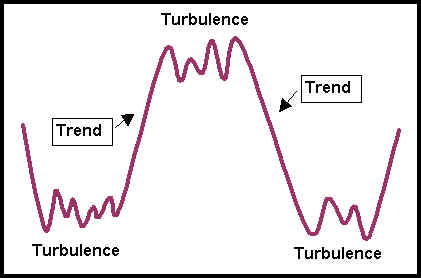

This analysis demonstrates two market types: 1) trending markets ; and 2) turbulent markets.

Trending markets occur when both SH and WH are in synch, when both groups are either net buyers or net sellers. Turbulent markets occur at cycle extremes when, as a result of offsetting cycles, SH and WH are at cross-purposes. The chart below shows both trending and turbulent markets.

Experienced traders know that the surest profits come during trending markets. Whether rising or falling, “the trend”, as the old saw goes, “is your friend”. Trading the trend is like paddling with the current.

Turbulent markets, on the other hand, are difficult even for wizened pros. These markets are like white water rapids. During these markets, the action of most individual stocks becomes choppy, while others trend upward and still others trend down. Navigating these waters successfully requires both skill and nerve, and capsizing is a real threat, especially for the novice trader.

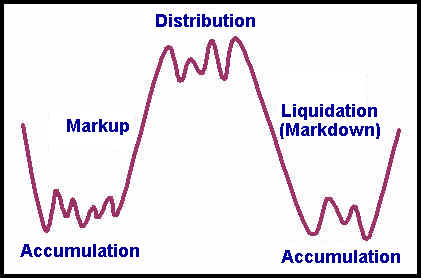

There are four distinctive stages of the buy-sell cycle:

Accumulation, Markup, Distribution and Liquidation

- Accumulation: shares move from weak hands to strong hands;

- Markup: price trends upward;

- Distribution: shares move from strong hands to weak hands;

- Liquidation (Markdown): price trends downward.

Join the discussion