Testing Support

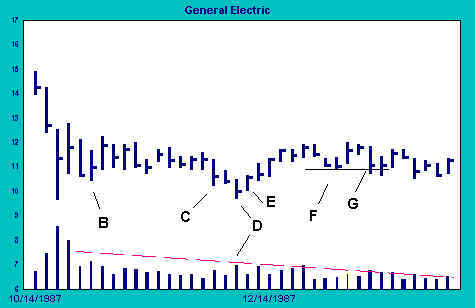

Volume on the decline to F is light, a good sign. Sellers are not aggressively pursuing the price down. After the test at F, the stock rallies on moderate volume and widening spread. We are encouraged by this action, and now expect bidding to breach supply at 12.

However, the decline at G upsets our expectations. Support at F does not hold, and the decline on increased volume and widening spread convinces us that sellers have not yet been flushed from the stock.

Based on our earlier analysis, we established a long position in the expectation that the stock would cut through supply at 12. The action at G offers evidence that resistance remains stiff. We suspect that more accumulation will be necessary before the stock is ready to rally. That might involve more dull trading and perhaps additional shakeouts in the attempt to dislodge stock from weak hands.

Buyers and sellers appear about even in strength. Betting on either side now is no better than a gamble. Our initial position was small, but we decide to close it out until the odds tilt more clearly in one direction or another.

It is important to note that the decision to close out the position is not based on the profitability of the trade, but only on our assessment of the technical condition of the stock and on our analysis of the odds of near-term success.

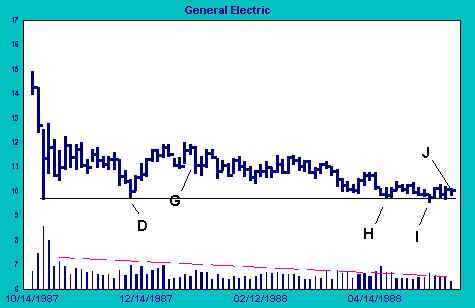

After we take a neutral position at G, the stock begins a long, slow decline on moderate volume. Those traders still looking to get out of the stock have little to cheer. Disgusted and bored, traders exit all the way down. Few rallies interrupt the dull drift of the stock back to the lows registered on the selling climax, and again at D. These desultory conditions favor more patient, stronger hands. Stock is taken in on dips by strong hands, without the kind of aggressive bidding which might provide encouragement to weak sellers.

At H, the price again tests support. Spread compression on increased volume shows that buyers are providing support. A modest rally ensues, but there is little evidence that the stock is ready to mount a tradable rally.

Then the stock breaks long-term support at I, a move which we must consider carefully. If sellers are still around in size, this evidence of weakness could spark a new wave of selling. To guard against a downside breakout, longside traders have doubtless amassed considerable stop-loss orders just under support. If those stops are triggered, the stock could drop sharply–unless buyers are ready to hold the bag for more cheap stock.

Price breaks support at I. Volume picks up and spread compresses–supply increases on the break, as expected, but offered shares are mopped up by stronger hands. The stock closes above support. This has all the signs of another shakeout, but one of considerable importance, given the importance of the support level being tested.

We decide to probe the long side by taking a small initial position at the opening on the next day. If the trade proves successful, we will add to our position; if not, we will again exit and await better conditions.

The stock rallies, then churns for two sessions on moderate volume. Price briefly returns to support, then closes higher during the following period. The high-low spread contracts considerably and volume drops away noticeably. The struggle for dominance at this level is over, and the noise of battle (volume) abruptly quiets. We conclude that the stock is set up to advance.

At J, we add to our initial long position. Should the stock fall again below support, we will exit at the market. This low in the range, our risk is small and quantifiable. On the other hand, GE has been accumulating for months, coiling for what could be a big advance. Risk vs reward is very favorable.

Join the discussion