Terminal Shakeout

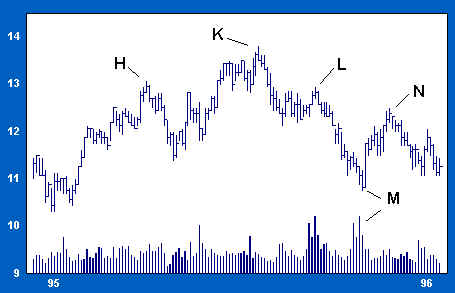

A corrective rally to N recovers nearly one-half of the decline from K to M. The rally peters out on low volume before price falls back to test support at 11. Volume picks up on this test, and we conclude that buyers are again active near the lows. A quick rally is followed by another decline to support just above 11. Volume falls off in a way that suggests that sellers may be tiring.

After the climactic selling at M, WMT has tested support above 11 twice, each time on decreasing volume. These are bullish indications. Supply is being absorbed. Now is the time to watch carefully for a buying setup.

Often, just before a rally begins, volume dries up as the high-low spread narrows. A period of quiet trading after a buying or selling climax often demonstrates that the battle between buyers and sellers is over. If we see this kind of tight trading near support we are ready to take a long position on the first indication that the stock is beginning to rally.

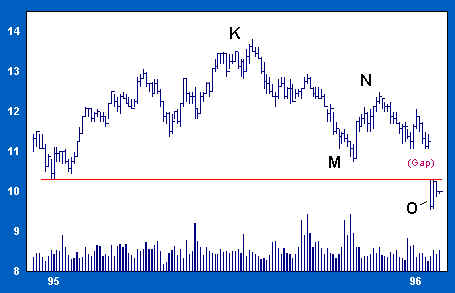

Instead, we are surprised by a gap to a new low (O) around 9 1/2. This decline breaks all support established over the last three years’ trading. Is this a bullish shakeout or the beginning of a new bearish offensive?

In either case, there is no trade to make. Even if we conclude that there is more weakness ahead, this is not a favorable point to initiate a short position. The stock is stretched to the downside and some distance from overhead supply. Our practice is to short weak stocks only on a rally, and then against a zone of supply which has demonstrated strong-handed selling. On the other hand, if this is a bullish shakeout, our practice is to wait for evidence that the trap is closing before taking a long position.

If this is a terminal shakeout, it is very bullish. The gapping break to O shattered long-term support and no doubt scared out all but the most courageous and committed bulls. Weak traders who might have waited to sell on a rally have, instead, now been forced out on the break to new low prices. Any rally from this point should encounter relatively light supply, and higher price levels which previously turned back rallies may now prove less formidable. A break of important support after a period of accumulation often signals the end of accumulation and sets up the markup phase.

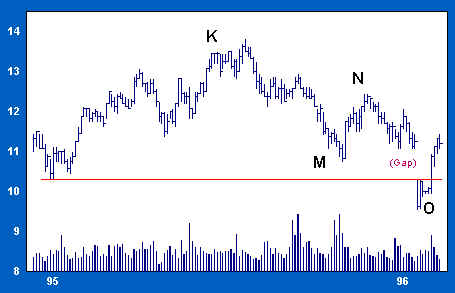

Strong-handed accumulation has been in evidence going back to early 1993. The upside targets implied by such a long basing period are significant. Taken together, weakened overhead supply and long-term accumulation are a powerful argument for a durable advance in WMT.

However, we cannot be confident that this is a bear trap until a rally back above broken support signals that the trap is closing.

A check of WMT’s relative strength shows that the decline from K to O has been devastating. Relative price has become oversold near the support line of its downtrend. While an interesting technical development, evidence that a weak stock is oversold is, by itself, not sufficient reason to take a position. We remain neutral.

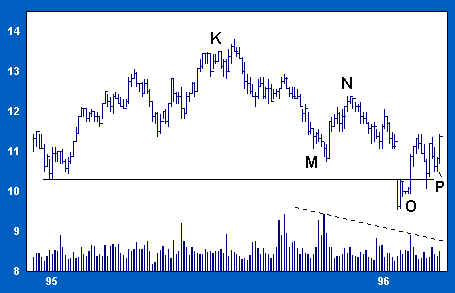

The bear trap closes with a bang as price snaps back through the gap left on the way down. A gap leaves a trading vacuum, a “hole” in the price structure of a stock. Since there are no buyers as the stock gaps down, there are no get-even sellers for buyers to contend with as the stock moves back up through the gap. When price returns through a previous gap, particularly if the gap is recent, the move through the gap is likely to be quick.

This is the case as WMT rallies from the shakeout (O) through the gap created on the way down. This action closes the trap very quickly, catching weak traders with flat or short positions. To correct their errors, these sold-out bulls must chase the stock as it rises. Their buying will only add to the urgency of any rally.

After the rally fills the gap, price backs up to long-term support around 10 1/4. The stock is now more volatile than it has been for months, and the spread on the test is wide. WMT rallies briefly again before easing back to higher support at P. Spread narrows. Easing volume tells us that selling pressure is modest. The stock is quieting down on a test near solid support just above 10. We take an initial long position at P.

Join the discussion