Q. Does Dollar Cost Averaging really work?

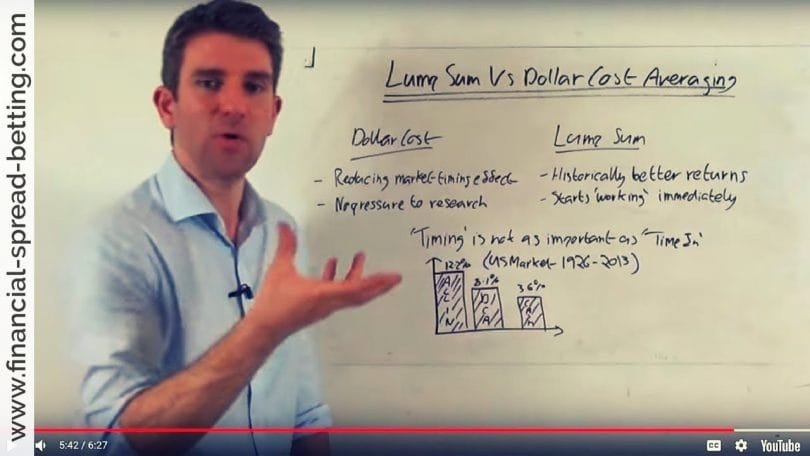

A: Dollar Cost Averaging consists of investing regular fixed amounts of monies in a fund at regular intervals and is a strategy designed to lower the average entry price and reduce the effects of volatility. This strategy has been mainly championed by investment fund managers and mutual funds and is a technique promoted by institutions to keep people invested. The problem with this strategy is that it has been proven flawed, not to mention that transaction costs increase when dealing with multiple smaller transactions (as opposed to one lump sum).

Although it does seem intuitively correct that Dollar Cost Averaging does provide a lower average entry price and a more stable return to investors, relying only on intuition can prove fatal when dealing with trading and money. After all it seems perceptibly correct that a loss is not a loss until you sell or that you can never lose taking a profit. Sadly intuition is wrong on both of these counts and is also wrong on Dollar Cost Averaging.

Dollar Cost Averaging as a concept was initially studied by by George Constantinides in 1979 whilst at the University of Chicago. He titles his academic paper ‘A Note On The Suboptimality Of Dollar Cost Averaging As An Investment Policy’ – a lustrous way of saying that DCA doesn’t work and is an inferior strategy to lump sum investing.

John Knight and Lewis Mandell in Financial Services Review 2.(1) 51-61 made a more meticulous study of Dollar Cost Averaging comparing it to Buy and Hold as an investment strategy. They analysed these investment strategies across a series of investor profiles starting with a high degree of risk aversion and progressing through different risk levels up to an aggressive investing style.

Their summary is extremely striking and quite well expressed:

“Brokerage firms endorse DCA primarily with two rationales. First, they state that returns are increased because more shares are purchased when prices are low and fewer when prices are high. Secondly, they assert that DCA enhances investor utility by preventing an ill-timed lump sum investment. Our results do not support either of these contentions.”

In conclusion they state:

“Using three separate methods of comparison, we have shown the lack of any advantage of DCA relative to two alternative investment strategies. Our numerical trial and empirical evidence, in consonance with our graphical analysis, both favour the Optimal Rebalancing and Buy and Hold strategies over Dollar Cost Averaging.

“Optimal Rebalancing and Buy and Hold strategies convincingly outperform Dollar Cost Averaging on theoretical grounds a well as on the basis of numerical simulations. Historical evidence also supports these two strategies, though the empirical differences are not significant.

“Our results strongly imply that the additional cost and effort associated with Dollar Cost Averaging cannot be justified for any investor, regardless of degree of risk aversion. With the possible exception of its promoters, nobody gains from Dollar Cost Averaging.”