What is Zopa

A privately owned company, it describes itself as "the world's first lending and borrowing exchange".

Why the weird name?

Zopa stands for Zone of Possible Agreement, a business term for the area of fertile ground between negotiating parties - it's the overlap between what negotiating parties will accept - for example, what one party is prepared to sell for and what the other party is prepared to pay.

As your MBA textbooks will tell you, if there's no ZOPA, there's no deal and accordingly, it's a very clever name for this new service and it perfectly describes what it does - like the Zopa logo which incorporates two intersecting circles, ZOPA has created a broader, more succulent ZOPA for both parties.

|

Who's behind it?

Zopa's credentials are impressive. It's been founded by the creators of online bank Egg, is financed by the venture capital company that backed eBay in its early days, and has won the blessing of well-known business people including Carphone Warehouse founder Charles Dunstone and Simon Woodroffe, the man behind the Yo! Sushi restaurant chain.

Who can use it?

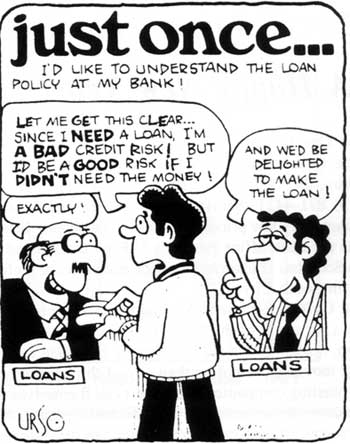

Zopa is open to UK residents over 18 years old with a current account. But while pretty much anyone is welcome to lend money, at the moment it is only open to borrowers it believes will be a low risk for lenders. It estimates that 50%-60% of the population won't have a credit rating good enough to allow them to borrow.

Why didn't someone think of this sooner?

They did! It's the same principle as micro-lending schemes that have been operating in Africa, Asia and Latin America where families, neighbours and friends lend amongst themselves to the benefit of the community. Without the frictional losses caused by greed or inefficient institutions, and with trust as one of the key elements, these schemes work wonderfully well.

As Zopa puts it, "The growth of the internet, the advance of verification and credit scoring technology, and changing attitudes to corporate institutions have combined to mean this method of lending and borrowing is now viable for everyone."

How does it work?

That depends on whether you're looking to borrow or lend money.

I'm interested in borrowing.

Before you can lend or borrow, you need to become a Zopa member (this doesn't cost anything). When you register your credit history is checked. Equifax, the credit reference agency used by Zopa, allots you into one of four categories, depending on your credit worthiness: A,B,C or D. A is the most creditworthy while D is the least. At present, only borrowers in credit categories A and B can obtain a loan through Zopa. Roughly half the UK's population falls into credit categories A and B. People passing the credit worthiness test will be able to scan the exchange for an appropriate loan. If they are in credit category A the rate of interest on the loan should be lower than if they are in category B.

As with traditional lenders, the higher the risk you as a borrower represent, the higher the rates of interest will be. Zopa is a "live" market and the rates will constantly vary depending on the lenders in that market. competitive within that band. The better your credit level, the lower the interest rates you'll be offered.

Borrowers on Zopa can wait for the right interest rate. If a rate looks good, a borrower can jump in and take it. If a rate looks less tempting, he or she can sit it out and see if the rate falls -¬ because if the rate's too high to be appealing, it probably will drop.

How much can I borrow?

The minimum loan is £2,000, and the maximum you can borrow will be your individual credit limit (maximum £15,000). Zopa makes its money by charging borrowers a 1% fee.

How are repayments calculated?

Your total amount repayable is the total amount you've borrowed. It includes the loan amount, Zopa's fee, and the total interest you would pay if you repaid the loan over the agreed term. You make monthly repayments. However, you can pay off the outstanding amount on your loan at any time without penalty.

Are the rates better than I can get from a traditional lender?

It says borrowers "should expect to get rates as good as or better than the best rates available on the high street". This week, interest rates were running at between 5% and 9%, depending on your credit rating and the term of the loan.

Can I choose who I borrow from - and will I know who they are?

No, you can't choose. Your loan will be made up of money from several different people. You'll be able to see the names of your lenders but you won't get any of their contact details such as addresses.

Zopa brings lenders and borrowers together in an online financial exchange.

Because there are no banks or middlemen, their rates are highly competitive.

for example you can borrow £5,000 or more at 5.5% APR typical.

And there are no charges if you pay back your loan early.

I might be interested in lending money. What's in it for me?

People looking to become lenders will have their credit history checked. This is to make sure that they are bona fide. The lender then chooses how much they wish to lend and whether they want the money to go to borrowers in credit category A or B. The lender should get a higher rate of interest by lending to people in group b than to those in group a.

Zopa says lenders should make a 6%-7% return per year if they relend all the money repaid to them (an average "bad debt" rate of 4% is already taken into account), which it says is 1%-2% higher than the current best savings account rate. Some may feel Zopa isn't offering a good enough return to make it worthwhile, bearing in mind the risks.

What's the procedure?

You can lend up to £25,000 (there's no fee to pay). You pick a market, depending on the level of risk you're happy to take. You choose the length of time you want to lend their money for and set the interest rate you're happy to accept.

Zopa says the cash you lend is split between at least 50 different borrowers, and your exposure to any one borrower is capped at £200, which means the risk is well and truly spread. You'll receive monthly returns that you can relend or transfer to your current account. In fact this raised a question in my head and and I wrote to them -:

I have a question on lending - you state that each loan is spread amongst at least 50 borrowers - but doesn't this increase the probability of a loss? I mean, ok granted that you are likely to suffer a milder loss but there is a greater probability that one of the 50 borrowers will default than just one?

They wrote back, in part -:

While splitting your lending offer does increase the chances of a loss, but minimises the size of this loss. If people were lending to individuals then if that person was to default and not repay then they would loose all of their funds. When working out how the system should work we decided that spreading the risk was a better solution for the majority.

If you do wish to increase your lending to each individual borrower you can do this using the website. To do this log in to your account and click on the "My Lending Tab", select Current lending offers from the drop down list and then click on Amend. There is a field at the bottom of the screen which you can choose the amount to lend to individual borrowers.

You are free to enter any amount to lend, however we do warn you that this is completely at your risk and while we have not had any defaulting borrowers to date we understand that this will not be the case forever.

But Zopa says "a small number" of borrowers may never fully repay their loans. Therefore it doesn't guarantee a level of return that you'll enjoy.

Give me an example.

If you lent £1,000 for one year at 6% (and assume everyone pays back), your total interest would be £31.92, not £60. That's because your borrowers do not borrow the full £1,000 for one year, so do not pay interest on the entire amount for that period. After six months you would have received back more than £500, but then you can relend the money and earn interest again.

Are there any charges?

Zopa's gain comes from charging borrowers an exchange fee of 1%, and - if borrowers take out repayment insurance on their loans - Zopa receives commission from the insurance provider. Lenders do not have to pay a fee to use the exchange.

Is it safe?

Zopa insists it is very safe - it is regulated by the Office of Fair Trading and the Financial Services Authority - and boasts high levels of online security and fraud protection, but concedes that as a new company, it has "a chance of failure".

Zopa members aren't covered by the official banking industry safety net scheme which provides compensation of up to £31,700 (100% of the first £2,000 and 90% of the next £33,000) if a financial institution fails.

What are the risks?

Non repayment of loan - the company manages the collection of monthly repayments and if any of that money is not paid on time, uses exactly the same recovery processes as the High Street banks. Zopa will refer the debt to a collection agency. The agency then pursues the borrower for payment and costs. However, if the debt collection agency does not manage to secure payment then the lender will have to take the loss on the chin.

What if Zopa goes bust?

The company says that in the event of business failure, the loan agreements still stand because Zopa is not a party to any loan contracts; it only provides the mechanism for agreeing them.

However, lending money is always risky and an economic downturn often leads to large numbers of people being unable to repay their debts. If this were to happen, then lenders could find it difficult to get their money back - even from people with a good credit history.

So it's not really like a bank at all?

In some respects Zopa isn't very different from the banks. Like them, it will earn commission by selling borrowers its (optional) payment protection insurance, which covers customers who are unable to keep up payments on their loans if they are made redundant or fall sick. If a borrower misses a repayment and doesn't contact Zopa first, it may hit them with a £20 fee. And if an individual fails to pay back their loan, Zopa will "get tough" and use exactly the same recovery processes that the banks use. If it doesn't recover the money, it will call in a debt collection agency.

Some comforting knowledge for lenders;

Benchmark Capital, which is putting up some of the money for the venture, has, in the past, backed EBay and Betfair. And Zopa's chief executive Richard Duvall is a co-founder of internet bank Egg. Zopa has also been authorised by the Financial Services Authority (FSA) and has a credit licence from the Office of Fair Trading.

More information on the credit scoring system;

Every member is looked at first on their credit score, which varies depending on which credit scoring company you use, so your score of 486 is good with us, but means absolutely nothing to barclays or natwest or any other lender, they have their own scoring criteria. We use Equifax, a US based company, Experian and Call credit, in an effort to diversify our knowledge and learn more about our members. Most high street lenders use just one or perhaps two. If we cannot build a reasonable picture, we do not just decline, we find out more. Taking into account things like their ebay feedback ratings, whether they pay their rent on time, and not just the simple yes or no criteria that we are all used to. As a freeformer, you will not fit into any category defined by the big institutions, we at Zopa, although currently hindered by regulation and a learning curve we are sharply climbing, belive that this will not only work, but will genuinely change the way people think about money and how to look after it. 95% of Zopa members say there are more important things in life than money, yet 93% are actively looking for ways to be smarter with their cash. This goes hand in hand with current trends of life that are changing the way we all live our lives financially and socially.

You must be a UK resident to participate;

Unfortunately for people outside the UK, you must be a UK resident to participate, and I doubt this is entirely Zopa's idea - it is undoubtedly some kind of legal/regulatory restriction arising perhaps from banking law, but just as likely from the fact the Zopa evidently supplies a number of the services banks supply to their creditors, including evaluation of credit ratings and collection from late payors and defaulters. Such a development would certainly become interesting to a lot more people if its scope were to include more places, or actually, people. Say, the US or, for even more people, China

A little earlier this month I wrote an email to Zopa asking about the UK-only requirement. They wrote back, in part -:

Thanks for your mail and your interest in Zopa. I'm sorry but in order to comply with UK Money Laundering Regulations all Zopa Members need to be UK residents and appear on the voters roll.

We know this sounds incredibly inflexible, but at this stage in Zopa's young life we have to be belt and braces with identification, money laundering and fraud.

Clearly this is a big turn off for you so please accept our apologies. Once we're better established we'll be looking to increase the number of ways that we can admit Zopa joiners online.

As Zopa grows we are planning to move into other countries by the end of the year and we hope very much that you'll consider trying to join us again then.

We hope you understand we have to take these measures in order to make Zopa a safe and secure place for all our members.

Word of Caution: I've been looking at Zopa recently and my experience wasn't particularly good. My lending was just £4000 about 13 months ago and in that time I have 10 late payers and some 6 write off's. In addition, they charge the borrower a wacking great fee up front, they charge the lender a monthly fee, that's the model you want to use, not opening up your account to see yet another default. Would never contemplate lending more than £40/£50. With fees and late/non-payers I'm probably running at about 5%. The risk appears to outweigh the benefits and it may not really be worth the effort so I'm in the process of running down my loan book.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.