Energy markets mainly consist of oil, gas and coal based products and the price of your fuel is to some extent dependent upon their market prices (the bit that is not tax!).

Like the farmers who use soft commodity futures, oil producers nation states represented by OPEC, oil companies…etc) and consumers (airlines, petrol companies…etc) will trade in underlying oil futures to speculate on the price movements. So will investors.

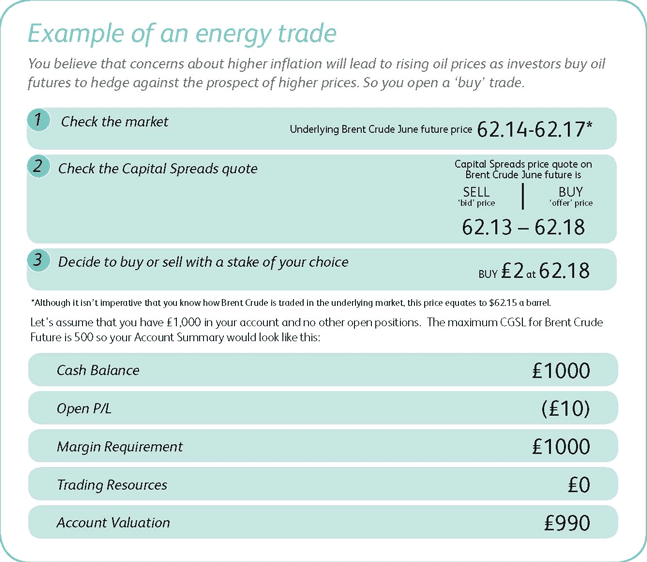

Let’s take an example of a trade with a fictitious spread betting company, say by the name of Capital Spreads:

Example of a Brent Future Spread Bet Trade. Trade Oil at Trade Nation

CGSL stands for computer generated stop loss (some providers generate an automated stop when you place a trade which you can then modify) In this case, the maximum CGSL requirement is exactly the same as your £1,000 Trading Resources before placing the trade. So the margin requirement will be £1,000. Your automatic stop loss would be placed at 80% of this total. With a £2 stake, this would be £1,000 x 80%=£800, which at £2 per point puts it 400 points away from your opening trade price, i.e. at 58.18.

If you wished, you could move this stop loss closer which would free up additional funds for trading. But, in this case, you would not be able to move the stop loss further away nor would you have any money available for any more trades because you have no further Trading Resources.

In the months ahead, global growth picks up. So not only does the demand for oil increase, but inflationary concerns also cause investors to rush and buy oil as a hedge. As a result, the price of crude oil rises and you decide to close your trade: