Time to talk some more about price targets. It’s obviously useful if you have an idea in mind about how far the price is going to go on a retracement before resuming a trend. The retracement is a countertrend movement, which traces back some of the primary trends gains before the primary trend takes over again and advances the price.

Retracements

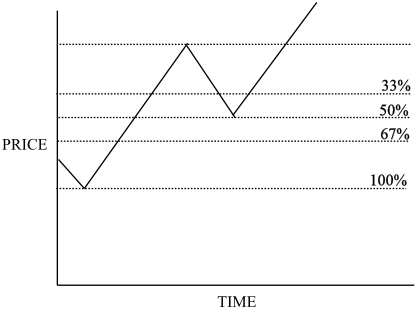

Fortunately for us, it’s been observed by analysts that retracements tend towards certain predictable amounts, or percentages of the primary move. One of the well-known and frequently observed percentages is 50%. After a primary trend move off, say, 100 units, there will be a retracement or move back of 50 units before the price starts off in the direction of the primary trend again. Other numbers that come up are 33% and 67%, or one-third and two-thirds. Usually you can expect a retracement to be a minimum of one-third and a maximum of two-thirds. So if you’re looking to buy a stock in an uptrend, you might wait for a retracement and expect that you should be able to get in at one-third to a half off the previous move, even if you don’t know much else about the stock. Here’s a diagram of a 50% retracement.

Note that it is not a third or a half off the price (that could be quite a lot!) but a third or a half off the previous move. It doesn’t matter what time period you’re trading, this applies to all sizes of trend, primary, secondary, and minor.

If the retracement approaches 67%, then it enters a critical area. If it doesn’t stop there, then the trend may be in doubt. But if the uptrend is solid, then 67% is a good place to buy, as with a continuing trend the retracement really can’t go any lower. If the price continues down, that’s really saying that the trend is over and about to reverse. You may remember that the Dow Theory mentioned these proportions.

Now in module 9 we will be looking at some theories which place those percentages nearer to 38% and 62%. You might like to think of the potential retracements as zones from 33% to 38%, 50%, and 62% to 67%, and for trading purposes this is probably as accurate as you need to be.