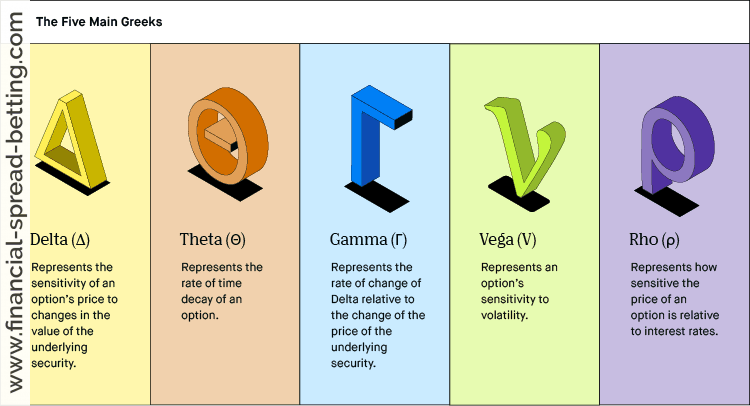

If you’re talking options amongst other traders, the Greeks may well be mentioned. These are five variables which describe the pricing sensitivities, and they’re called the Greeks because they’re known by Greek letters. They basically tell you how sensitive the option price is to changes in other numbers. Here’s a brief summary of them —

- Delta – describes how the option premium changes when the underlying price changes. Can be from 0 to 1, and is about 0.5 when the option is at the money, meaning a change in share price will change the option price half as much. Option traders use this in determining which strike price to select, and particularly when using a spread strategy, as explained later, the Delta is valuable in deciding how a position will perform with changes in price.

- Gamma – how much change you can expect in Delta for a small change in the stock price. A measure of the sensitivity of Delta, in other words it is a kind of “Delta” of Delta. The Gamma is at its highest when the option is trading at-the-money, as you might expect, as the Delta will be changing the fastest at this level. Apart from the obvious influence of where the strike price is in relation to the current price, Gamma is affected by the time remaining before expiration, and by the volatility of the underlying stock.

- Theta – how much the option changes for a change in time to expiration, normally stated as cents per day loss in value, although not constant. Because there is an expiration date, time is very valuable to an option holder. Theta will be small early on in an options life, but when it begins to reach expiration Theta will get larger and larger.

- Kappa, or Vega – the change in the value of the option for a given change in volatility. Vega is not actually a Greek letter, but it is the term commonly used. One of the major influences on the value of Vega is the time remaining until expiration.

- Rho – change in value of an option for a change in interest rates. Rho is the least used of the five option Greeks, mainly because options are traded over reasonably short time spans, when you do not expect much change interest rates. It is more significant if you ever become involved in trading LEAPS (Long-Term Equity AnticiPation Securities), which are long-term options that expire up to three years in the future.