Mining Mania

In case you have not spotted it already the UK smaller companies market has a new mania and it’s the mining and exploration sector. The names have changed since the DOT COM boom but the behaviour of investors and traders have not.

If you look at some of the recent charts of smaller mining stocks you can draw similarities to the old dot com shares. Many new mining companies are using the London AIM market as a way to raise money with investors happy to pile into anything that has mining, gold, oil, resources or exploration in the name.

Now many will say that mining is far safer than some internet story and I agree if you are talking about major players, but most of the shares that are being bid up are not actually producing anything.

In many cases they own no Gold, Copper, Zinc, Oil or whatever. In most cases they have a small rented office and maybe a licence to mine. The actual results if any will be years down the line.

There’s a big difference between owning a physical commodity and owning mining or oil exploration share, with most shares you are buying a story.

Now before I sound anti mining shares I am not, I own by fair share of them including African Diamonds, Firestone Diamonds, Asia Energy, Falkland Oil & Gas, Centurion Energy, Vane Minerals to name a few.

And my own mining portfolio is up well over 400% but I do realise that these are high risk shares and are not for ploughing your life savings into this companies.

For every mining share that will become a winner you can bet that we have at least 12 that are going to crash and burn, and that’s my concern. Most traders have not realised this. Charts that go up in a straight line often come down to earth.

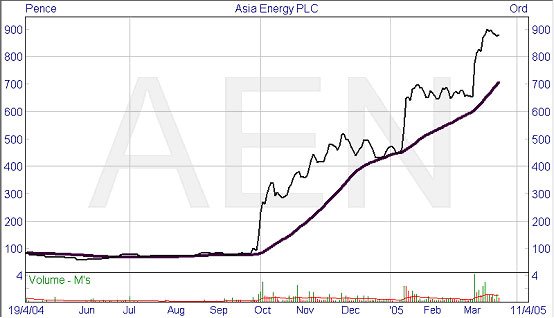

Chart of Asia Energy

Over 800% in a few months. No one is saying that this share cannot continue but keep your feet on the ground.

The key is to be sensible and not over invest in any one share, however sure you are. And make sure you have a stop loss or an exit. Don’t get married to your trades, if bad news comes out then be ready to cut and run. In many cases bad company news comes in 3 or 4s so don’t hang around for a second chance to get out.

Another point you have to be aware of is spreads and liquidity. Many smaller companies may be hard to buy and sell, or you may find you are able to buy but then when you come to sell you find liquidity is very thin, especially if the market has become negative on the company. This is another reason to spread your trades over various companies.

Short selling

Some of the mining shares can be traded via spread betting firms so you have the option to bet shares to go down. You should never go short a share just because its looks high, who says it does not go higher? What you are looking for is the price to start moving down after a very big move up before you start placing down bets.

Summary

Mining shares are hot and I see no let up in investor’s appetite for these junior stocks, however I warn you that whilst some of these companies will go on to great things the majority will never report a profit or find anything, and a lot of people will get burnt.

So play the mining mania carefully.

Until next month wishing you lots of success with your trading.