Q. What is the difference between Market and Limit Orders, Trailing Stop Orders, OCO and Parent and Contingent Orders?

A: Ok, the differences at a glance…

-

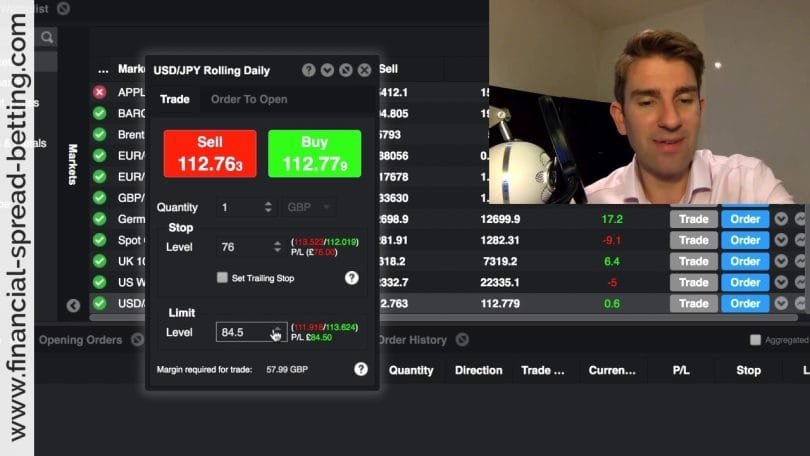

- Market order – An order to place a spread bet, to be filled immediately at the next quoted price. This is the most common of all order types. Be careful, as you may not receive the most advantageous price in a fast-moving market.

- Limit order – Specifies that a trade must be executed at a specific price. Limit orders are placed to enter the market or to protect profits. Because limit orders are not executed unless they reach the specified price, they may or may not be executed.

- Stop order – An order used to close out an open position, reverse a position, or open a new position at a specified price. They are typically placed to limit losses, closing a position if a price drops or rises beyond the specified point. However, you can also use a stop order to open a long position if the market rises and breaks through a previous area of resistance, or sell short if it falls past support.

- Trailing stop order – A type of stop loss order that is set to follow price movements by specifying the distance that you would like your stop to move, depending on the market direction and type of stop order placed.

- Order cancels order (OCO) – After entry into the market, a limit for profit order and a protective stop-loss order can be placed. When either the limit or the stop order is executed, it will automatically cancel the other order. This allows traders to automatically execute specific trading strategies to limit losses and protect profits without having to constantly watch the market.

- Parent and contingent order – Two separate orders that are linked by an if/then condition. The contingent order will not be subject to a fill until the parent is filled. This allows traders to set up the entire trade while they are away from their trading desk, including entry, exit and risk management, based on specific market prices. For instance if you are away from your computer during the day you can use an ‘if done’ order to protect your downside should your opening trade get triggered by a normal limit or stop order.

- Guaranteed stop order – Ensures that you will obtain your stop loss at the triggered value. There is an additional charge for this order, and there are minimum distances that orders must be placed away from the current price (only available on selected markets).

New Orders

Placing a trade is great if you want to open a long or short position at the current price.

However there may be times when the price you would be willing to open a position at is different from the current price.

In that case you can either:

- Sit at your computer, watching and waiting for the price to change, or

- Use a new order to place a trade for you

New Orders

- A new order is used to open a position if, and only if, the price reaches a level you choose.

- You also decide the ‘Good Until’ date and time, which determine how long the order remains valid for.

- If the Trade Nation quote reaches the level you choose before the Good Until date (and during Trade Nation market hours), Trade Nation will place the trade for you.

- However if the price doesn’t reach the level you chose before the Good Until date and time, Trade Nation will cancel the order (although you can extend the Good Until date as often as you like).

- Naturally you can cancel a new order at any time – as long as the Trade Nation price hasn’t reached the level you chose.

New Order

- Our new ‘buy’ order is now set. So if the Trade Nation ask price falls to €5.50 at any point over the next month the trade will automatically be executed and our long position will

be opened. - However if the ask price does not fall to €5.50 before our Good Until date Trade Nation will not execute the trade and our new ‘buy’ order will be cancelled.

- Of course a new order can also be used to open a short position. In this case it would be called a new ‘sell’ order

Stop Loss Orders

Stop Loss orders are a particular type of new order which we discussed in Tutorial Two.

The key points are:

- Stop Loss orders help us to put a limit on our likely maximum potential loss – but don’t forget they aren’t guaranteed.

- We can change the level of this Stop Loss whenever we like – assuming we have sufficient ‘Trading Resources’ in our account.

- A Stop Loss order remains in place until executed or changed by us – the Trade Nation computers will never change a Stop Loss without our instruction to do so

Advanced Order Types

There is a final order type called a One Cancels Other (OCO) order.

As OCO orders are quite advanced we won’t be spending much time on them here. However, in short, they can be used to place both a new ‘buy’ order and a new ‘sell’ order at the same time.

Which of these orders will be executed first depends on whether the price rises or falls – however as soon as one order is executed the remaining order is cancelled.

for monitoring the markets.

Email Confirmations

Some people like to use email as their main method of keeping records. So Trade Nation will send us a confirmatory email if:

- we place a trade and buy or sell a bet

- we alter a Stop Loss order

- we create or alter a new order a Limit Profit order or an If Done order

- any one of our chosen levels in our New, Limit Profit or If Done orders are hit and a bet is bought or sold for us

keep your email address up–to–date

To Sum Up

- The simplest way to buy or sell a bet is to place a trade. Doing this will buy or sell a bet at the current market price.

- If you would only be willing to trade at a better price than the current one you can use an order. This is simply an instruction you send Trade Nation to buy or sell a bet if the prices reaches a level chosen by you.

- Trade Nation offers you several order types.

- New Orders are an instruction to open a new position by buying or selling a bet if the price reaches a certain point.

- Stop Loss Orders help you to put a limit on your likely maximum potential loss. They do this by closing your position if the price moves against you and reaches a certain point. However Stop Loss Orders are not

guaranteed. - Limit Profit Orders are an instruction to close your bet if the price moves in your favour and reaches a certain point. Like Stop Losses, Limit Profit Orders are not guaranteed.

- Orders can be combined using If Done or Conditional Orders.

You could, of course, also use the different type of orders together… A possible strategy would be to use a ‘parent and contingent order’. This involves placing a standard stop order to sell below the current market – for example 5% – with a trailing stop placed above this level. This trailing stop will then automatically follow the market down, so that if the market move does in fact turn out to be a correction, you will not only be short but your stop loss will be simultaneously moving in the direction of your trade.

Q. What is a guaranteed stop loss?

A: All margin traders should be familiar with the basic idea of a stop loss as stop losses are essential to capital preservation. Stop losses help you manage risk and provide the key to long term trading success.

A stop loss is the level at which a spreadbetter will close the position if it moves in the wrong direction. If the position moves in the trader’s favour, the level of the stop loss can also be adjusted to lock in profits.

You should be aware, however, that it will not always be possible for a stop loss to be transacted at the exact price you have selected. This may happen overnight or when the market moves very quickly. For instance let’s say the FTSE is trading at 5800 and you go long at 5805. The FTSE then moves up to 5830 and your position is now in profit. After the London close, the Dow Jones falls by 320 points. In such a scenario the FTSE is likely to fall before you are able to activate the stop loss.

To avoid the pitfalls of slippage some spread betting firms have introduced bets which have guaranteed stop-losses attached to them (also called ‘controlled risk’ or ‘limited risk’ bets). A guaranteed stop loss is a stop loss order with a guaranteed exit price, eliminating the risk of the stop order not being filled. If the market moves 500 points against you, your position would still be closed at the level agreed.

The spread betting provider will normally charge an extra spread of around 20% to put the guarantee in place – thus even if useful guarantee stop losses are expensive. Also, spread betting firms will not let you place a guaranteed stop-loss close to the market level because, in a volatile market, it would be too easily triggered and they would be too vulnerable to paying out.

Whether to use guaranteed stop losses or not depends on the market you are trading and how many points profit you are trying to make. If you trade small market moves then guaranteed stop losses are not likely to work but if you are betting on large moves or markets which suffer from high volatility then the judicious use of guaranteed stop losses can reduce the downside risk of your trades. For instance it does make sense to use guaranteed stop losses when trading commodities where moves are more likely to be sudden and dramatic. If you know your stocks well, you will have a feel for the likelihood of jumps of different sizes – for example, how often Barclays has fallen in 20p increments.

If you are overly concerned about the potential unlimited risk liability of spread betting (which is, however remote if you make use of stops!) some providers like IG Index, CityIndex and CMC Markets have a limited risk spread betting account where all trades have to carry a guaranteed stop and there must be enough cash to fund the worst-case potential loss.

Note that the guaranteed stop affects only the potential down-side of a bet and not the potential profits. Note also that gapping applies equally to stop losses and limit orders (limit orders are the reverse of a stop loss). If you have a long position with a stock and there is a takeover bid, the price might gap upwards from 150p to 270p at a stroke. If you had set a ‘take profit’ limit order at 220p, you would be filled at the price traded – 250p – not at the limit order price.

Q. When are guaranteed stop losses particularly useful?

A: Logically, guaranteed stop losses are most useful in news trading and trading shares (especially the volatile ones) as the market can gap sharply (even before the open).

Q. I was wondering why IG have the limited risk account which uses wider spreads when you could just use a plus account and put a stop loss in?

A: Depending on your level of experience and financial situation, IG Index may steer you towards that account for your own safety (where all your trades come with a guaranteed stop). Once you have some experience, you can always request a (free) swap to the other account.

‘One sees the gain, but not the danger’

Here is a true story: Two men were sitting across from me at a restaurant. One had his nose bandaged. He was explaining to the person next to him that he had the bandage because he was walking on the sidewalk and fell. The other person asked, ‘How did you hurt yourself so much by just falling?’ He explained he had both hands in his pocket. And he couldn’t get them out of his pocket fast enough. The result was his face took the full brunt of the fall. He broke his nose and gashed his forehead.

The reason I tell you this story, gory as it is, is to get you thinking about stops. Think of this person falling full force on his face- not able to stop his face from hitting the floor since he didn’t have his hands free. Likewise, without the protective stops you are open to great financial pain. And remember not to walk with both hands in your pocket!

Q. What is the difference between using ‘Market’ stop losses instead of stops based on ‘Our Quote’ {i.e. finspreads quotes}

A: What ‘our quote’ means, is when the Finspreads’ quote hits the specified level.

‘Market’ means whatever Finspreads is quoting at the moment the market is at your specified level, this does not mean you will get an exit at a specified price, when the market is trading at this specified price, and does not mean that you are trading on prices any closer to the real market. Therefore the actual real difference between the ‘our quote’ & ‘market’ may be minimal since although you can opt to close at the market stop you will, still, only get paid according to their spread at the time and that will probably be a worse price than by using ‘their price’.

Q. Are there any companies that allow me to use the market prices to trigger the stop and limit orders, which would then transact at the firms prices?

I’m quite happy using spread betting as my main trading instrument for the time being, and have slowly but surely made money in my first year of trading, but if I could use market prices to trigger the stop and limit orders, which would then transact at the firms prices, it would make my job of automating my trading whilst I’m at work a whole lot easier.

A: Yes, some do offer market price but I’m not sure which although I think Man do even though I believe only on daily cash prices.

“Market Price Order Orders can be left on a market basis. This means that if the underlying market triggers your order, you will be filled on our current quote.”

Q. My FTSE stop was hit when the underlying markets were closed!!

I feel like I have been scammed, but I would like the view of a senior trader who have experience of markets. I traded with IG Index on Friday going long on the FTSE 100 March at 6181…with a stop at 6151, the market closed at 6177 at 5:30 on Friday. On Monday Morning the opening was 6166 and low was 6163 and so far the high has been 6223.

I have been told I was stopped out on Friday at 8:10 (after the exchange was closed) according to in-house quoting by IG Index as they quote a price 24 hours a day. They say that the low was 6151 right where my stop was and they do this on the basis of other markets that are trading at that time and the fluctuations taking place at that point. Is this a scam on their part? They have in-house information as to where all the stops and positions are held by their clients and can make a market in order to stop them out. Please comment↑↑↑↑

A: In short the answer is NO, this is not a scam.

Be careful when trading the FTSE or other European markets because the price movements of the US markets will affect them accordingly throughout the US session >9.15pm UK time. If the Dow Jones Index plummets by 200 points and then recovers to previous levels – the FTSE cash quote will fall sharply also even though the market has closed.

When trading with spread betting companies you’re not trading the underlying index, you’re trading IG’s version of that market. If you are holding overnight beyond the close, you have to be prepared for such incidences. The best way to avoid being stopped out after the market closes on any FTSE spread bet is to leave a screen order instead of a market order. This means that your order won’t be monitored when the exchange is closed (in your case the FTSE). The only problem you’ll have with screen orders instead of market orders is that you won’t have any protection against large US moves. I believe IG doesn’t offer these kind of orders anymore (check the other providers). City Index still do screen orders but over the telephone only.

I suggest you do some research on the spread betting companies, their activities and other traders experiences of them. When creating your strategy to trade the FTSE cash you need to take this into account – you can’t rely on yahoo data for instance to formulate a plan.