Contract Periods: Quarterly and Rolling Spread Bets

Quarterly:

On all spread trades that you make you will notice that there are periods that are known as contract periods. These are designated months where the contract will automatically close, and run for 3 month periods and close on the 3rd Friday of the month given in the trade.

Example:

FTSE100 (March) Sell…. Buy…. High…Low…Bid….etc.

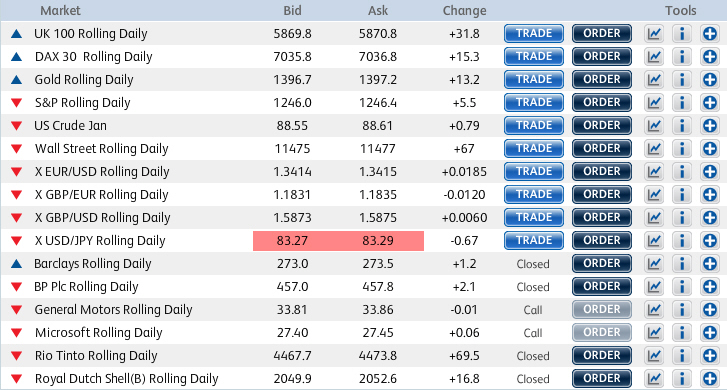

This is what you would expect to see (along with a list of other Indices) when you wish to trade. There all quite self explanatory. Take a look at the screen shot taken from one of the spread betting providers.

As you can see we have a list of various Indices, currencies and more to select from. This is just a fraction of what is there. But take note of the contract periods, some are just days only and are set at one set date), more about that in moment. Others are for longer periods. Note too how the spread changes from one to the other; for instance the spread on a Daily trade is usually smaller than one for a Quarterly.

A year is split into 4 quarterly future periods, March, June, September and December. If a future expires (which is around the 18th of the month) then normally what happens is that your trade is closed and any gain or loss credited or debited to your spread betting account. If you wish to keep the position open, you can arrange for the position to be rolled onto the next quarterly period (or you could set it to auto-rollover from the outset). The profit and loss will still be crystallized but the position will be re-opened – meaning that it will also result in a cost of proportion or whole of the spread.

Looking at the example above the March month is the contract month when this particular trade will expire. The contract months run as follows:

March – June – September – December

The FTSE 100 trade above would expire on the 3rd Friday in March. When the trade expires, this means that the trade is automatically closed for you. Depending on the spread betting provider and the time of year you can have two contract months appear for the same Indices/Trade etc. Don’t be surprised when you see FTSE 100 March and FTSE 100 June next to each other. It’s down to personal choice as to which one you wish to trade, and in the long run makes little to no difference. Except if you traded the June contract your trade would expire later.

Daily

There are other options that have always been available, such as daily trades that expire at the end of the day. These tend to have a lower spread (the difference between the mid price and the Sell (bid) and Buy (ask) price). They can be good for trading over a very short time, especially if you expect a certain trade to move quickly within one day. More about the use of what I call ‘bounce’ trading in the techniques section.

Rolling Bets

A relatively new type of trade, where the trade is closed and re-opened the next day (incurring a financing charge), any profits are calculated from a combination of the current interest rate and the stock’s current value at the time of closing. More about rolling bets and the uses of them later.