Interest Rates

Believe it or not you can even open spread trades on Interest Rates. In fact the there are more and more products entering the market every year. It makes my mind boggle as to what they will add next. It’s all very good news for us, as it supplies us with an added means of making money from a financial movement in a particular product, old or new.

Bonds and short-term interest rates (STIRs) are grouped together because they often move in tandem with each other. There is a rule of thumb that, as expectations of base-rate rises increase, so the price of bonds and STIRs will fall and vice versa although this is not necessarily always the case.

Interest Rate trades may seem a little strange at first, but stick with me and they will soon make sense. Just remember that the trade works just the same as they have before – BUY (LONG) SELL (SHORT) etc. and your profit is the difference between you opening and closing prices.

The key difference you have to realise and take note of, regarding Interest Rates is what the prices quoted to you actually mean. At present there are two differing trades that you can open with most spread betting companies.

Interest Rates Spread Betting by Spreadex

Short-Term Interest Rates:

STIRs are interest rate prices based on the benchmark interest rates set by an individual country’s central bank. A short term interest rate trade, allows you to open a position on the direction of various countries’ 3-month interest rates. For example, Short Sterling prices are based on the interest rate set by the Bank of England. Eurodollar short-term interest rate (not to be confused with the FX pair EUR/USD, which is also called the euro/dollar) prices are based on the interest rate set by the US’s Federal Open Market Committee (FOMC).

Prices for all STIRs are calculated by taking the market’s expected level for the 3-month London Interbank Offer Rate (Libor) set by the major lending banks, and subtracting them from 100. So, if Short Sterling for June next year is trading in the market at 96.50, this means that the market is expecting the 3-month Libor to be around 3.50% (100.00 – 96.50) at that time.

Short-Term Interest Rates are priced like this because of their correlation with bonds, so when central banks are expected to raise interest rates, bonds and STIRs should fall in price. Therefore, if you buy a STIR, you believe that interest rates are going to fall.

If you plan to trade Interest Rates, it’s obvious that you start trading your own country’s interest rate. As news on your local interest rate is obtained quickly and relatively easy to come by. Most daily newspapers, TV etc. have the local interest rate available at hand. Remember though to use this as a guide. As the trading we are involved with is linked to that of the Futures markets and therefore they are more volatile.

As we have noted above the price of the contract that is opened is the number 100 minus the actual interest rate figure. Therefore a price of 94 signifies that the interest rate would be 6%, a price of 97 would mean 3% and 100 would obviously mean that there is no Interest rate at all, which I’ve not so surprisingly seen yet.

If you think the Interest rates will fall you simply BUY, go LONG and if on the other hand you think that the interest rates are going to up you. That’s correct… you SELL go SHORT on the trade. Simple really.

Dealing in Interest Rates is very similar to dealing with Guilt Edge Securities. Isn’t it funny that when we hear these terms that sound so complicated, we assume that trading in them would be incredibly difficult. Yet as we have proved over and over, the banks want you to believe that and justify their jobs and charges.

Let’s look at an example just to clarify:

If we take UK interest rates as an example, only because they are my local interest rate. The trade can be any interest rate you chose from any country, regardless of your location.

We believe that the short term interest rates will rise so that the price of 3 month Sterling. Deposits (sometimes called Short Sterling) will fall in value.

Therefore we decide to sell go SHORT on 3 month Sterling Deposit because interest rates we believe will rise, as the interest rates rise the value of UK currency falls, as it becomes less attractive globally. The quotation we receive on Sterling Deposits are minus the decimal point 9030/9070 (first price is SELL (SHORT)/ second is BUY (LONG)) We decide to go SHORT/SELL at 9030 on March Short Sterling at £10 per point. The price of interest rates rise, the values of Sterling Deposit Futures fall to 89.90 and we Buy to close the trade. Which works out at a 40 point difference between our opening (9030) and closing prices (8990) , working out a £400 profit.

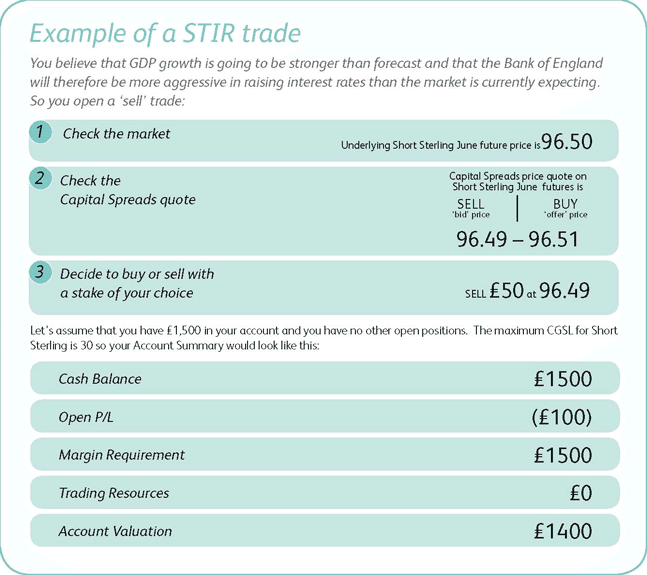

Example of a Short Term Interest Rate bet courtesy of Capital Spreads

At Capital Spreads your automatic stop loss would be placed at 80% of the maximum CGSL. The maximum CGSL for Short Sterling June is 30 and, as you have placed a trade of £50 per point and you have £1500 Trading Resources, the stop loss will be placed at 30×80%=24 points away, i.e. at 96.73. You will use all your Trading Resources on the trade.

You would be able to move your stop loss nearer to the opening trade price, which would free up additional Trading Resources but, as you have no Trading Resources remaining, you would not be able to move it further away.

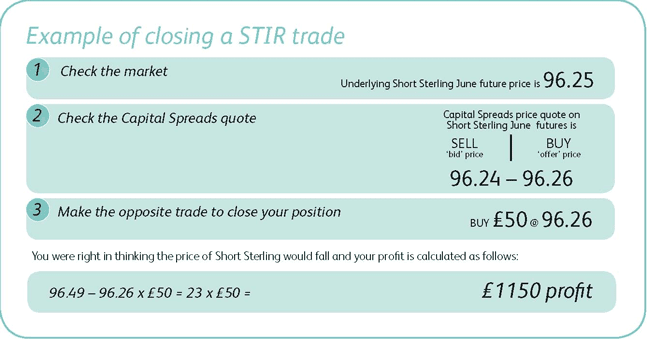

Your expectations prove correct and the increased growth numbers cause a sharp shift higher in inflation. The market now expects the Bank of England to tackle this by raising interest rates in the near future. As a result the price of Short Sterling falls and you decide to close your trade:

Remember the price that we get quoted on is not the interest rate itself. It is on the local currency value Short Sterling UK etc. going up or down as a reflection of the interest rate change. Told you they can be a little tricky.

Join the discussion