Don’t Put All Your Eggs In One Spread Betting Basket

Mar 19, 2012 at 1:29 pm in Risk Management by

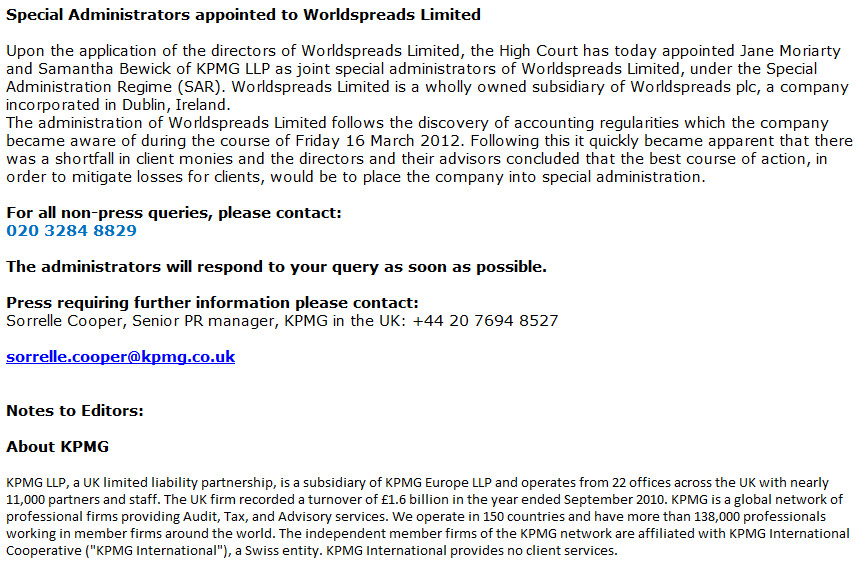

Did you read the shocking news about the trouble at WorldSpreads, and did you then visit their web site to be greeted with the following message from the administrators?

As if spread betting wasn’t difficult enough, without providers like WorldSpreads and MF Global going to the wall, eh?

Although the signs were there when two WorldSpreads directors resigned followed by the resignation of the CEO, clients of the company (like you and me) could not reasonably have been expected to anticipate the imminent demise. So there would have been little or not time to cash in and get your money back, and you might have found it difficult if you tried. So now it’s a waiting game to see what the administrators come up with, and it may be a waiting game too for clients of the World Spreads “white label” spread betting brands.

It’s easy to say it with hindsight, I know, but I think there are (at least) two ways in which you can help protect yourself against counter-party risks like these.

#1: Diversify across spread betting providers

I learned some time ago not to put all of my eggs (i.e. money) into one spread betting basket, and I said as much in my article How many spread betting accounts do you need? Although I was looking to rationalise my accounts at that point, so as not to hold multiple “white label” accounts with essentially the same provider, I still considered the counter-party risk to be important enough to hold at least three accounts across the separate providers.

Although I did have some funds lodged with World Spreads — and hopefully, still do — it may be some time before I find out how much, but in the meantime I have sufficient resources with other spread betting companies so that I can carry on trading.

#2: Making money, not storing wealth

Although I favour a more long term investment-like “position trading” spread betting strategy, there’s a big difference between trading and investment in at least one important respect. When trading via spread betting I’m looking to make a lot of money from very little, and then to withdraw much of the money so that I’ve taken out more than I ever put in. That money should then find it’s way to a safe home for “investment”.

I see investment as a different beast, which is more about storing wealth and preserving capital. And this may be better achieved via physical assets (like property) or deposits with highly regulated, well capitalised financial institutions with government-backed guarantees. National Savings, perhaps, but not the likes of WorldSpreads.

The benefit of hindsight

It’s easy to tell you “what you should have done” with the benefit of hindsight, but I don’t think it’s hindsight at all. I’ve always advocated spreading risk across more than one spread betting company, and playing with small stakes (with a view to turning them into big gains) rather than trying to make a small profit on a big spread bet investment.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.