Firstly, some context on pricing of natural gas and crude oil. Despite a 2.6% fall in the S&P 500 this week (the Dow industrials fell 3.5%) driven by worries about China and other emerging markets, there was actually a rise in energy prices.

Natural-gas futures rose to $5.16 per million British thermal units (mBTU) on Friday, a rise of 9% on the day and over 20% on the week. Prices for natural gas have never been so high mid 2010. Despite the shale gas boom, a very cold winter in the United States has driven up the price from $3.5 per mBTU in October.

Reports from the U.S. Energy Information Administration on supply showed a record weekly drop in January, with supplies in storage falling 107 million cubic feet for last week and inventories due to move 2 trillion cubic feet, a low level. As of the week ended January 17th, natural gas in storage stood at 2.423 trillion cubic feet, according to the EIA . That’s down 598 billion cubic feet from last year and 369 bcf below the five-year average.

The cold American weather is also positively driving up U.S. crude oil futures, with a barrel of WTI crude at $96.9 versus $94 at the beginning of the week. The discount to Brent crude has dropped to its lowest level in two months, with Brent holding at $107 a barrel.

There was 3.2 million barrel draw on distillate stocks in the U.S. versus expectations of 900,000. TransCanada’s Gulf Coast pipeline also opened last week which will eventually carry 700,000 barrels of oil per day from the huge storage facility at Cushing, Oklahoma, to Gulf Coast refineries also helped to support prices.

So despite all the talk of Iranian oil entering the market due to a potential easing, worries about China and the shale oil and gas boom in the USA the oil price is remaining remarkably resilient.

Supply side constraints may be easing significantly but there can no be getting away from the fact that demand for now remains robust as economic activity in Europe and the United States moves up as GDP growth accelerates.

The principle of “peak demand” rather than “peak oil” has been the talk of the town in recent months. The argument goes that Western demand for oil has peaked and is in a structural down trend because of energy efficiency measures, a move to gas and alternative energy sources such as wind power.

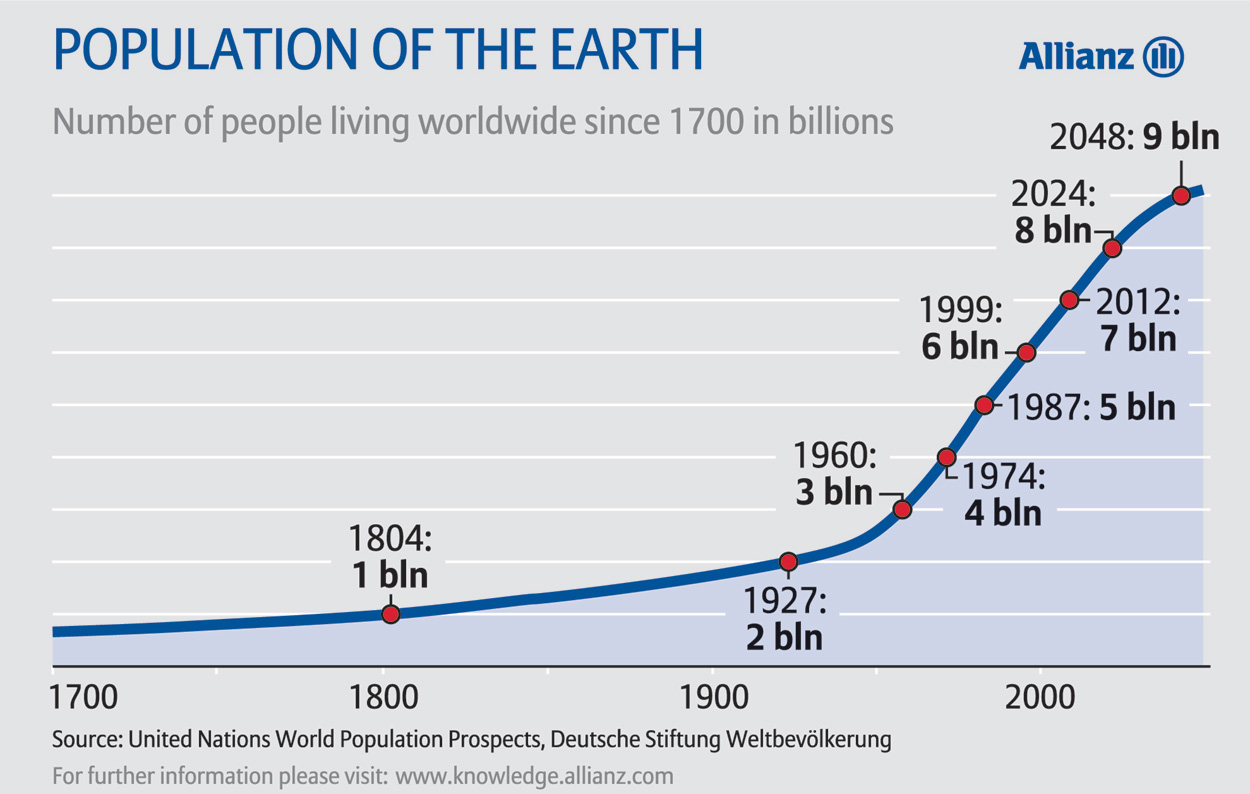

There seems to be a strong counter argument to this with a clear link between oil consumption and economic growth. It seems likely that population growth in the USA and Asia will counteract any impact of a shift to alternative fuels or technologies. The US population is expected to grow from 318 million to 400 million by 2050 and the global population will increase by close to a billion people in the next decade.

In addition a growing middle class in countries like China means that more and more consumers will be buying and driving cars thereby driving up petrol/diesel use and therefore oil consumption. It is unlikely that the electric car revolution will dent this trend in the coming decade in any significant way, certainly not in the developing world. U.S. consumers bought 15.6 million vehicles last year, in China over 20 million vehicles were sold. Despite Chinese curbs in some cities introduced to try to limit pollution the appetite for new cars seems insatiable. The same will be true of the newer emerging economies in Asia such as Vietnam. Gasoline consumption is underpinned by demand unless the global economy collapses.

Data from the US Energy Information Administration show average consumption of 18.8 million barrels a day over 2009-12, compared with 20.5 million barrels over 2005-08, a fall of 8%. But US oil consumption rose by nearly a million barrels a day in the latter months of 2013, the fastest rate of growth in nearly a decade. Total 2013 US oil consumption was 1.7% higher than 2012, with fourth quarter growth of 4% versus the same period a year before. Consumption in December 2013 was around 20 million barrels per day, the same as 2008.

The US shale revolution is helping to cap American energy prices with the growing demand but with a ban on exports of crude oil and with the problem of shale oil not being suitable for refining into the distillate products that US refiners are legally permitted to export it is unlikely that energy independence in the US will drive down global prices.

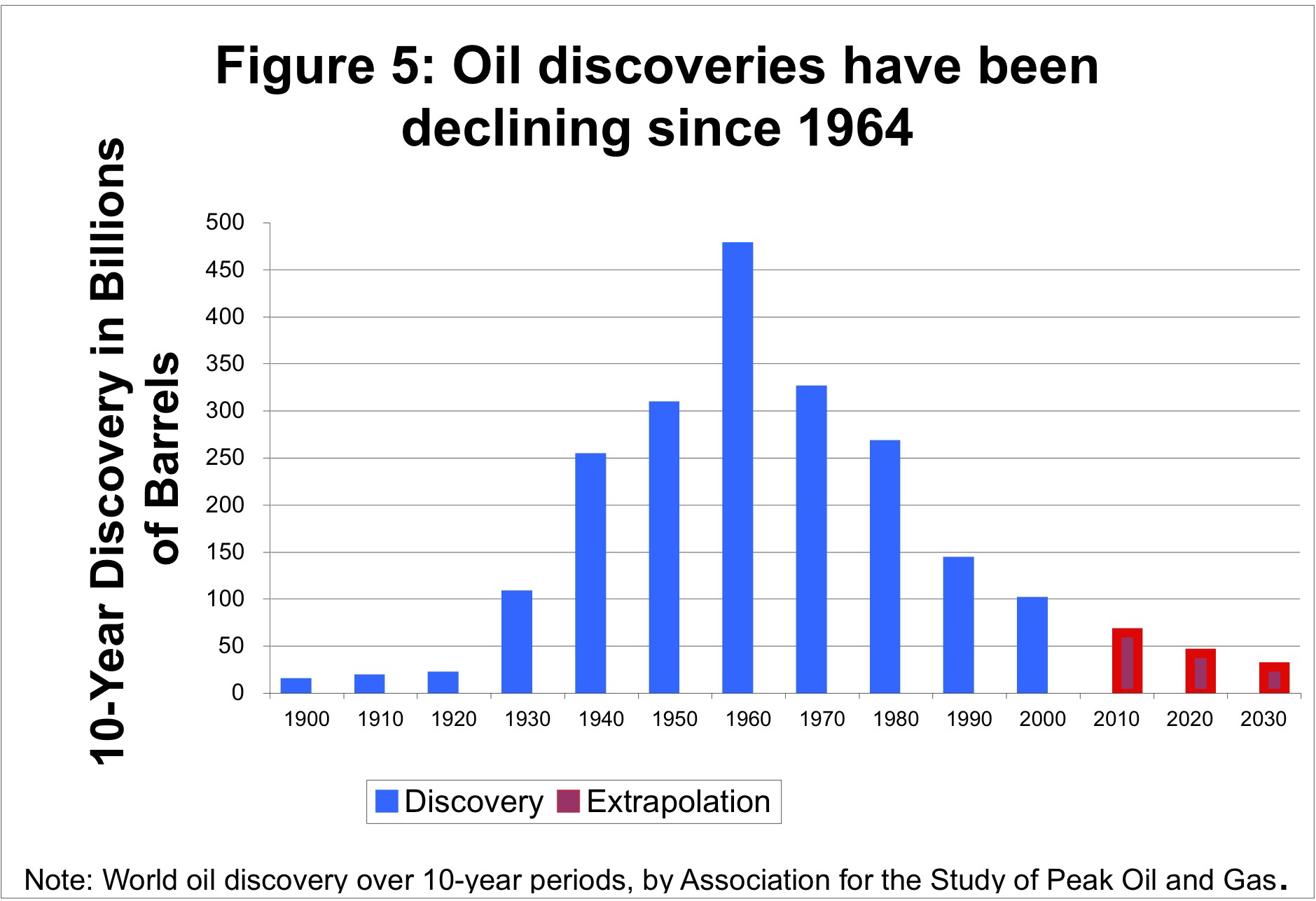

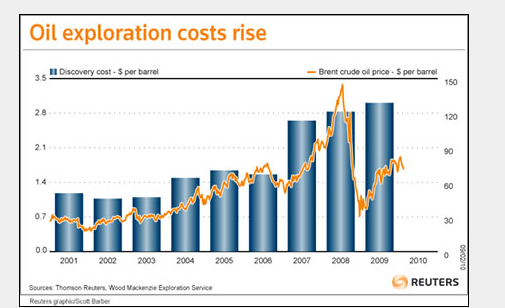

Finally, oil is getting much, much harder and more expensive to find. The cost of finding oil has almost tripled over the last decade with each barrel of oil equivalent costing approximately $3 to find, compared to $1.18 in 2001. It is estimated that the industry discovered 20 billion barrels of conventional oil (and equivalent natural gas) in 2013, against global consumption of 50 billion barrels worth.

So in summary, predictions that the oil industry is doomed in the short term seem wide of the mark. Certainly for oil majors the economics for oil exploration are getting more difficult. Population growth and a growing middle class in the emerging markets is certain to drive up demand for energy. With the total world population just over 7 billion right now, it is estimated to be close to 10 billion by 2050.

Though it is correct that new fields from Kurdistan, Africa and Asia as well as an easing of supply issues from Libya and Iran will help offset this growing demand but there are no signs that a giant oil field similar to those present in Saudi Arabia are likely to be found and although US tight oil and Alaskan, Brazilian pre-salt oil are growing in importance they are all very expensive to extract.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

“Peak oil” in supply or demand – you decide!

Jan 26, 2014 at 9:28 am in Market Commentary by contrarianuk

Firstly, some context on pricing of natural gas and crude oil. Despite a 2.6% fall in the S&P 500 this week (the Dow industrials fell 3.5%) driven by worries about China and other emerging markets, there was actually a rise in energy prices.

Natural-gas futures rose to $5.16 per million British thermal units (mBTU) on Friday, a rise of 9% on the day and over 20% on the week. Prices for natural gas have never been so high mid 2010. Despite the shale gas boom, a very cold winter in the United States has driven up the price from $3.5 per mBTU in October.

Reports from the U.S. Energy Information Administration on supply showed a record weekly drop in January, with supplies in storage falling 107 million cubic feet for last week and inventories due to move 2 trillion cubic feet, a low level. As of the week ended January 17th, natural gas in storage stood at 2.423 trillion cubic feet, according to the EIA . That’s down 598 billion cubic feet from last year and 369 bcf below the five-year average.

The cold American weather is also positively driving up U.S. crude oil futures, with a barrel of WTI crude at $96.9 versus $94 at the beginning of the week. The discount to Brent crude has dropped to its lowest level in two months, with Brent holding at $107 a barrel.

There was 3.2 million barrel draw on distillate stocks in the U.S. versus expectations of 900,000. TransCanada’s Gulf Coast pipeline also opened last week which will eventually carry 700,000 barrels of oil per day from the huge storage facility at Cushing, Oklahoma, to Gulf Coast refineries also helped to support prices.

So despite all the talk of Iranian oil entering the market due to a potential easing, worries about China and the shale oil and gas boom in the USA the oil price is remaining remarkably resilient.

Supply side constraints may be easing significantly but there can no be getting away from the fact that demand for now remains robust as economic activity in Europe and the United States moves up as GDP growth accelerates.

The principle of “peak demand” rather than “peak oil” has been the talk of the town in recent months. The argument goes that Western demand for oil has peaked and is in a structural down trend because of energy efficiency measures, a move to gas and alternative energy sources such as wind power.

There seems to be a strong counter argument to this with a clear link between oil consumption and economic growth. It seems likely that population growth in the USA and Asia will counteract any impact of a shift to alternative fuels or technologies. The US population is expected to grow from 318 million to 400 million by 2050 and the global population will increase by close to a billion people in the next decade.

In addition a growing middle class in countries like China means that more and more consumers will be buying and driving cars thereby driving up petrol/diesel use and therefore oil consumption. It is unlikely that the electric car revolution will dent this trend in the coming decade in any significant way, certainly not in the developing world. U.S. consumers bought 15.6 million vehicles last year, in China over 20 million vehicles were sold. Despite Chinese curbs in some cities introduced to try to limit pollution the appetite for new cars seems insatiable. The same will be true of the newer emerging economies in Asia such as Vietnam. Gasoline consumption is underpinned by demand unless the global economy collapses.

Data from the US Energy Information Administration show average consumption of 18.8 million barrels a day over 2009-12, compared with 20.5 million barrels over 2005-08, a fall of 8%. But US oil consumption rose by nearly a million barrels a day in the latter months of 2013, the fastest rate of growth in nearly a decade. Total 2013 US oil consumption was 1.7% higher than 2012, with fourth quarter growth of 4% versus the same period a year before. Consumption in December 2013 was around 20 million barrels per day, the same as 2008.

The US shale revolution is helping to cap American energy prices with the growing demand but with a ban on exports of crude oil and with the problem of shale oil not being suitable for refining into the distillate products that US refiners are legally permitted to export it is unlikely that energy independence in the US will drive down global prices.

Finally, oil is getting much, much harder and more expensive to find. The cost of finding oil has almost tripled over the last decade with each barrel of oil equivalent costing approximately $3 to find, compared to $1.18 in 2001. It is estimated that the industry discovered 20 billion barrels of conventional oil (and equivalent natural gas) in 2013, against global consumption of 50 billion barrels worth.

So in summary, predictions that the oil industry is doomed in the short term seem wide of the mark. Certainly for oil majors the economics for oil exploration are getting more difficult. Population growth and a growing middle class in the emerging markets is certain to drive up demand for energy. With the total world population just over 7 billion right now, it is estimated to be close to 10 billion by 2050.

Though it is correct that new fields from Kurdistan, Africa and Asia as well as an easing of supply issues from Libya and Iran will help offset this growing demand but there are no signs that a giant oil field similar to those present in Saudi Arabia are likely to be found and although US tight oil and Alaskan, Brazilian pre-salt oil are growing in importance they are all very expensive to extract.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.