Happy New Year!

It proved to be a fairly subdued end to the trading year with the US markets moving down on the final session of 2014 but showing strong gains for the year as a whole. The S&P 500 finished at 2,059, a 1% decline on the day and an 11.4% gain for the index during the year. The narrower based Dow Industrials finished at 17,823, below the key 18,000 market and ahead 7.5% for 2014. Both indices are up 3 years in a row.

S&P 500

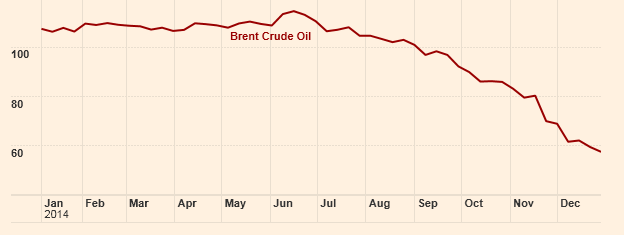

Crude oil has had a rough end to the year with WTI crude ending the year at $53, compared with $98.5 at the end of 2013, a 46% decline. Brent crude finished at $57.55, down 47% this year.

The FTSE 100 finished 2014 down 2.7% at 6,566, quite a disappointment versus the gains of the US market, whilst the FTSE All share fell just over 2% this year to close at 3,532. The higher percentage of oil, gas and mining stocks in the UK index has hampered progress with commodity prices struggling this year.

FTSE All share

Russia was the worst-performing country in 2014 among MSCI indices, showing a total return of minus 42.3%, calculated on a dollar basis, which includes dividends and share price movements. In contrast the Chinese Shanghai 225 index rose a whopping 58% in 2014 to finish at 3,234.

Shanghai Composite

Iron ore bounced this week to finish 2014 at $71 a tonne, but still down 47% this year. The commodity fell as low as $66.84 on December 23rd. Gold finished 2014 at $1,183 an ounce. For the year, down 1.5%, compared with the December 31, 2013, settlement price of $1,202 an ounce and compared with $1,379 an ounce earlier this year.

Just like in 2013, passive index investors in the S&P 500 have been well rewarded with a couple of dips during the year proving to be excellent buying opportunities. Commodities have been the dogs of 2014 with oil and iron ore close to halving this year and with the outlook uncertain as an OPEC driven price war and weakening Chinese demand prove worrying for 2015. The strength of the US economy has been surprisingly robust, helped by an accommodative Federal Reserve. In contrast, Europe has failed to keep pace. With economic worries continuing to plague the eurozone countries and the European Central Bank forced to cut interest rates and start an asset purchase programme to try and ignite sluggish growth.

Will the US markets finally change direction in 2015? Perhaps, but the collapse in the oil price will certainly help economic prospects for countries like the United States with the low tax on gasoline meaning that low prices per barrel feed through quickly to the price at the pump. China for me remains the worry and if it stumbles in 2015 it may impact equity sentiment in general. The gigantic gain in the Shanghai composite this year seems to indicate that retail investors in China remain confident, but perhaps a little over confident. Surely a bubble due to burst?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

UK stock market indices strongly lag US performance in 2014

Jan 1, 2015 at 11:35 am in Market Commentary by contrarianuk

Happy New Year!

It proved to be a fairly subdued end to the trading year with the US markets moving down on the final session of 2014 but showing strong gains for the year as a whole. The S&P 500 finished at 2,059, a 1% decline on the day and an 11.4% gain for the index during the year. The narrower based Dow Industrials finished at 17,823, below the key 18,000 market and ahead 7.5% for 2014. Both indices are up 3 years in a row.

S&P 500

Crude oil has had a rough end to the year with WTI crude ending the year at $53, compared with $98.5 at the end of 2013, a 46% decline. Brent crude finished at $57.55, down 47% this year.

The FTSE 100 finished 2014 down 2.7% at 6,566, quite a disappointment versus the gains of the US market, whilst the FTSE All share fell just over 2% this year to close at 3,532. The higher percentage of oil, gas and mining stocks in the UK index has hampered progress with commodity prices struggling this year.

FTSE All share

Russia was the worst-performing country in 2014 among MSCI indices, showing a total return of minus 42.3%, calculated on a dollar basis, which includes dividends and share price movements. In contrast the Chinese Shanghai 225 index rose a whopping 58% in 2014 to finish at 3,234.

Shanghai Composite

Iron ore bounced this week to finish 2014 at $71 a tonne, but still down 47% this year. The commodity fell as low as $66.84 on December 23rd. Gold finished 2014 at $1,183 an ounce. For the year, down 1.5%, compared with the December 31, 2013, settlement price of $1,202 an ounce and compared with $1,379 an ounce earlier this year.

Just like in 2013, passive index investors in the S&P 500 have been well rewarded with a couple of dips during the year proving to be excellent buying opportunities. Commodities have been the dogs of 2014 with oil and iron ore close to halving this year and with the outlook uncertain as an OPEC driven price war and weakening Chinese demand prove worrying for 2015. The strength of the US economy has been surprisingly robust, helped by an accommodative Federal Reserve. In contrast, Europe has failed to keep pace. With economic worries continuing to plague the eurozone countries and the European Central Bank forced to cut interest rates and start an asset purchase programme to try and ignite sluggish growth.

Will the US markets finally change direction in 2015? Perhaps, but the collapse in the oil price will certainly help economic prospects for countries like the United States with the low tax on gasoline meaning that low prices per barrel feed through quickly to the price at the pump. China for me remains the worry and if it stumbles in 2015 it may impact equity sentiment in general. The gigantic gain in the Shanghai composite this year seems to indicate that retail investors in China remain confident, but perhaps a little over confident. Surely a bubble due to burst?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.