One of the key advantages of spread betting is that you are able to make money on falling prices as well as rising ones – that is to say that you can bet that the share price of a company (or group of companies) will go down in the future!

If you own something and its value looks likely to fall, whether it be a buy-to-let property or a surplus PC, it makes sense to sell it quickly, before too much of that drop in value occurs. The same principle applies to selling failing investments too. Indeed, it is one of the most important rules for successful investing that you should cut your losses quickly.

Identifying over-priced assets.

Sometimes we identify an over-priced asset that we don’t own. It could be an optimistically priced house or a petrol-guzzling car. In our day-to-day lives, this is clearly a bit of expertise going to waste because we can’t take advantage of our judgement in the same way as we could if the price were too low.

However with shares, you can profit from such a skill thanks to a process called short-selling. That means you sell shares you don’t own, hoping that by the time you have to produce them for the buyer, they have fallen in value and can be more cheaply supplied.

Going short probably needs closer monitoring than would be required of a normal investment. Your potential losses are unlimited, because a share can in theory go to any height, but your profit is finite. Because a share can never be worth less than zero, your profit can be no more than the value of the investment you shorted.

It also needs some mental inversion. Good news for a company, such as better than expected profits, dividend increases, or an unexpected takeover are bad news for you. What you are looking for, indeed hoping for, are profit warnings, management incompetence and poor trading.

It is perhaps this last aspect that has got the idea of short selling (and thereby spread betting) its bad reputation. Many politicians and some economists think shorting is akin to demolishing factories and putting thousands out of work, especially when it is done by large and unregulated hedge funds. Yet short selling, so long as it is transparent and can be monitored, gives useful two-way liquidity to a market.

It cannot on its own push a company into collapse unless there is a matching shortage of buyers. Indeed, many of the fastest rises in share prices are attributed to short-sellers buying back shares like crazy to cover their losses after unexpectedly good news at a company.

Any stock market transaction by definition involves both a buy and a sell of equal size. The only difference between a conventional trade and a short-sale is that the two take place in a different order. In any case, neither sales nor purchases of shares carry any moral properties.

Having said that, short-selling is usually associated with rapid trading rather than long-term investment. Participants will normally be looking for volatility to give the quick returns required, but that also means lots of risk. If you decide you want to profit from over-priced shares, you have to be prepared for that.

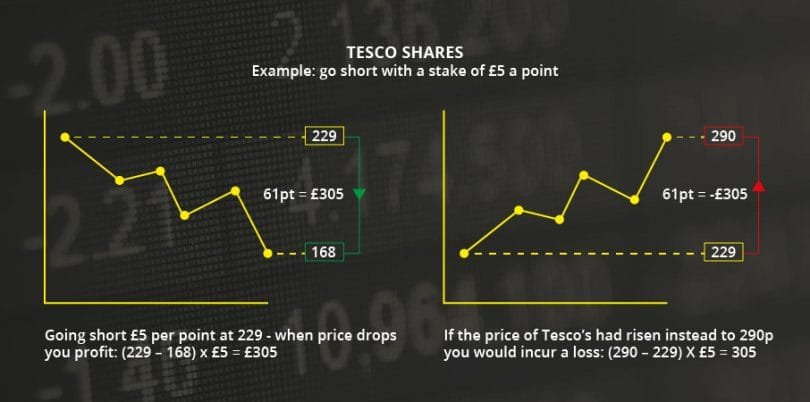

Short Trade Example

The first thing to emphasise here is that the beauty of spread trading is that it is just as easy to go short as long. If you are used to the conventional method of buying shares for investment or trading, you may find that going short is a strange thing to do.

To start with you may also find it difficult to spot short trades because you are not used to looking for them. I urge you to educate yourself and your eye to ensure that you give equal importance to short trades. This is for two reasons -:

- If the market is in a down trend it is the only way to make money consistently.

- Prices often fall more rapidly than they rise so it is possible to make more money by going short.

In Figure 3 is a chart of a better-known FTSE 100 company, British Airways. Let’s assume here that in April 2004 (arrow) you notice that the share price is likely to fall. In order to profit from that you need to go ‘short’.

Again, let’s take a closer look at the chart to see how this will work.

In the above example on the 30th April you decide to go short when the market mid price for British Airways is 285 (£2.85).

The spread offered by the trading company at that time was:

284.8 to 286.6 (a spread of 1.8).

You sell at 284.8 (sell price).

On the 20th May you decide to close the trade. The market mid price is 257 (£2.57) and the spread offered by the trading company at that time is:

256.5 to 258.8 (a spread of 2.3).

You buy at 258.8 to close the trade.

Your profit is 284.8 – 258.8 = 26 points.

There are a couple of things in that last trade worth looking out for -:

- The spread changed from entry to exit.

- The spread was not even on either side of the market price.

Let’s look at these in more detail.