Simulated trading accounts are a MUST if you either haven’t tried spread betting before, or are new to spread trading. In fact, they’re important even if you are experienced in other markets, so you can see how futures markets react compared to the cash (immediate) markets. Virtual trading offers an opportunity for potential spread betters to understand the markets, the dealing process, how a software platform works and margin requirements and test trading strategies before committing real money, and going through the normal account set up procedures involving proof of ID and Address. The ability to practice with virtual money reduces the risk of clients entering into incorrect positions and helps clients understand the risks involved in dealing with geared products. This is also very important when you are risking your own money as losses can exceed gains.

Trade Nation are currently offering a free demo account to start practicing. It offers a convenient way to learn to trade online, and practice, practice and more practice! Is there a better way to do it than a free demo?

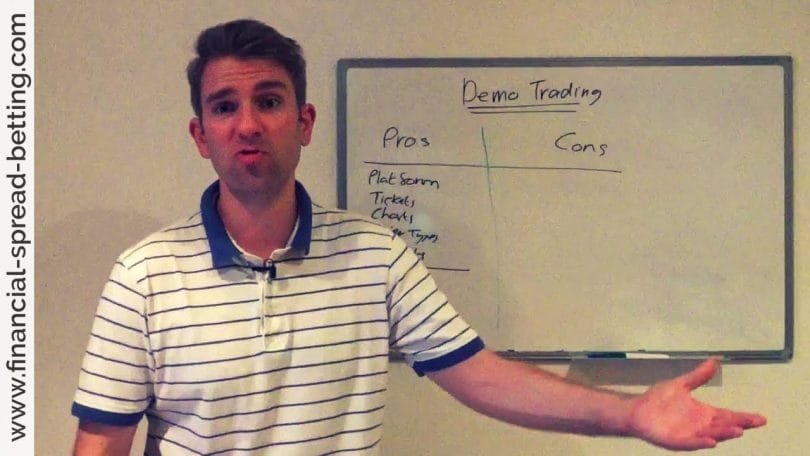

Demo accounts are also useful for a number of other reasons -:

- You can get a feel for the provider you will be using. This is one of the main reasons spread betting firms offer these free simulated trading accounts – they get you used to the trading platform so you’re more likely to stick with them when you trade with real money.

- You can try out a few trading systems before putting real money in. This is a lot tougher to actually do, as many simulated accounts don’t offer the full range of markets, and don’t have the full functionality of real trading accounts.

- Paper trading is essential as a means of assessing yourself. I know the emotions are not there but if you are going to trade a one minute chart or on the tick as I do you need to be able to act quickly to get in and out of the trade before it moves and to set a contingent limit order. A long period of paper trading will give you confidence in the trading platform without the pressure of money being involved. You may find that the strategy you start with is not for you and so it gives you a risk free go at an alternative until you find the right one. It also gets boring after a while which is where the it tests your ability to maintain discipline. You find out if you have the patience to sit out the long boring periods until a trade comes together. If 90% of those who try day trading loose I would bet that 90% also would not have the patience to paper trading for 6 months….which after all is a very small period in a the total of a traders life….a bit like an apprenticeship.

The best simulated trading account I’ve found is at TradeNation. I wish all real spread betting accounts were as user friendly as this simulated account. Here you can not only trade shares and indices, but they also offer a fantastic range of FX, and they will get you used to spread betting, CFDs, and other instruments. In addition they have a few guides and research, market overviews, stock alerts, and numerous reports and news articles.

Downside of Demo Accounts

Is demo trading identical to trading for real? Virtual trading is a good way to sharpen your skills before parting with any real money. Demo accounts are also great if you want try out different things. But demo accounts carry no stress, there is nothing quite like making real losses or gains (even small ones) and in this context paper trading is of little use from a psychology perspective – it totally lacks the pressure that comes with real trades – and that will hit you when you move from paper to real no matter how much the paper trading taught you. You see virtual trading will always be a lot different to trading with your own money. You will always take more risks and do things you wouldn’t with your own money, no matter how much you try not to. Sometimes it is better to do it for real but with tiniest allowable stakes. And don’t scale up from there too soon, no matter how impatient you are to move up – wait until you’ve turned your token starting amount into your target amount – and then do that exercise again at the same tiny stake, to find if it was a fluke!

THE PSYCHOLOGY OF TRADING A SIMULATED ACCOUNT IS VERY DIFFERENT TO TRADING WITH REAL MONEY. Many people consider simulated trading to be a waste of time because of this simple fact. This is because you only ever know how you are going to react if a market is going against you or in your favour when you are trading with real money. That’s why I recommend that you start putting some real money to the test as soon as you familiarise yourself with the workings of spread betting. Trade with the minimum trade sizes at the start. You can thus get a feel for how trading works for a minimal level of risk, which can help you decide on your technique and favoured markets, and how you should use the other tools such as stop losses.

>> Next Page – Spread betting trading capital: How much do I need to start?