The sterling versus euro currency exchange rate is one of the major Forex pairs, with both currencies being large players in world economics. You can also see this exchange rate quoted the other way round, as EUR/GBP. Of course there is no fundamental difference in the analysis; simply the order of the currency determines whether to take a long or short position.

The sterling versus euro currency exchange rate is one of the major Forex pairs, with both currencies being large players in world economics. You can also see this exchange rate quoted the other way round, as EUR/GBP. Of course there is no fundamental difference in the analysis; simply the order of the currency determines whether to take a long or short position.

The euro has been under some pressure, with a few member countries in the euro zone facing credit downgrades if not national bankruptcy. Through it all, Germany has been a strong country that is called upon to support the weaker members. There have even been rumours of the alliance breaking up, but it appears that all possible efforts will be made to keep it together, and prevent further turmoil in the global markets.

The European Central Bank is responsible for propping up ailing economies, as the lender of last resort to them. It is also charged with setting official interest rates to try and stabilise the diversity of economies that use the euro.

The fact that the UK controls its money printing presses, can support its bond market and is politically committed to cutting its budget deficit has ironically transformed it into a European destination of choice for traders. For the Euro, it is an existential crisis. Should Greece leave the euro, markets will swiftly speculate over the next exit candidate, likely to be Spain.

On the UK side of the equation, the Bank of England is responsible for the interest rate, and meets monthly to decide whether it needs to be changed. Once again, fundamental principles underlie its action, which is designed to keep inflation in check, stimulate employment, and stabilize growth, to the extent that all these goals can be achieved. Even if the data hardly paints a great picture of the UK economy, our economy still looks much sturdier than that of many of the UK’s debt-laden eurozone counterparts who don’t even have control on their currency.

Whatever is decided by the European Central Bank and the Bank of England can have a marked effect on the GBP/EUR, and any time that the interest rates are out of step with each other there is inevitably a pressure on the relationship. Obviously, money flows to where it is treated best, which in the absence of other factors would be the bank which offers the higher interest rate, so demand increases and the price increases when the interest rate goes up.

Having said that, even if you become aware that the rate is going up, it is not always a good idea to bet on this principle. Unless you are alone in this knowledge, it is likely that other traders will also have taken account of it in advance, so the actual announcement may not have the expected effect.

The next item to be considered is the balance of trade, and the amount of imports and exports and other income. In the long run, inflow and outflow of money should be balanced, but it is not unusual for countries to borrow significantly when required to pay for their imports. These figures are also hinted at or known in advance, and the same caution applies.

There are many other indicators which should be reviewed, such as the gross domestic product, unemployment figures, and cost of living or inflation factors. These all provide a backdrop for trading on the currency pair GBP/EUR, and can give some useful indications of trends to come. However, for spread betting and short-term trading on the Forex markets, you will also need to refer to technical analysis to derive indications to time your trades.

So why is the pound so strong versus the single currency and will it continue?

There are two key drivers of FX markets at the moment that may be pound positive. Firstly, the Eurozone debt crisis has caused a massive flight to “quality” assets as uncertainty caused by Greek elections along with a weak growth picture spooks investors. The second theme is relative monetary policy stances by the developed market central banks.

Looking at the first point, believe it or not the pound is viewed as a safe haven even if we have recently emerged from the first “double-dip” recession since the 1970’s. Investors are ditching European government debt and instead buying UK Gilts. Interest in our bond market seems fairly immune to our own hefty deficit and weak growth outlook, so why is it attractive?

There are two reasons: 1) the Gilt market is both deep and liquid and 2, the UK government has never defaulted on its debt and recent figures have been improved boosted by the service industry. The United Kingdom is increasingly seen as a good place to invest and a great place to boost one’s business. Investors don’t even know for certain if the Eurozone will continue existing in its current form, hence it doesn’t have the same safety value as the UK market. Thus, a strong pound is not necessarily a nod to a strong UK economy.

The UK economy has expanded by 1.9% in 2013, that’s the strongest rate since the year 2007, according to the Office for National Statistics (ONS).

The second point is about the stance at the Bank of England. Although it is expected to keep interest rates on hold for some time yet, it still sounds concerned about the outlook for inflation, which has remained fairly sticky in recent months. In contrast, some countries like Spain and Ireland are at risk of deflation, which should continue supporting a looser monetary stance at the ECB.

Since yield is hard for investors to find in the current environment, the yield advantage of sterling may be enough to weigh on EURGBP.

The obvious question now, of course, is how long will the euro’s weakness against sterling continue and which trading strategies will be those that yield the best returns over the coming weeks.

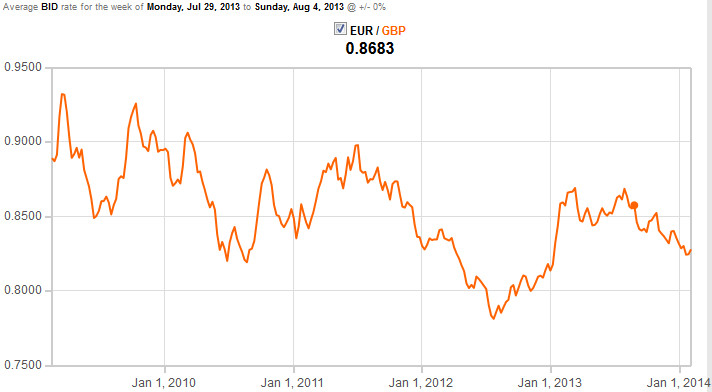

Statistical analysis shows that the euro has effectively been falling against the pound since the beginning of July 2011, dropping around 12% during that time with the pair trading in a descending channel.

Recently, the pound has managed to benefit from safe haven flows from mainland Europe and the fact that the UK economy has returned to growth. With Euro periphery concerns still present, investors have preferred to divest some of their euro asset holding by using sterling as their currency of choice.

GBP/EUR (British Pound/Euro)

- Track ECB and BOE Policies

- The GBP/EUR pair is heavily influenced by the monetary policies of the European Central Bank (ECB) and the Bank of England (BOE).

- Tip: Pay attention to interest rate decisions, inflation data, and central bank meetings for insights.

- Monitor Post-Brexit Developments

- Trade agreements and policy changes between the UK and the EU can cause significant market movements.

- Tip: Stay updated on trade relations and regulatory changes affecting the GBP/EUR pair.

- Use Economic Divergence

- Compare economic performance indicators like GDP growth and employment data for both regions.

- Tip: Look for trends in economic divergence to anticipate price movements.

Spreadbet the GBP/EUR | Spread Betting on Sterling/Euro

The UK took the decision over 10 years ago not to join many of its European partners and convert to using the euro. The disadvantages of sharing a currency, with weak countries creating problems for the stronger partners, has been evident recently, but the UK was not without its own problems in the global economic crisis. Spread betting on the GBP/EUR allows you to express your own views on the market.

The current spread betting quote on the GBP/EUR is 12,014.4 – 12,018.4. If you were strong on the pound, or thought that the euro would see further trouble and fall in value, then you might want to place a long bet on this currency pair. Say you bet £10 per point that the rate would go up.

Assuming the rate goes up, you must use your skill to decide the appropriate time to close your bet and collect your winnings. You want to make sure that you capture as much gain as you can, but guard against staying in the bet too long and allowing the price to come back down. Perhaps you close your bet when the quote is 12,236.1 – 12,240.1.

You bought the GBP/EUR at a price of 12,018.4, and sold to close the bet at 12,236.1. Taking one from the other, you have gained 217.7 points. With your stake of £10 per point, this is £2177 that you have won.

Sometimes the bet won’t go your way, and you have to take action to close your bet before you lose too much. Perhaps it dropped to 11,982.6 – 11,986.6, and this was as low as you were prepared for it to go, so you closed your bet for a loss.

Once again, you bought the GBP/EUR at a price of 12,018.4, but this time you closed at 11,982.6. That means you lost 35.8 points. Your losing bet has just cost you £358.

If you think that the euro will do better than the pound, then you can still bet on this pair. You simply need to place a short or sell bet, which is against the pound and in favour of the euro. Going back to the original quote of 12,014.4 – 12,018.4, your sell bet goes on at 12,014.4. Perhaps you stake £5 per point on this one.

If the price falls, you could decide to take your winnings when it reached 11,882.1 – 11,886.1. You sold the bet at 12,014.4, and closed it at 11,886.1, which means you gained 128.3 points. Multiplying it out, you have gained a total of £641.50.

If your bet is not good, and the price goes up, you may have to cut your losses when it gets up to 12,043.9 – 12,047.9, say. You can calculate your losses in the same way. You sold the bet at 12,014.4, and closed it at 12,047.9. The difference in points is 33.5, and as it went up it is against your short bet. With your chosen stake of £5 per point, that means you lost £167.50.