Intertrader, founded in 2009, was created with the goal of making the financial markets accessible to a wider audience. It operates under the trading name of Alvar Financial Services Limited, which is authorised and regulated by the Gibraltar Financial Services Commission (ref FSC1108MIF), with limited regulation by the Financial Conduct Authority (FCA) in the United Kingdom (ref 597312).

Corporate History

Intertrader was originally launched in 2008 under the name Party Markets through a partnership with City Index. At that time, it was a division of GVC Holdings PLC, a leading online gaming company listed on the UK stock exchange. In January 2010, Party Markets moved from the City Index platform to the London Capital Group (LCG), rebranding as Intertrader.

In 2016, Intertrader decided to operate independently from LCG and launched a new website, with operations run directly by GVC Holdings PLC. However, GVC Holdings PLC sold Intertrader to a private company at a later date, severing its ties with the brand. Intertrader is now a trading name of Alvar Financial Services Limited, a private firm, and it continues to provide trading services to both UK-based and international clients.

Curiosity: There are two parts to the meaning behind the name; ‘Inter’ stands for both Internet and international and in the coming months you will see how we are going to exploit the latest technology on offer to provide a trading service that enables customers to use a single account to access financial markets around the world and; secondly, many companies use the word ‘Index’ or ‘Spread’ in their brand name, but we preferred ‘Trader’ as this is our main focus – ‘you are the trader not us’.

Knowledge is everything. We have gained a better understanding of spread bettor’s needs, particularly the basics of a strong and reliable platform, superb execution, tight spreads and low margins. Understanding the need to tailor our service for many different types of traders has also been part of our learning curve. For instance, the needs of an equity trader using fundamental analysis are completely different from those of FX and index swing traders. The common denominator for both, though, is that they require tools and information to help them make more informed decisions.

Overview of InterTrader’s Current Trading Platforms

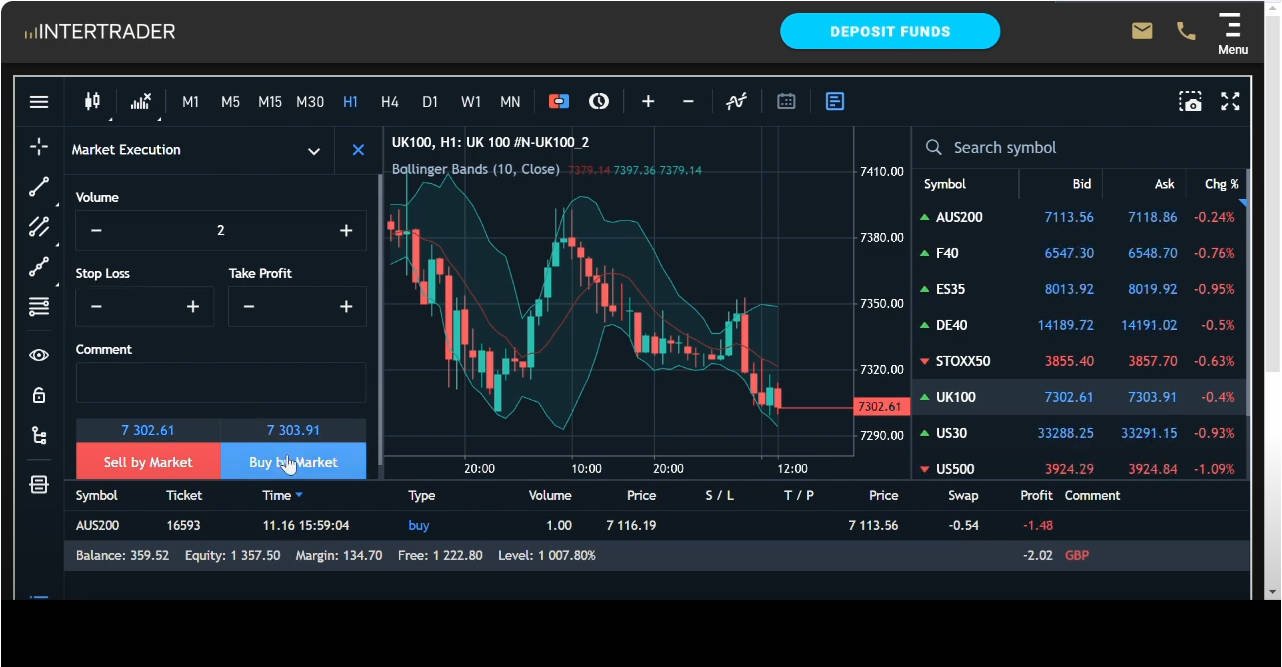

As of 2024, InterTrader provides a diverse range of trading platforms aimed at catering to traders of all levels. These include beginner-friendly web and mobile apps, as well as advanced desktop solutions. However, while the platforms offer some robust features, there are areas where improvements could enhance the overall experience. Here’s a breakdown of their key platforms:

1. InterTrader Web Platform

The InterTrader Web Platform is a browser-based solution designed for those who prefer trading without downloading software. Accessible from any device with internet access, it offers flexibility. Key features include:

Strengths:

- Real-Time Market Data: Comprehensive live pricing across Forex, indices, commodities, and shares.

- Customizable Charting Tools: A variety of technical indicators and drawing tools for analysis.

- Risk Management Features: Options like guaranteed stops and trailing stops provide some control over risk.

Drawbacks:

- Limited Advanced Features: Compared to downloadable platforms, the web platform lacks some advanced analytical and execution tools.

- Performance Concerns: The reliance on browser performance can result in slower load times during volatile market conditions.

This platform is suitable for casual traders seeking basic tools but might not satisfy those requiring more advanced functionality.

2. InterTrader MT4 (MetaTrader 4)

MetaTrader 4 remains a popular choice among Forex traders, and InterTrader’s integration brings its key benefits to the table.

Strengths:

- User-Friendly Interface: Intuitive design that appeals to both beginners and experienced users.

- Automated Trading: Ability to employ Expert Advisors (EAs) for strategy automation.

- Broad Community Support: Access to a wealth of third-party tools and resources.

Drawbacks:

- Aging Platform: While functional, MT4 is becoming dated compared to newer platforms, such as MT5.

- Limited Asset Coverage: Primarily focused on Forex, which may not meet the needs of traders seeking broader market access.

MT4 is ideal for Forex traders but may fall short for those wanting modern features or trading non-Forex assets.

3. InterTrader MT5 (MetaTrader 5)

The successor to MT4, MetaTrader 5, enhances capabilities with multi-asset trading and additional tools. Intertrader claim to be one of the first brokers to offer the MetaTrader 5 platform for both spread betting and CFD trading.

Strengths:

- Expanded Asset Coverage: Includes stocks, options, and futures alongside Forex.

- Improved Charting: Offers more technical indicators and timeframes than MT4.

- Integrated Economic Calendar: A useful feature for fundamental traders.

Drawbacks:

- Steeper Learning Curve: The added features can feel overwhelming for new traders transitioning from simpler platforms.

- Limited Adoption: While growing, MT5’s ecosystem is smaller compared to MT4’s well-established network.

MT5 is well-suited for traders looking for multi-asset coverage but might take time to master for MT4 users or beginners.

4. InterTrader Mobile App

The mobile app ensures traders can manage positions and access markets on the go, available on iOS and Android.

Strengths:

- Convenience: Full trading functionality from a smartphone or tablet.

- Custom Alerts: Stay informed about market conditions with price-based notifications.

Drawbacks:

- Limited Screen Space: Mobile trading can be less effective for detailed chart analysis.

- Occasional Performance Issues: Some users have reported lag or crashes during high market activity.

The app is great for managing trades on the move but is best paired with a desktop or web platform for detailed analysis.

5. InterTrader Pro (For Advanced Traders)

InterTrader Pro offers professional-grade tools and enhanced trading capabilities via a desktop application.

Strengths:

- Direct Market Access (DMA): Faster execution and lower spreads for professional traders.

- Customizable Workspace: Tailored environments for efficient trading.

Drawbacks:

- High Complexity: Geared toward experienced traders, which may make it intimidating for casual users.

- System Demands: Requires a powerful system for optimal performance, potentially excluding those with older hardware.

This platform is best for high-frequency or institutional traders who need precision and speed, though it might be overkill for less active users.

Conclusion

InterTrader’s range of trading platforms offers something for traders of all levels, from the straightforward Web Platform to the advanced Pro desktop solution. While there’s a strong focus on providing flexibility and diverse features, some platforms lack modern refinements or fall short in specific areas, such as user experience and performance under stress.