Trading Web iPOs

Web IPOs in general have a chequered history. No matter how good the fundamentals of the company, such IPOs have not always enjoyed great success.

For example, according to the Renaissance Capital listing of biggest Web IPOs, out of all the 10 companies in their list, just one – Google – has seen its shares rise over their initial offering price.

The question I am interested in now is what are the likely outcomes for a web iPO stock? If we don’t buy it now due to the risks facing most stocks when they launch on the market – high volatility and unpredictability (given there is no price history) – then when would be the best time to do so?

Firstly, I am going to allow the ‘honeymoon period’ on such shares to expire. That could take a while – maybe a couple of weeks or a month. The point is to allow time to pass for the stock to come back down to Earth, once all the hype and excitement has subsided. From here there are three scenarios: Growth, weakness or an all out flop.

This is probably what every punter who is buying Facebook/Twitter/LinkedIn shares right now wants to happen: another Google. In other words, for the stock to ‘skyrocket to the moon’ within a year.

Now apart from all the persuasive arguments that Facebook/Twitter/LinkedIn are not another Google let’s just assume that such sites do take off and begin to rally from here. What is often forgotten about Google is that had you patiently waited, you could have bought the stock two weeks later for the same price as on the day of its launch.

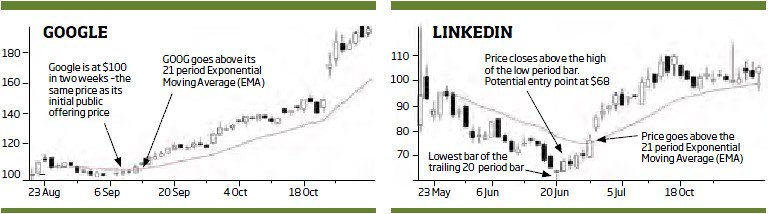

I suggest using a 21 period exponential moving average (EMA) on a daily chart of the stock (see Chart 1) and as a safety measure, only considering buying the stock when it is above this line and preferably as closer to it as possible.

This is a slightly conservative strategy and you may not catch the dead lows of the stock, but at least you have better odds of the stock going in your favour.

You can see from the chart below that LinkedIn’s first day was also extremely volatile, (although unlike Facebook, it managed to finish the day with a positive close). For the next 30 days it sold off until late June when it rallied above its 21 EMA. Traders who prefer a more aggressive approach, could consider buying when the price has closed above the high of the low period bar (HOLP). This method is carried out by counting back 20 bars and then identifying the lowest bar in this period. Once the price has closed above the highest point of that bar, you can go long. A stop loss can be placed a few ticks below the low bar.

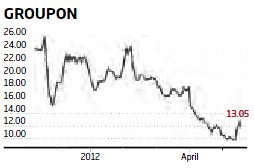

This would give you the advantage of firstly allowing the odds to turn in your favour and also getting an earlier entry into the markets. There is also the possibility that such companies could befall the same curse of Groupon (GRPN) and a whole bunch of other web stocks, and that 12 months from now it is still trading lower than its IPO price.

Even though this may seem an unlikely scenario at first, it is worth remembering that history has shown that a great business does not necessarily translate to a great stock.

Contributed by Alessio Rastani; a professional stock market and forex trader