Bonds and Commodities

Rising commodity prices tend to push bond prices lower, while falling commodity prices lead to higher bond prices. In other words, there is a distinct inverse relationship between bonds and commodities–most of the time. On the other hand, there is also a lagged relationship that is rarely noticed, but is equally powerful. Commodity price trends follow major bond market turning points by about two years.

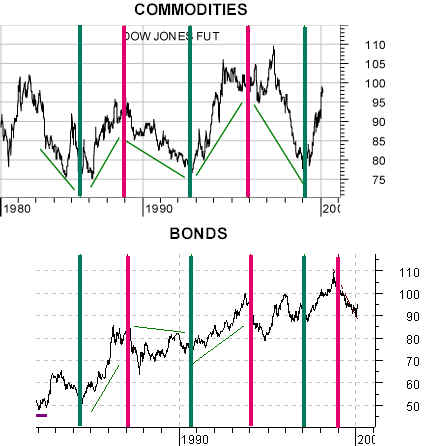

I have included charts (below) of the U.S. 30-year T-Bond futures and the Dow Jones AIG Futures Index, and shifted them so that the lead/lag relationship can be seen more clearly. What you are looking at, then, are the broad movements of longer-term interest rates (with falling bond prices equating to rising rates) and commodity prices. Viewed in this way it is possible to see quite clearly how major peaks in the bond market (lows for interest rates) are followed about two years later by cyclical peaks in commodity prices.

It makes perfect sense that there should be a lag. Central bankers admit that it often takes 12-18 months for monetary policy changes to impact the economy. Like a pebble splashing into a body of calm water, the ripples spread out over time through the conduit of the financial system and into the real world. It is my observation that major changes in the direction of longer-term interest rates–either up or down–affect commodity prices as a whole two years later.

Join the discussion