Ja’nus: Early Roman god of gates and portals, represented by two opposing faces, probably suggesting the two sides of a door. Janus symbolizes the two-sided nature of things.

During bull markets, traders alternate between two modes. At times, traders favor relatively strong stocks. Laggards are sold, and the proceeds are used to finance the purchase of stronger stocks. A strength-following strategy works best during these periods.

At other times, the reverse is true. Profits are taken in stocks which have been strong, and the proceeds are redirected into laggard “bargains”. During these periods, a contrarian approach is more profitable.

The Spread

During strength-following markets traders express a preference for relatively strong stocks. As a result, stocks with a recent history of relative strength outpace the benchmark. At the same time, relatively weak stocks are sold or ignored, so they fall behind the benchmark. Capital flows from weakness toward strength.

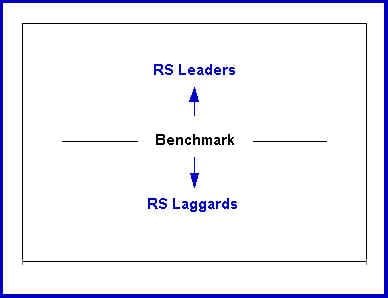

A strength-following market is a positive-feedback system. Higher relative strength attracts buyers, who in turn drive relative prices even higher. Lower relative strength brings out sellers, and weak issues continue relatively weak. As a result, a performance gap, or Spread, opens up between relative-strength leaders and relative-strength laggards, as illustrated in the graphic below:

Strength-Following Market

At some point, the Spread is wide enough that traders recognize increased risk in pursuing relative strength leaders further. At the same time, opportunities among laggard stocks become compelling.

As traders’ preference switches to laggards, positions in strong stocks are sold and laggard bargains are purchased. As a result, relative strength leaders may sell-off or consolidate as laggards begin to break to the upside. Capital flows from strength toward weakness.

A contrarian market is a negative-feedback system. Low relative price attracts buyers, and their buying turns relative price higher. High relative price, on the other hand, brings out sellers, and the relative price of relative strength leaders begins to sag. As a result, the performance gap, the Spread, between relative strength leaders and RS laggards narrows, as illustrated in the next graphic:

Contrarian Market

The Spread constantly expands, then contracts, as traders first push stocks to relative-strength extremes before pulling them back toward the benchmark. This process is repeated again and again. This dynamic is the power behind much of the market’s fluctuations, and is as natural and necessary as breathing or the beat of the heart.

Traders who limit themselves to either a strength-following or a contrarian approach do well part of the time, but at other times their one-sided strategy produces inferior returns. Changing the focus of trading from relative strength leaders to relative strength laggards, and back again, in synch with the Spread improves overall results and reduces frustration.