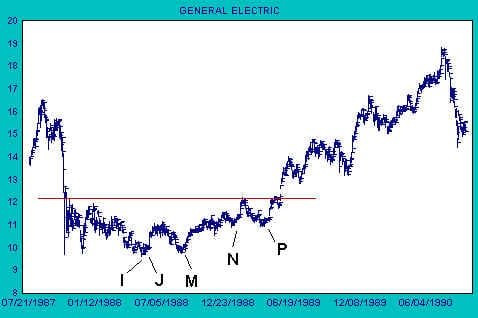

We established our long position by increments at I, J and M. Now GE rallies into a range of supply which extends from about 11 to just over 12 before settling into narrow trading just above 11. The stock is now in strong hands, and residual supply at 11 is easily absorbed. We elect to add to our position at N.

The stock promptly rallies to the upper end of the supply range (O), before dipping back to support at 11. We recognize this as a normal correction which retraces about one half the previous advance from 10 (M). At P, trading narrows as volume drops off. Supply is exhausted.

Evidence is building that the stock is ratcheting upward on higher support. Given this evidence of growing strength, we add again to our position. Of course, should this higher support not hold, we are prepared to control our risk by selling shares purchased at N and P.

It has taken months to accumulate our long position in GE. Our strategy has been to acquire our line by increments, adding only as evidence builds of accumulation by strong hands. Each addition to our position has been acquired as close to short-term support as possible in order to contain risk, and we have been prepared to reduce or eliminate our shares at any time, should important evidence of weakness seriously threaten the bullish case for GE.

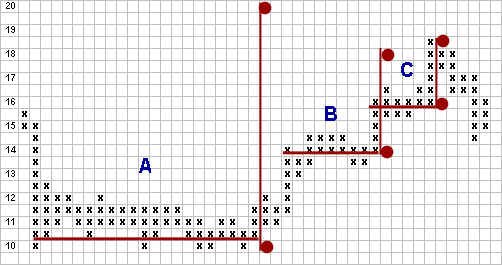

Our position, assuming four purchases of an equal number of shares at I, J, M, N and P, gives us an average cost below 10 1/2. By the time GE convincingly breaks out above supply (12) in May of 1989, our average holding period has been roughly seven months. At the point of break-out, we have a profit of nearly 20% under our belt already. At every point our risk was under positive control because of our willingness to immediately reduce exposure should the technical condition of GE deteriorate. Our first target of 13 is exceeded by a strong rally. This is a good indication of strength and augurs well for the longer-term.

As the rally unfolds, our original long-term objective (18 to 20) established by measuring the accumulation at A is confirmed by smaller counts at B and then at C. In May of 1989, GE tops at 18 7/8, within the range of our original long term target of 18 to 20.