If you follow the advice of many financial professionals they will tell you that buying and holding quality shares over the long run is a sound investment. Whilst this may be true over 25 or 50 years the last 10 years have been dead money from anyone tracking the markets. In fact cash on deposit would have produced better results with a lot less risk.

Let's use the S&P500 which is the still the world's best benchmark to track is an example. If you had invested in November 1998, 10 years on you would be sitting at a loss.

So whilst Buy and Hold has not worked the last decade we also know that most short term traders don't make money as many including Warren Buffet are certain that hedge funds and trades cannot beat the index over the long term, so what's a good solution?

Here is a very simple trading system which keeps you in during the good periods and gets you out during the poor years. Just using a simple 20 month moving average, 420 days (21 trading days roughly per month).

Based on this you would have been out of the market in January 2008 and still be out, saving you a lot of pain. You would have bought in June 2003 and stayed with the up move until January 2008. It's going to be a long time before you get a new buy signal on this trading system, I cannot see a buy signal until at least end of 2009. More aggressive traders can of course also short when the 20 month SMA is broken.

On a shorter term view I do see some attempt for markets to bounce between now and the end of the year. I really cannot see the S&P500 closing the year down 40%, so some sort of upside is due, but even if we do get this 2008 is going to be a year most investors want to forget.

I am the first one to admit that the bullish call on Gold is not looking great, however its not over yet, and do remember any one buying Gold at the start of the year is far better off than anyone that had bought the stockmarket. I still see Gold ending 2008 with a gain, I cannot say the same for the FTSE100 or Dow. The next 6 to 8 weeks could see some large moves in Gold. One way to play this would be a SL76 which a Gold 800 Call for December 2009 currently around 70p, also Silver should see a lift and this could be backed with SW66 which is a $15 September 09 Call currently trading around 90p.

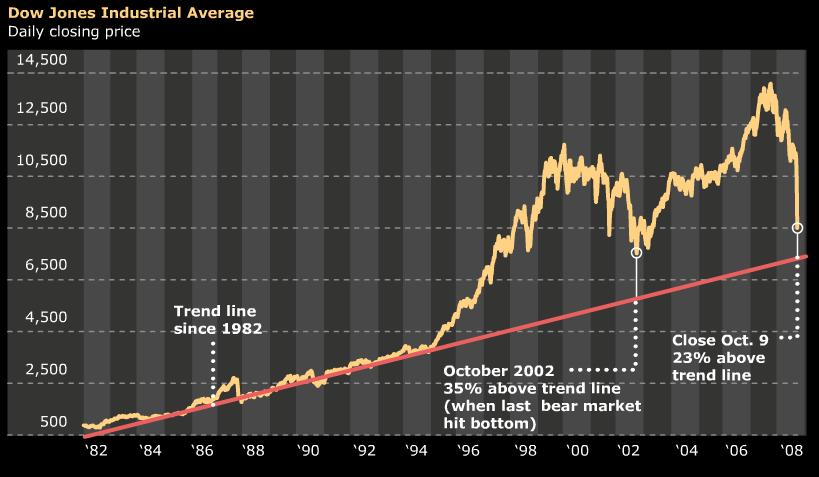

In times when everyone is focused on minute by minute moves its sometimes good to a step back and look at the longer term picture. Here is a chart going back to 1982 and long term trend line in red calls for a move to around 7,000. Whilst no one can say for certain 7,000 should hold up and produce some sort of a bounce, however this does not mean it's the start of a new bull market, its just some temporary relief. 2009 could easily see whatever lows we make now being retested and broken. It will be at least 12 months before I can consider a new bull market starting.

|

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.