Q. How does a Contingent Order work?

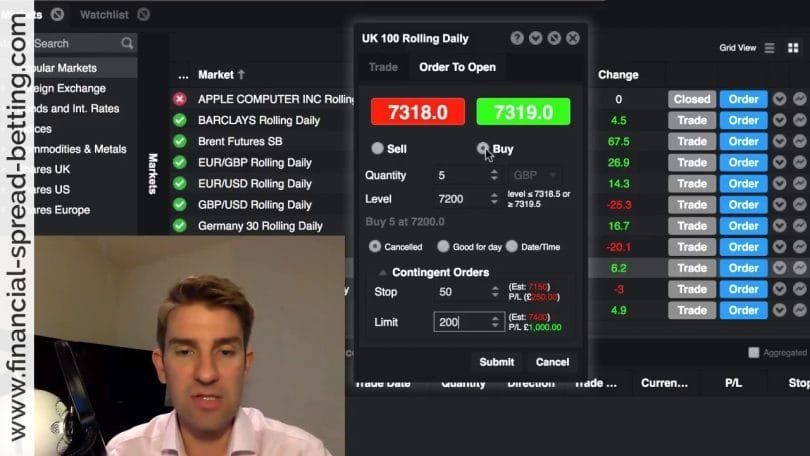

A: There are a number of different order types and all are intended to help you manage risk. Contingent orders are a kind of advanced order, lying inactive until after the first order is executed. As soon as the primary order is executed, its contingent orders (if it has any) become active. Contingent orders are intended to counter against severe future losses or preserve potential profits by closing the position at one of two specified prices.

These two price points are called the Stop level and Limit-Profit level:

-> The Stop level is intended to limit potential losses by closing the position at a pre-determined, losing price (once the stop level is triggered, the order will be filled at best price execution). The Stop price will be set below the market price for a long position and above the market price for a short position.

-> The Limit-Profit level is intended to help preserve profits by closing the position at a pre-determined, profitable price. The Limit-Profit price will be set above the market price for a long (buy) position and below the market price for a short (sell) position.

Contingent Order: Index Trade Example

A trader has a bearish view of the Dow Jones and decides to place an order with a stake of GBP5 to sell the Dow at 11,000. Even though the trader is bearish on the Dow he doesn’t believe that the Dow will fall below 10,300 anytime soon. Additionally, the trader wishes to cap his losses should the price rise above 11,500.

-> The trader should place the following primary order: Sell: 5 Dow Jones per point @ 11,000.

-> The trader should place the following contingent order: Limit-profit: Buy: 5 DJ per point @ 10,300 with a Stop: Buy: 5 DJ per point @ 11, 500.

These contingent orders will become active as soon as the primary order to sell the Dow Jones is executed. Once the contingent orders are active, the Dow Jones position will be closed if the price falls to 10,300 or increases to 11,500.

On a really bad day it’s now crystal clear that we can’t depend on Barclays Stockbrokers to enact stops at the set price. Here’s the dialogue:-

‘Why didn’t you sell at my stop price rather than wait an hour into trading and sell at 20% below the stop price?’

‘The price dropped overnight’

‘No it didn’t it was trading at the stop price from 8:00 until 8.15’

‘We were busy and it was a very volatile share’

‘No it wasn’t. There were only 50 deals in it in the first hour’

‘Customers who placed their stops first were dealt with first’

‘My stop had been lodged 7 days previously’

‘Well – the market maker took the share off automatic trading and we had to deal with it manually?’

‘What – all 9 Market Makers took it off automatic simultaneously?’

‘I don’t know – but you should have put a limit on your stop price’

‘But if I’d done that it wouldn’t have been sold at all’

‘Possibly – but a stop price only means that we’ll sell it – it doesn’t mean that we’ll sell at the price you put on it’

‘But that’s the whole point of a stop order’

‘Our stop order only guarantees to execute – it doesn’t guarantee the price. Yes your share could have been sold at the price you set but by the time we dealt with it manually the price had fallen further’

‘And are you going to recompense me for that?’

‘No’.