Finspreads was set up in March 1999 by a team of six people with considerable experience in financial spread betting. Initially, backing was provided by Sporting Index, the biggest and most successful sports spread betting company in the UK. In May 2002, Sporting Index decided to concentrate on their core business and sold Finspreads to IFX Group PLC.

Mid-2006 IFX Markets (which operates Finspreads) was acquired by City Index in their quest to consolidate their position in the industry (Finspreads having a significant client base...) and expand their business horizons and thereby both City Index and Finspreads are now subsidiaries of City Index Holdings Ltd. The two companies are now under the same roof and share the same office floor and systems so although retaining the name...it is all City Index driven. In addition to spread betting, IFX deals in FOREX, CFD's and commodities. The Group is a member of the FSA, and, for the purpose of spread betting, holds a bookmakers' license..

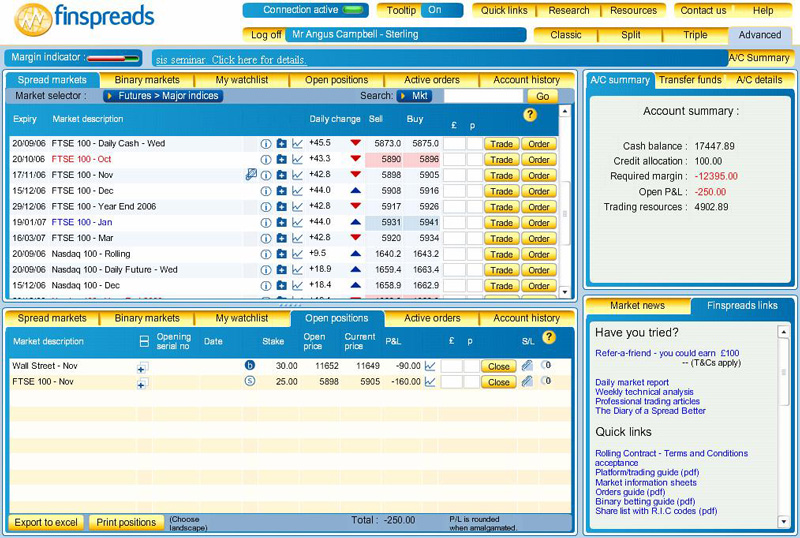

Newcomers who require (or think they could endure) a step-by-step guide to spread betting and who initially only want to dabble in small stakes might consider taking out an account with Finspreads. Finspreads, now part of the City Index group, claims to have well over 35,000 clients on its books making well over one million trades a year.

Clients can join on-line or by downloading an application form from the website and as usual the account is set up on either a debit or credit basis. You can open a spread betting account with as little as £100 with Finspreads, but you do need more in reality, I would think a minimum of £500. At Finspreads you can trade from as little as 50p a cent move, which is the approximate equivalent of 50 shares. Once up and running clients receive a weekly statement of all trades which have either closed or expired naturally.

As with most applications for a spread betting credit account, be prepared to contend with the necessary paperwork. Supporting documentation from other financial arrangements is required to prove you are worthy of operating such an arrangement. Finspreads offers a wide array of financial markets on which to have a spread bet either on-line or over the phone.

The majority of popular markets are available to spreadbet, as are all the stocks in the FTSE 100, 250, 350 and many other UK companies. We note that Finspreads currently quotes hundreds of US shares, including the 30 Dow Jones stocks and a large number of NASDAQ 100 and S&P 500 shares. You can also bet on the top stocks from Germany, Holland, Italy, Spain, France and Switzerland. Indices, currency pairs and commodities are also available as spread betting markets, with indices being very popular bets. Included also in the market information sheet are bond and interest rates and commodities (including London wheat and, more intriguingly, US lean hogs, oats, corn, rice and soya). The next time a farmer complains about falling prices, make his day by pointing this out. Finspreads seem to push 'approachability' as one of their selling points - maybe more so than narrow spreads.

When clients make an initial application they also have the option of joining the Finspreads Trading Academy. This is an eight week patronizing course which, Finspreads says, is intended to help clients get a better understanding of spread betting. During the period, course notes are sent to clients through the post on various aspects of trading. Catch one of Sandy Jadeja's free sessions (note that this is really a plug for his course, as he gives you snippets from his full price course, all on Fib ratios) and you'll come away with a trading strategy, which has the potential to work (although you do need experience and still have to learn, patience, discipline...etc).

Applicants who take up this offer are allowed to make the bulk of their trades at 10p per point online (rather than the usual 50p per point) through the learning period as a means of limiting initial risks. The offer does not cover FTSE 350 shares, however, where the minimum bet stands at £3 per point. Note also that you can't place stops at this level, you have to go to 50p/point for that. You can open an account with them for £100 although £200 might be more appropriate, which is quite enough for rolling bets of 50 pence per point. If you lose that £200, think hard before adding more. If starting in this way remember not to count the pennies but the points... And do keep in mind that they don't really want bets under the £1 point level although they have never objected to my 10 pence bets (they cost more for them to admin than they can make). As a general rule, it is also worth noting that Finspreads imposes a higher trading minimum for its telephone bets (£2 per point and £3 in the FTSE 350) compared with internet transactions (50p per point).

They are an important investment tool. Losses are unlimited if you sit there like a chump running your losses forever and a day. You can always cut that position and take that loss. People do lose money because they do watch their positions go worse and worse and worse in the hope that things are going to improve. Sometimes, they have to just take their medicine and close that position.

|

Patrick Latchford - Managing Director at Finspreads (on stop losses)

|

Both City Index and Finspreads now share the same underlying platform. At the present time only CityIndex offers iPhone dealing, also with Finspreads one can only spread bet but with City Index you can trade both spread betting and CFDs. Finspreads may be better suited for investors that are new to spread betting as it allows you to place spreadbets for as low as 10p for the first 8 weeks. On the other hand with City Index for the first 4 weeks you can bet in stake sizes of 25p per point (via the 'Learn to Trade' programme). Margins and spreads on both platforms are identical.

Good platform for those of you starting out as it allows you to place spreadbets with lower stake sizes. News, Charts and Technical analysis tools are nice but an execution platform with data which is actually there when you need it is important too.

Finspreads, a division of City Index Ltd.

See a very good video introduction to Finspreads by downloading the file by clicking here and open it (its in a winzip file) using your Internet Explorer (its a flash video which Microsoft Internet Explorer should be able to read). Please remember to support us by clicking on the advertiser banners - this consumes a lot of bandwidth and we need your support since everything on this site is free.

List of codes and stock names by Finspreads:

My list of codes and stock names by Finspreads.If you are located in the UK you can request a free no obligations brochure about Finspreads and the latest products and services they offer by clicking here

Read and Write Customer Reviews about Finspreads

Please note that here we are only giving an account of our experiences and readers comments/contributions, please do not take this as advice to open/close/avoid any firms - your experience might be different! Send us your comments by filling in the form below.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.