FSB: Hello Shai, thank you for agreeing to be interviewed. I think to start the interview; I would like you to introduce yourself.

Shai, InterTrader: I am the Head of financial spread betting and CFDs at GVC Holdings PLC and I have a background in marketing online services that spans almost 15 years. I always had a passion for the financial markets and especially trading, this is dream job for me especially as I have been an active trader for several years. I trade a wide range of instruments from FX through commodities to ETFs. My philosophy is that 'money should work hard for you all the time'.

FSB: We understand that InterTrader is the spread betting arm for GVC Holdings PLC which group is behind such brands as PartyPoker and Bwin. Tell us more. When was InterTrader launched? Why the name InterTrader?

Shai: InterTrader was officially launched on January 13th 2010. There are two parts to the meaning behind the name; 'Inter' stands for both Internet and international and in the coming months you will see how we are going to exploit the latest technology on offer to provide a trading service that enables customers to use a single account to access financial markets around the world and; secondly, many companies use the word 'Index' or 'Spread' in their brand name, but we preferred 'Trader' as this is our main focus - 'you are the trader not us'.

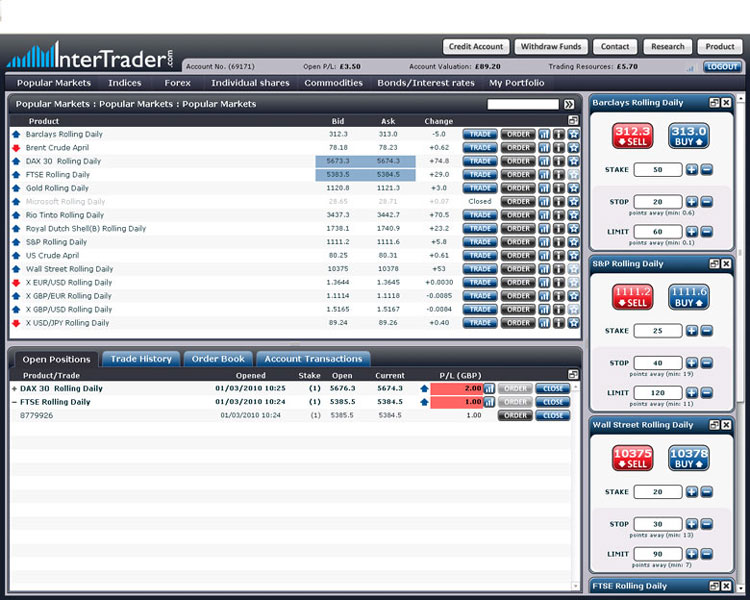

|

A peek at the InterTrader Platform

FSB: You've been offering a spread betting service for quite some time already (July 2008). What have you learned with your experience with PartyMarkets?

Shai: Knowledge is everything. We have gained a better understanding of spread bettor's needs, particularly the basics of a strong and reliable platform, superb execution, tight spreads and low margins. Understanding the need to tailor our service for many different types of traders has also been part of our learning curve. For instance, the needs of an equity trader using fundamental analysis are completely different from those of FX and index swing traders. The common denominator for both, though, is that they require tools and information to help them make more informed decisions.

FSB: We know that GVC Holdings PLC is mainly into poker and entertainment. Why the plunge into spread betting?

Shai: Our expertise is in delivering gaming services online. It doesn't make a material difference if it's online Poker, sport betting or spread betting. It's all about developing innovative and creative solutions to satisfy customers' needs and demands now and in the future. One of our success drivers is 'delighting the customer'.

FSB: There has been something of an explosion in the popularity of spread betting in the UK over the last few years. Why this and what is is the secret behind the success story of these products?

Shai: Greater awareness, understanding and familiarity with trading coupled with the accessibility provided by broadband technology. Spread betting is one of the gateways to anyone who wants to trade global financial markets: the common points system used for numerous financial instruments, is simple, in effect enabling traders more time to focus on making more informed decisions.

FSB: On InterTrader you put a good amount of focus on educating clients. Do you think the average casino or poker punter knows what spread betting is about?

Shai: Some do, some don't: it's difficult to provide precise percentages, but we do invest in education because we believe they have skill sets and abilities that are transferable. There are many similarities between a football betting punter who spends time analysing the teams ahead of a game, and a trader who devotes attention to analysing financial reports. The 'real time' analytical skills of a competent poker player are probably similar to those of a day trader.

FSB: We have read that you intend to focus on providing your offering in Europe. Tell us more.

Shai: Our intention is to offer this service across Europe where we have valuable experience in localizing our games - we intend to do the same with a CFD offering.

FSB: You launched into a market with established competitors. Why were you confident there was room for another player and is the market meeting your growth expectations?

Shai: A competitive market is a healthy market. Our focus is on putting the customer first, particularly in providing tools that they can use to make more informed decisions that hopefully will result in more profitable trading.

FSB: Investors interested in the financial markets like to think of themselves as having a certain amount of knowledge and sense. I do know for a fact that the average trader isn't much interested in online casino gambling (unless I'm wrong) but how does this work in reverse - is the average casino player interested in trading? And which segment are showing the most interest in your financial offering: casino or poker players?

Shai: There are traders who enjoy betting and there are poker players and sports punters who see spread betting as a natural evolution of their activities. Poker players are probably more suited to crossing the divide to trading, because of the mathematical skills required to work out the betting odds on each and every hand that they play.

FSB: Poker is often compared to stock market trading in a myriad of ways. Please expand. Do poker players make good traders?

Shai: There are many similarities. Managing your bank-roll in a poker game has very similar principles for adjusting the size of your trades to the size of the investment. Understanding the probabilities of the cards you have is not that much different from analyzing a candle stick chart and assessing the expectancy of what a trade can yield.

FSB: Who guarantees and is the ultimate 'trustee' of customer funds?

Shai: InterTrader is a trading name of London Capital Group (LCG are authorized and regulated by the Financial Services Authority (FSA). On top of this LCG is listed on the London Stock Exchange so anyone can find out information about them if they need to.

FSB: InterTrader is based on the LCG platform. Tell us more about it and your future plans to develop it.

Shai: I'd love to but that would be akin to handing the 'keys to the safe' to our competitors who will be watching us closely!

FSB: Do LCG handle your customer support? Also, do you have a development team of your own working on InterTrader?

Shai: The basic customer support is being provided by LCG whilst we develop the added value services beyond the basic trading platform.

FSB: Can non-UK residents open a spread betting account?

Shai: Yes, although there are certain jurisdictions from which we are unable to accept clients.

FSB: What markets do you deal in? Is the coverage of markets the same as LCG's?

Shai: All the markets offered by LCG are available on InterTrader.

FSB: What is the minimum amount of risk capital required to begin spread betting at InterTrader?

Shai: You can start from as low as £30 for opening a £1 per point position on the FTSE 100.

FSB: You used to offer minimum stakes of 10p at Party Markets which is perfect for beginners. Will the minimum 10p stakes still apply at InterTrader?

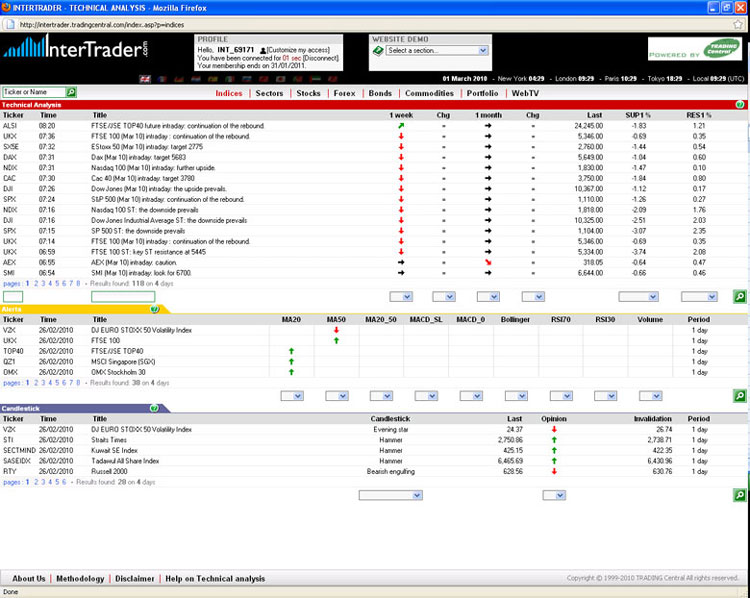

|

Technical Analysis Tools Centre at InterTrader

Shai: The minimum stake for interTrader is £1 per point. Many of our customers used the 10p minimum stake to evaluate their strategies before they committed to the full amount InterTrader customers can access our demonstration platform which has live quotes where they can test their strategies before plunging into the real thing.

FSB: How much is the financing rate for holding long share positions? And short positions?

Shai: InterTrader currently (at today's date) applies 2% over and under libor for overnight financing.

FSB: For future bets is it better to allow the bets to run to expiry or does it make no difference? {some spread betting providers will not charge a spread on the close if the bet is left to run till expiry}

Shai: It's entirely up to the client as to whether they roll a future contract or not. If they want to continue their view that a market will move in a particular direction and don't want to pay the small spread on re-entry (bets are exited at the mid-point of the near month, so there is no charge on closing a roll), then all they risk is if the market moves in their direction and they haven't rolled.

FSB: Recently we have seen spread betting providers upping margin requirements with little or no advance notice and curbing credit accounts. What is InterTrader's' policy on margins and credit betting?

Shai: As per margin, we do not harbour any plans to change our current policy. Our customers can to continue and enjoy the low margin requirement. We do not offer credit accounts, the margin as itself creates a leverage on customers' equity and we see no reason to increase the financial risk with credit. My personal view is never trade with money that you don't have.

FSB: Do you allow trading on FTSE 350 stocks? Smaller Caps?

Shai: Yes.

FSB: What are the order types that are available to be placed?

Shai: Clients can place new order stops, limits and OCO leaving them good for the day, good till cancelled and good till specific time. All open bets have an automatic stop loss attached (which is subject to slippage) and they can attach a limit order too.

FSB: Are there limits on how far a stop loss order can be placed from the entry price?

Shai: Yes and they differ from market to market but generally stops and limits can be left very close e.g. just a few pips away.

FSB: Can one trade out-of-hours?

Shai: InterTrader has a 24 hour dealing desk and we quote the FTSE 100 index throughout the night.

FSB: Tell us about your TradeBack rebate scheme. How does it work? Isn't this a bit like rakeback in poker? The idea is certainly novel but doesn't it make more sense to have tighter spreads instead?

Shai: TradeBack is a loyalty programme that rewards customers with a monthly rebate. The idea is to create for the trader a revenue stream that is based on volume rather than on P&L.

This is how TradeBack works: Let's say a customer trades the Wall Street and cable (GBP/USD) his average stake is £25 per point , he trades about 3 days a week, 10 round trip trades in each market on a session.

Wall Street : 3 days * 4 weeks * 10 trades * £25 stake * 3 point spread = 9,000

GBP USD : 3 days * 4 weeks * 10 trades * £25 stake * 2 point spread = 6,000

Together : 15,000 points, resulting in a gold status award of a 10% rebate of £1,500 per month.

FSB: What markets are most popular with your clients?

Shai: Most of our customer prefer trading the main Indices and FX.

FSB: What is the average holding period?

Shai: The new service is very young; it's too early to pull out any data that will be statistically significant.

FSB: What types of client do you aim to attract?

Shai: Everyone who is looking to get the best value for their money.

FSB: Any idea of total volume of spread betting market / CFD trading industry?

Shai: It's difficult to obtain all of the information needed to provide an accurate picture, especially for the private company operators. It's fair to say, however, that the market is big.

FSB: What's your view on the future of spread betting in general?

Shai: The future is bright. I believe more investors who today trade equities and other instruments will appreciate the benefits of margin trading as a more efficient utilisation of capital.

FSB: What sort of stakes are your clients trading for? Where is the bulk of the action?

Shai: The service is currently in its early stages, so it's too soon to tell.

FSB: Do you see any differences in trading when the stakes are raised? How do experienced traders behave in such situations vis-a-vis speculative traders?

Shai: Many PartyMarkets traders used the 10p stakes to test very aggressive strategies that they would otherwise not do at higher stakes.

FSB: Please describe some interesting strategies which your clients are using to spread bet the markets.

Shai: There are no set rules in how to profit from the financial markets. On the one hand we have day traders coming in and getting out of the market 20-40 times a day and; on the other hand there are traders who use quarterly bets to build a portfolio and wait patiently for the market to turn in their favour. Essentially, trading is all about research 'think before you act'.

FSB: Do you envisage that there will be major regulatory changes with regards to spread betting in the future?

Shai: Most regulatory regimes tend to evolve over time and I expect that to be the case for spread betting.

FSB: What differentiates you from other competitors?

Shai: Our TradeBack Scheme is unique in this space - the fact you, the customer can earn a monthly rebate from us based on volume only can be found nowhere else in the market. TradeBack provides a level of certainty in terms of potential income from trading. Combined with tight spread and superb execution, our package as a whole is very attractive.

FSB: And what's next on the cards for InterTrader?

Shai: Professional traders in the large financial institutions have access to a wide variety of tools that help them make more informed decisions. Without giving too much of our game away to our competitors, we are looking to see how we can adapt some of them to the retail space.

FSB: Do you organize any training seminars or meetings which our readers could attend? Do you have any special sign-up trade offers for our readers who decide to go ahead and open an account at www.intertrader.com?

Shai: We intend to start a webinar programme next month. Traders can log into this service wherever they are, avoiding the costly and time-consuming journey to the centre of London during rush hours to listen to a lecture. Our webinars will be hosted by a professional trader, who will provide education on a number of areas such as how they trade the markets, trading strategies, money management, psychology of trading and much more. Professional insight, but not advice, for free- that's what we mean by delighting our customers.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.