Originally launched in July 2008 through a partnership with CityIndex, InterTrader (previously known as Party Markets) is a division of PartyGaming, the biggest online gaming company listed on the UK stock exchange. In January 2010 PartyMarkets migrated away from the City Index platform to the London Capital Group family and it has been re-baptized as InterTrader. InterTrader accepts UK applications as well as international clients. Founded in 1997, the PartyGaming Group is a constituent of the FTSE 250 share index with its shares listed on The London Stock Exchange under the ticker: PRTY.

PartyGaming's move to offer financial betting products is in line with an increasing number of operators like Victor Chandler, 32Red, Purple Lounge and PaddyPower, all traditionally pure gambling companies that have diversified their product range to include such financial offerings and marks a change of focus from targeting the recreational player base.

A representative of PartyGaming said: 'This agreement with LCG represents a bridge between egaming and traders. It acts as a step towards convergence.'

And so now we have PartyGaming and London Capital Group jumping into bed...two big boys of spread betting and poker have agreed an alliance to help launch InterTrader. The problem is that the average casino or poker player is unlikely to want to bet on the direction of the Dow Jones or FTSE. For me I can definitely say that the opposite is true - very few traders are interested in gambling their money away.

Where is the real growth potential for the spread betting market? Will it be emerging markets like Asia or would it be 'dumbed' down products for the Joe Public?

InterTrader is branded with the Party name but is in fact a white-label of London Capital Group. The InterTrader platform runs on the latest technological trading platform as developed by LCG.

InterTrader are taking the approach of investing heavily in customer education which is natural as they need to educate their client base - their partnership with London Capital Group is highly flexible and allows InterTrader (formerly Party Markets) to create some nice custom applications/programmes to help with acquisition and retention.

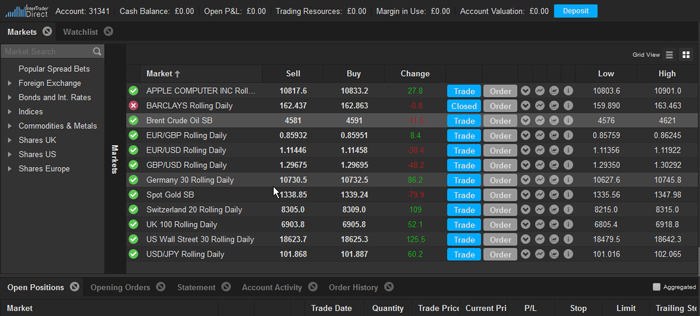

|

The InterTrader trading platform interface

Many spread betting firms focus their efforts louring traders to use their services with exceptional bonuses and safety nets, this is nice and beneficial for all sides involved but, what about keeping the loyal customer happy, does your spread betting broker reward you for trading with him overtime?

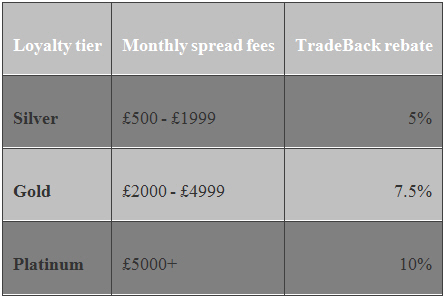

InterTrader decided to take a stand and reward loyal traders in the best way possible cash. InterTraderís loyalty programme called TradeBackô rebates traders every month for a fraction of the total spread fees paid over a month regardless of P&L the more you trade the higher the rebate rate and the overall rebate will be. InterTrader.com use the following table when calculating rebates.

|

Letís use an example to better illustrate how it works -:

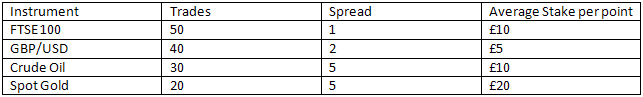

Monthly trading log Mr Trader

|

The calculation will be the following -:

(50X1X10)+ (40X2X5)+ (30X5X10)+ (50X5X20) =7,400 X 10% = £740 rebate.

On the first week of the following month Mr Trader will receive £740 directly to his trading account no strings attached.

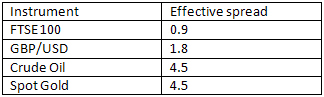

Traders are always looking for the tightest spreads around, if Mr Trader will calculate what was the effective spread on his trade he will find out that it was -:

|

The InterTrader loyalty programme is available to all traders who sign up from FSB, once an account is live it is automatically entitled to enjoy TradeBack rebates. Note also that the Gold bid-offer spread is now 4 points.

Read and Write Customer Reviews about InterTrader here

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.