I am often asked how I have made so much money from trading and how I keep track of so many markets. For those that don't know I trade a variety of markets ranging from commodities, currencies, bonds, shares and indices, but because of my trading style I don't have to be an expert on a market to trade it.

Whilst many will spend hours reading reports, checking lots of data and fundamentals before opening a trade my style of trading requires now of this data. The number one concern for me is PRICE. If the price has gone from 50,55, 60, 65, 78 and 80 then I know we are in an up move and the trend is up. It does not matter what the press say, what the company director says, whether the P/E is 10 or 100, all I know is that if the price is steadily moving up then I should buy it and if it is steadily moving down then I should sell it short.

One of the biggest reasons people cannot make money in trading is that they find simple strategies to hard to follow. The truth is humans like to be clever, they want to second guess the markets and the only saying "if its that simple everyone would be doing it", well the truth it trend following is easy, what's hard is have the discipline to follow it.

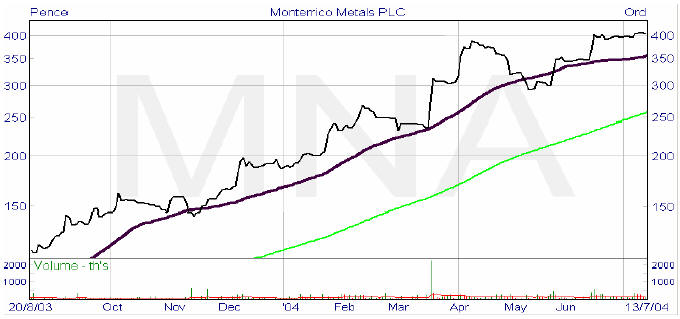

Let me give you an example, look at this chart of Monterrico Metals which was up to 13th July 2004.

|

We can see the chart has gone from £1.00 to £4.00 in around 12 months. Well many would say it's moved up so far it's "over bought" it cannot go higher. Some will say its time to sell take profits. What would a trend follower do? Well as a trend follower we take the view that everything we need to know is the price, we don't need to know what the company does, whether its just had a big copper find, what the analysts think, all we know is the price is moving higher and we take the view that trends continue so we would still buy it. Right now the price of Montterico Metals is over £5.80 so the trend continues up and who says that it could not move up to £7.00 or more in the coming months.

No one can tell you where a trend will end, I have seen trends go for months and years. Everyone likes to think they can call a top or bottom but that's the easiest way to go broke. My honest advice is go with the flow, it easier and if the flow is up you should be with it.

At some stage this trend will change and by using a trailing stop loss you can make sure you lock profits whilst keeping the trade open. Trend trading reminds we of the Hare and the tortoise story, the hare being the trader that wants to be in and out of a share all the time, the Tortoise being the steady plodder that in the end wins the race.

You can find UK shares that are long term up or down trends by looking at the 52 week highs or lows. A few of my own bets at present include SAB Miller, Derwent Valley, Northgate, Pennon and DCC. Of course it seems strange buying a share which is trading at its highest price over the last 52 weeks, after all should be not but low sell high? NO buying high and selling higher has been a great way to make money and you would be foolish to bet that this will not continue to be the case.

Thou shall not forget: YOU SHOULDN'T SPEND MORE THAN £500 TO ATTEND A WORKSHOP OR SEMINAR NOT EVEN IF THEY PROMISE YOU GOLD FOR ATTENDING

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.