More about the Google Finance Portfolio

Dec 16, 2011 at 6:36 pm in Tips and Strategies by

You already know that I ditched my Google Docs spreadsheet implementation of my Stop-Out List in favour of one based on the Google Finance “Portfolio Feature”. The more I use the new implementation, the more I like it, and in this article I’ll tell you why.

A Watch List for Me and for You

If you’re not bought into my idea of a Stop-Out List, you will nonetheless recognise it as a kind of watch list — of equities that I might consider buying (or selling) in the future. I could have used the Google Finance ‘Portfolio’ merely to construct a list of the equities I’m interested in; but by adding transactions to the portfolio I am able to record my last selling or buying price of each stock.

Whether you decide to use it in the way that I am, or in some other way to support your trading strategy, as a watch list tool you may find it invaluable.

Interesting Features

The first thing to emphasise is that you can create multiple portfolios and give them names. So how about your ‘Current Holdings’ portfolio (if you must maintain this yourself), your ‘Prospective Penny Shares’ watch list, and your watch list of ‘High Yield Stocks’ (for the more investment-oriented readers)?

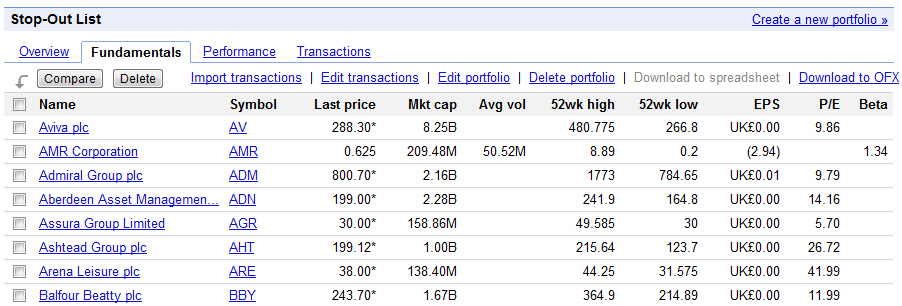

In my original article I showed the portfolio in Performance view to emphasise the ability to record a last-selling-price and subsequent price change for each stock. Continuing the “investment” theme for a moment, how about viewing your portfolio or watch list in Fundamentals mode (as shown below) to see such goodies as Earnings-Per-Share (EPS) and Price / Earnings (P/E) ratio? If you like that sort of thing.

In my original Stop-Out List spreadsheet I had included a column containing hyperlinks that would jump to the Google Finance or Yahoo! Finance web page showing detailed information plus a chart for any stock entry. Each of the entries in the new Google Finance Portfolio is hyperlinked automatically so that you can discover everything you wanted to know about Aviva (for example) by clicking the Aviva plc hyperlink in the portfolio.

I’ve not yet found a domestic or international equity that I can’t add into the portfolio, and if indices are your thing then you might consider adding the FTSE 100 index via its unique symbol or by searching for it like this:

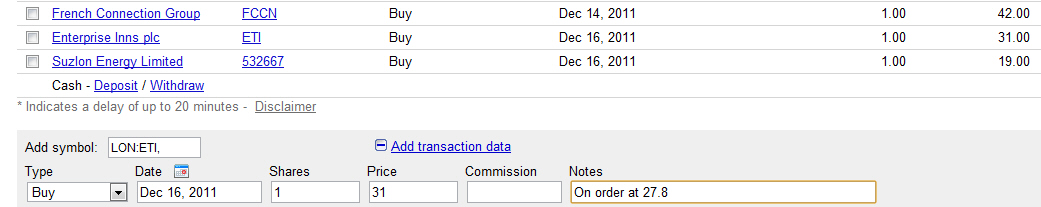

As you can see above, when adding a (stop-out) transaction it is possible to add some Notes. I could have added a note that my Enterprise Inns position had stopped out for a profit of £3.20, or I could have recorded my last entry price, so that I know not to buy again until it becomes at least as attractive as it was the first time around.

Alternatively, as shown above, I have recorded the fact that I immediately (upon stopping out) placed a new opening order on Enterprise Inns at my previous entry price of 27.8 — so as to have another bite at exactly the same cherry. This ability to record a note for myself is useful because I have a tendency to re-establish a stopped-out position while forgetting that I already have an order in place to do so; so then I have made the mistake of ending up with two positions unintentionally as I did once on Psion.

Don’t Ditch the Spreadsheet

Although I’m pretty sold on this portfolio and watch list tracking facility, it’s early days and I might yet decide that a spreadsheet implementation was better — in which case all of the effort involved in building this portfolio will have been in vain. Or will it?

Did you notice the following hyperlinks in my first figure above?

Portfolio

It means I can get my entire Stop-Out List back into a spreadsheet format at the click of a single Download to spreadsheet link. Nice!

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.