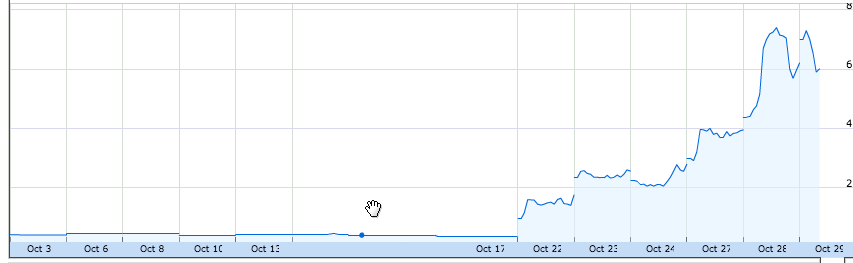

Fitbug Holdings – over 1000% rise in the last month

Oct 29, 2014 at 12:00 pm in AIM by contrarianuk

A company called Fitbug holdings caught my eye yesterday and I was astounded to see that the company which is a provider of online coaching services and fitness devices has risen 1329% in the last month. It currently sits at 6p after trading as little as 0.3p as little as a few weeks ago. Yesterday it sold as high as 7.6p with the company being forced to issue two RNS’s saying that it knew no reason for the extraordinary rise as the shares doubled, “Further to the announcement of 12.03pm today, the Company wishes to make it clear that it knows of no reason for the move in its share price other than its agreements with Target Corporation and J Sainsbury plc to stock Fitbug products in their stores, as announced on 22 October 2014.” The current market cap is around £10 million.

Fitbug Holdings Plc (FITB) is the AIM listed holding company of Fitbug Limited, a leading provider of online coaching services and devices. The company produces wearable devices that help monitor calorie burn and sleep. The products transmit their data to computer via a Bluetooth signal and allow users to monitor their fitness progress. Fitbug’s range is similar to the US product Fitbit and the former is currently fighting a legal battle with Fitbit for trademark infringement. A trial date of 9 February 2015 has been set by the U.S. District Court of Northern California to hear the Company’s legal action against Fitbit. The Company has asked the court to order Fitbit to permanently cease use of its trade mark and from engaging in conduct that is causing confusion with Fitbug’s brand and services.

A month ago the real interest in the company began when Target and Sainsbury announced they would stock their products by Christmas. Next month it is also due to launch the KiQplan™digital coaching product. In late September the company issued its first half results with sales increasing by 98% to £914,000 (H1 2013: £461,000) reflecting increased device sales following launch of Fitbug Orb with a pre-tax loss of £1,610,000 (H1 2013: loss of £1,049,000) reflecting increased investment in KiQplan™ development and legal fees to support the Fitbit action.

But with only £160,000 cash at the mid year stage plenty now depends on a successful conclusion of the legal action and strong sales of the Fitbug Orb and KiQplan™products. For those buying in below 1p a mighty fine investment….but further gains might be harder to come by. A ten bagger in a month from an obscure AIM company is not to be sniffed at. The Times was reporting this morning that shorter Simon Cawkwell, aka Evil Knievil, was shorting the shares and predicting a placing to raise funds. Given the meteoric rise in the share price, the board would be probably sensible to take advantage of the share price right now and conduct a placing to clear its loans and give it more ammunition to pursue its legal claims.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.