EY 2013 and the Falklands drillers

Dec 4, 2013 at 2:31 pm in AIM by contrarianuk

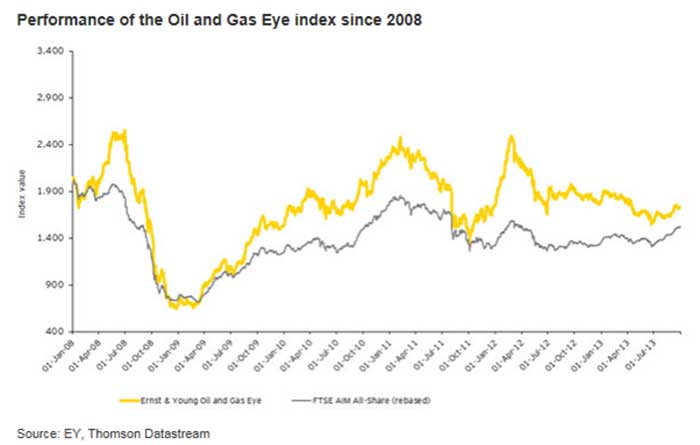

Ernest and Young produce a quarterly report on a clutch of small and mid cap U.K. AIM listed oil and gas explorers as part of their Oil and Gas index report.

Highlights of the Q3 2013 report were:

- The Oil and Gas Eye index posted 9.6% growth in Q3, the largest quarterly gain in eighteen months.

- Selective investor appetite for perceived riskier stocks has returned. Three AIM oil and gas IPOs reflected this positive sentiment, and the IPO pipeline suggests the AIM oil and gas universe will welcome more entrants in the remainder of the year.

- This market stability is welcome, even if it is once again short-lived. The index has not had more than two consecutive quarters of growth since 2009. The feel-good (or at least less-bad) factor has yet to reach the majority of junior oil and gas companies though.

- Secondary fundraising came to £49.3 million, 17% higher than Q2’s total. Just four companies accounted for almost three-quarters of funds raised though, and, five years since the financial crisis began, equity capital market conditions for most junior oil exploration companies remain difficult.

- With a number of companies undertaking strategic reviews, we believe Q4 will be busy for M&A activity. Strategies to focus on core assets, establish in key geographies, and accelerate production, are likely to make companies more attractive to potential investors.

But for many AIM oil and gas investors it probably hasn’t felt like a good year or two. The FTSE All share oil and gas index compared with the FTSE AIM 50 Index shows a large divergence in 2013. The key reason for the difference in the picture is that the Ernest and Young Index excludes some of the oil shares which have been most popular with private investors, the Falklands drillers – Falklands Oil and Gas (FOGL), Desire Petroleum (DES) and Borders and Southern (BOR), though does include Rockhopper Exploration (RKH). Its been a fascinating period of excitement and gloom for punters in the Falklands and many including myself have learnt valuable lessons about dealing with wild cat drilling in a frontier oil and gas province.

But for many AIM oil and gas investors it probably hasn’t felt like a good year or two. The FTSE All share oil and gas index compared with the FTSE AIM 50 Index shows a large divergence in 2013. The key reason for the difference in the picture is that the Ernest and Young Index excludes some of the oil shares which have been most popular with private investors, the Falklands drillers – Falklands Oil and Gas (FOGL), Desire Petroleum (DES) and Borders and Southern (BOR), though does include Rockhopper Exploration (RKH). Its been a fascinating period of excitement and gloom for punters in the Falklands and many including myself have learnt valuable lessons about dealing with wild cat drilling in a frontier oil and gas province.

Many of the former have had a rough time after failed or disappointing exploration drilling in the Falklands basin in the period 2010-2012. I won’t go into detail with Desire Petroleum since it’s a story in itself, but in the case of Borders and Southern, the Stebbing Well was a failure due to technical issues in July 2012, prior to that Darwin produced a significant gas condensate find in April 2012. The City was looking for a good oil find since gas/gas condensate is technically more challenging to extract, process and transport than crude oil.

For FOGL, it was gas on their Scotia and Loligo prospects in November 2012 and September 2012, respectively. Apart from Rockhopper’s Sea Lion there has been no major oil find in the Falklands (Desire also had a minor discovery on their acreage) and gas/gas condensate is the major hydrocarbon so far in the deeper waters of the South Falklands basin.

For FOGL, it was gas on their Scotia and Loligo prospects in November 2012 and September 2012, respectively. Apart from Rockhopper’s Sea Lion there has been no major oil find in the Falklands (Desire also had a minor discovery on their acreage) and gas/gas condensate is the major hydrocarbon so far in the deeper waters of the South Falklands basin.

In July 2012, Rockhopper farmed out its acreage to Premier Oil which saw a large drop in the share price partly because of the financial terms which were to some extent dictated by the political climate in relation to Argentinian agitation but also the long lead time to first oil (2017). Premier acquired 60 per cent of Rockhopper’s interests in its North Falkland Basin licences with a $231 million upfront cash payment on completion of transaction and a $722 million Sea Lion development carry (net to Rockhopper) plus $48 million exploration carry (net to Rockhopper)

In October this year FOGL and Desire announced that they have reached agreement on the terms of a recommended merger in which FOGL will acquire the entire issued and to be issued share capital of Desire in exchange for FOGL Consideration Shares. Desire shareholders will be entitled to receive 0.6233 FOGL Consideration Shares for each Desire Share. FOGL Shareholders will own 60 per cent. of the Combined Group’s issued share capital, with Desire Shareholders owning the remaining 40 per cent.

FOGL also signed heads of with Premier and Rockhopper with respect to a farm-out of licences PL004a and PL004c and will fund the Combined Group’s share of the cost of two exploration wells, one on each of the Licences.

Two wells in the South Falkland Basin, partnered with Noble Energy and Edison International and three wells in the North Falkland Basin, one of which will target the Zebedee prospect will be drilled in 2014.

Yesterday, Desire shares were finally suspended and cancelled from AIM. Quite a milestone!

Yesterday, Desire shares were finally suspended and cancelled from AIM. Quite a milestone!

Desire Petroleum was founded in 1996 by Dr Colin Phipps, a former geologist for Royal Dutch Shell. The company is named after Desire, the ship, captained by John Davis, which discovered the Falkland Islands in 1592. In 1998 the company was floated on AIM and was awarded licences for drilling in the Falklands in 1997. Test drilling was carried out in 1998 but the major exploration effort happened in 2010-11 using the Ocean Guardian rig.

A 15 year story came to an end yesterday as the company officially disappeared, some may say thank goodness but it sure was a ride. The company was infamous for announcing an oil discovery in their North Falklands campaign and then over the weekend changing their minds and finding it was actually water. Calamity or stupidity?

Late 2014 will be a fascinating period as drilling restarts in both Rockhopper’s acreage in the North Falkland basin and on FOGL’s acreage in the deeper waters of the South Falklands basin. A final decision on whether Premier Oil will develop Rockhopper’s Sea Lion discovery will also be made next year with the context that major institutions are trying to persuade Premier to abandon the project as too risky and expensive e.g. Schroders despite the large amounts of oil which can be recovered – 350 million barrels or so.

Late 2014 will be a fascinating period as drilling restarts in both Rockhopper’s acreage in the North Falkland basin and on FOGL’s acreage in the deeper waters of the South Falklands basin. A final decision on whether Premier Oil will develop Rockhopper’s Sea Lion discovery will also be made next year with the context that major institutions are trying to persuade Premier to abandon the project as too risky and expensive e.g. Schroders despite the large amounts of oil which can be recovered – 350 million barrels or so.

by the Contrarian Investor

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.