Hurricane Energy confirms AIM IPO in February

Jan 23, 2014 at 6:31 am in AIM by contrarianuk

AIM will have another North Sea oil explorer in its ranks shortly with Hurricane Energy due to float in February under the ticker HUR.

AIM will have another North Sea oil explorer in its ranks shortly with Hurricane Energy due to float in February under the ticker HUR.

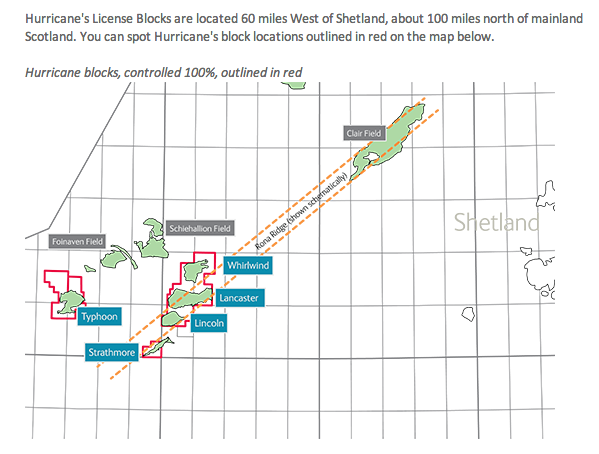

The company was founded in 2005 by chief executive Robert Trice, an ex Enterprise Oil man with its key asset being the Lancaster discovery west of the Shetlands Islands. The Lancaster acreage was fist licensed by Shell in the 1970’s but never developed and Hurricane has spent around £150 million so far discovering oil in 2009 at the field and then at its Whirlwind prospect in 2011. It plans to spend over £40 million appraising Lancaster with the Competent Person’s Report, prepared by RPS Energy Consultants Limited in November 2013, allocating 2C recoverable Contingent Resources of 207 million barrels. In total the company has around 450 million barrels of 2C Contingent Resources and 440 MMboe P50 Prospective Resources on acreage it controls 100% under licences P1368, P1485, P1835 and P1884 in the North Sea.

The company’s board is chaired by John Hogan, former chief operating officer of Lasmo, with non-executive directors including former BP chief geologist David Jenkins.

Hurricane is raising £18 million at 43p a share with another £31.4 million through the conversion of loan notes and a warrant at the time of the IPO, valuing it at £272 million. Early investors have included BP, F&C Asset Management, BlackRock, Artemis and JPMorgan.

The company is focusing its effort on so called “fractured basement reservoirs” in granite formations. These type of reservoirs have led to major discoveries in countries like Vietnam. The company has two further fractured basement prospects, Typhoon and Lincoln.

Hurricane also announced today that it had entered into an agreement with Transocean Drilling UK Limited and Talisman Sinopec Energy UK Limited for the provision of a drilling rig for Lancaster basement oil discovery which is The rig is expected to be available to start drilling in the second quarter of 2014.

The Hurricane Energy AIM float shows there is still some investor appetite for companies with a seemingly lower risk profile having found oil and in a position to prove up resources and move their fields into development. Though it is clear that generally speaking times are tough especially for those drilling in riskier parts of the world with a speculative wild cat drilling programme which often have a 1 in 5 chance of success for each well.

Hurricane comes a few months after the successful IPO of Caracal Energy. Caracal is a Canadian based oil explorer, previously known as Griffiths Energy International, which successfully raised $202 million in November 2013 to develop oil reserves in Chad. In mid 2013 it had to drop plans for a $150 million fundraising at the IPO onto the LSE after a lack of interest.

The company issued issued 28 million shares at £4.50 each compared with the IPO price of £3.55 and today they are £4.57. In June 2013 the company completed a $300 millon deal with Glencore Xstrata in exchange for a 25% share in its key Chad licences.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.