Leni Gas and Oil places its bets on Trinidad

Jan 19, 2014 at 9:01 pm in AIM by contrarianuk

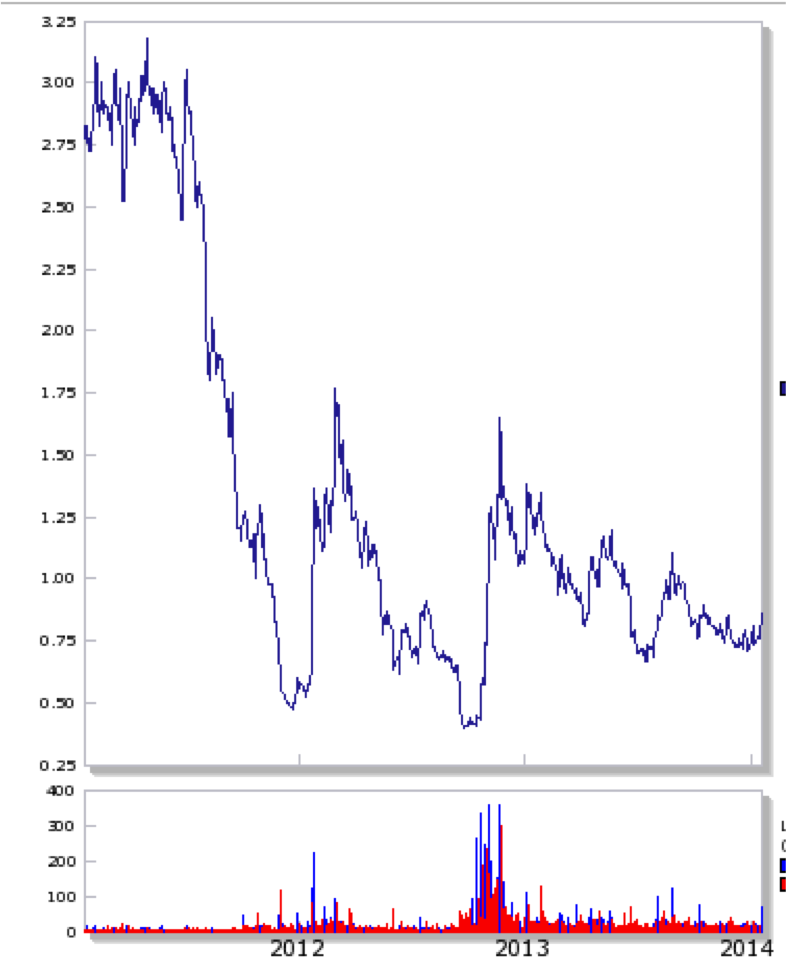

Investors in AIM listed Leni Gas & Oil (LGO) have had a wild ride over the last few years. The shares that traded at over 3p in 2011 and a lot more than that in prior years, currently sit at 0.86p after 14% rise on Friday, down 27% in the last year. Its market cap is now £19.5 million with 2,250,773,914 ordinary shares in issue.

Investors in AIM listed Leni Gas & Oil (LGO) have had a wild ride over the last few years. The shares that traded at over 3p in 2011 and a lot more than that in prior years, currently sit at 0.86p after 14% rise on Friday, down 27% in the last year. Its market cap is now £19.5 million with 2,250,773,914 ordinary shares in issue.

The company is led by a colourful character, David Lenigas, who is officially executive Chairman. Interestingly Lenigas is the Chairman of the Remuneration committee. He is also currently a Director of Solo Oil plc, Stellar Resources plc, Afriag plc, TEP Exchange plc and a Non Executive Director of Rare Earth Minerals plc.

History

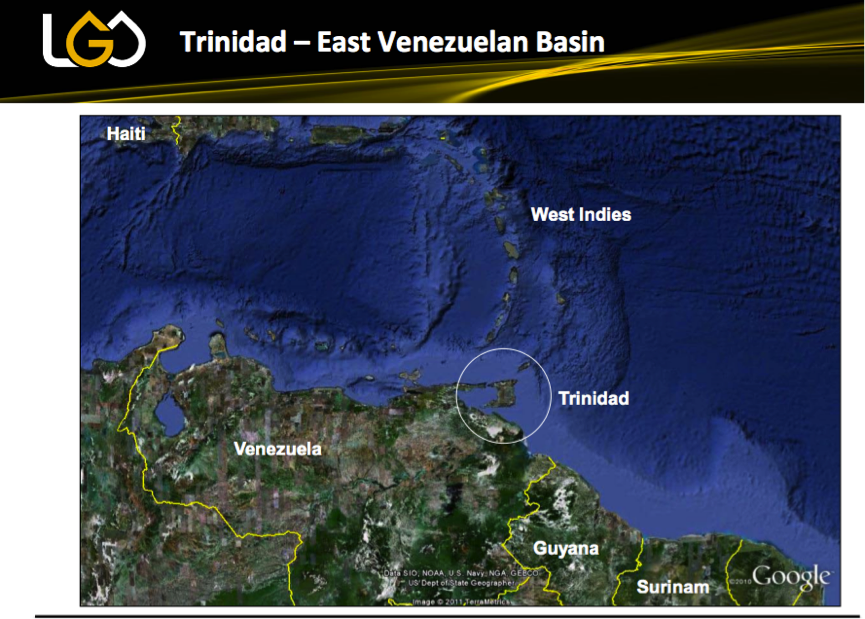

The company was incorporated in August 2006 and began trading on AIM in March 2007 and in that same year acquired interests in Malta and Spain. In 2008 it acquired its first assets in Trinidad with a 50% interest in the producing Icacos oilfield in Southern Trinidad.

In July 2008 LGO acquired a 22% interest in Byron Energy Pty Ltd for US$22 million in cash, which was later increased by a further 6.64% for $6.57 million. Byron is a private Australian company, incorporated in 2005. Since its incorporation, Byron has operated as an oil & gas exploration, development and production company focused on opportunities in the US Gulf of Mexico and the US

LGO also completed the acquisition of a 7.3% interest in PetroHungaria Kft and a 14.5% interest in ZalaGasCo Kft. PetroHungaria in Hungary which owns a 100% interest in the Peneszlek gas development. In March 2010, the Company relinquished all of its holdings in Hungary.

In October 2009, a Heads of Agreement was signed with Byron Energy Pty Ltd to transfer the Company’s 28.94% shareholding in Byron Energy to a direct ownership of its US Gulf of Mexico oil and gas assets.

In July 2011 the company farmed out 49% of its Moruga field and then in October that year it acquired 100% of Goudron in Trinidad.

Major assets

The country has a long history in producing oil, with around 3 billon barrels produced in the area. The energy sector represents approximately 40% of national GDP and 70% of all exports.

The first drilling took place in 1866, with the first commercial oil development in 1907/8 at Guapo (Point Fortin) with the offshore well in 1955 being the Soldardo Field discovery. The first refinery opened in 1911 at Point Fortin. There have been over 10,500 onshore wells drilled to date and peak oil drilling activity was in 1982 with 830,000 feet (on and offshore) . In 2012 Trinidad produced oil and condensate of 81,735 barrels per day.

In 2012/2013 new fiscal Incentives were introduced by the Trinidad and Tobago government including a 20% investment tax credit (against the Special Petroleum Tax) for mature fields and enhanced oil recovery projects, introduction of a 40% tax uplift for deep drilling costs, removal of VAT from large items of oilfield equipment, an exploration allowance of 100% capital in first year (to 2017), one years roll-over of unused EOR tax credits, full allowances against SPT for work-overs and side-tracks in year incurred.

Leni Gas and Oil first acquired interests in Trinidad in December 2007, with a 50% interest in the producing 1,900-acre Icacos oilfield. This was subsequently followed by the acquisition of the Cedros leases in 2011/12 and Goudron in October 2012 (Goudron E&P Ltd) (GEPL), this included the Incremental Production Service Contract (IPSC) for the Goudron Field in the Eastern Fields Area in south eastern onshore Trinidad.

Leni Gas and Oil first acquired interests in Trinidad in December 2007, with a 50% interest in the producing 1,900-acre Icacos oilfield. This was subsequently followed by the acquisition of the Cedros leases in 2011/12 and Goudron in October 2012 (Goudron E&P Ltd) (GEPL), this included the Incremental Production Service Contract (IPSC) for the Goudron Field in the Eastern Fields Area in south eastern onshore Trinidad.

Goudron

Goudron is the key asset with 2P reserves of 7.2 million barrels and over 60 million barrels of contingent resources associated with future water flood independently assessed in July 2012 by Challenge Energy Limited.

Prior to taking over control of the field as operator, LGO had agreed to carry out various works in support of the previous contract operator including the mobilising of a light work-over rig in May 2012. On taking over the full-time operation of the contract, GEPL immediately commenced a series of well work-overs and reactivations which have continued through the first half of 2013.

Two workover rigs have been continuously deployed at the field since April 2013 and are expected to remain until at least the end of 2013. Oil produced at Goudron is stored in sales tanks before being measured and pumped into the Petrotrin owned pipeline adjacent to the field which carries the oil directly to the Pointe-au-Pierre refinery in western Trinidad. As production rose steeply in the period, even increasing the frequency of sales was not sufficient to avoid capacity constraints, and so a new sales tank was constructed and commissioned in August 2013. Sales capacity has been increased to approximately 745 barrels which allow production of up to 530 barrels of oil per day (bopd) to be handled on a weekly basis. Additional sales tank capacity up to 2,000 barrels has been planned and environmental permits have been requested. Longer-term the installation of a Lease Automatic Custody Transfer (LACT) meter will be investigated to handle anticipated production from the field.

A total of 42 wells had been reactivated by end June 2013, from a total stock estimated to be some 90 accessible and reusable wells.

The application for the certificate of environmental compliance (CEC) for 30 new infill wells was submitted to the Environmental Management Agency and final approval was received on January 17th 2014 from the Environmental Management Agency of Trinidad and Tobago. Drilling contractor assessments have been performed and the first well is expected to spud as soon as the rig can be mobilised to the field, now expected to be in February 2014. New wells will be placed on production within approximately 60 days of spudding.

The Company is expecting an additional 10 new pump jacks in January 2014 and the current recompletion programme will continue in parallel to the drilling of the new wells.

On 18 October , the first anniversary of production on the field was marked by a visit by Senator the Honourable Kevin Ramnarine, Minister of Energy and Energy Affairs of Trinidad and Tobago, His Excellency Arthur Snell, British High Commissioner to Trinidad & Tobago and Mr Khalid Hassanali the President of the Petroleum Company of Trinidad & Tobago Limited (Petrotrin).

Maxim

In March 2013, a head of agreement was signed with Maxim Resources Inc. (Maxim), to collaborate on oil field developments in the South Erin Block.

LGO agreed to provide CDN$2.5 million in shares or cash to fund Maxim’s activities and will gain up to 49.99% of the issued share capital in Maxim as a result. Should Maxim be successful in acquiring control of the South Erin Block, LGO will invest up to US$5 million in further developing drilling in the producing Jasmin Field, and will become field operator and hold at least a 50% working interest. Maxim is presently engaged in a legal dispute with the shareholders of the Jasmin Oil and Gas Limited, the resolution of which is key to progress. As a consequence the transaction deadlines have been progressively revised to accommodate developments in this legal case.

On October 3rd LGO announced that agreement had been reached with Maxim to extend the deadline to complete the transaction. The proposed closing date of the Maxim transaction was previously set as 26 September 2013 and the companies have extended this by 6 months in order for Maxim to continue to pursue the imminent court case concerning its interests in the South Erin Block in Trinidad.

Other Trinidad interests

In the wider Cedros Peninsular, LTL holds a number of private petroleum leases totalling about 1,750 acres and is in the process of obtaining a private petroleum licence from the Trinidad and Tobago Ministry of Energy and Energy Affairs (MOEEA), in order to carry out a number of field surveys with a view to eventually drilling exploration wells.

LGO has also entered into a Letter of Intent with Beach Oilfield Limited (BOLT) to cross-assign the interests of the two companies within the Cedros Peninsula at stratigraphic levels below 7,000 feet. LTL will be the operator of the combined leases and will hold a 100% working interest, with BOLT receiving an overriding royalty on any future production revenues.

On 9th December 2013 LGO announced it had made progress on definitive agreements with BOLT with the signing of an Exclusivity Agreement, a Consultancy Agreement and Data Agreement. The first activity is now expected to be underway in early 2014.

The Farm-in Agreement is still at a drafting stage and to ensure the continuity of the relationship between BOLT and LGO an Exclusivity Agreement has been executed to give LGO exclusive rights under the HOA until the end of March 2014 by which time all the associated arrangements are expected to be finalised. The Data Agreement has now been agreed between the parties and is expected to be signed in December. The Consultancy Agreement was signed in October for an initial period of 12 months.

Subsequent to the signing of the HOA, BOLT have successfully received their assignment of the leases covered by the Farm-in Agreement and have commenced work on those leases. It is for example envisaged that a surface soil geochemistry survey pertinent to the joint interests of BOLT and LGO will be acquired in early 2014.

LGO’s own Private Petroleum Licence for the Cedros leases in the Perseverance and Columbia Estates which are under 100% LGO ownership is at the Ministry of Energy and Energy Affairs for approval and is now expected to be granted in early 2014.

No substantial progress has been made with the conveyancing of the leases associated with the North Moruga farm-in and as a consequence no operations had commenced in the field. The field option may ultimately be allowed to lapse. A sunset clause in the contract fell due in late 2013.

SPAIN

Leni has outright ownership of the Ayoluengo Field onshore in Northern Spain.It is a late life asset with original oil in place of over 100 mmbbls and current production of 100-200 bopd. The nearby Hontomin Field is awaiting a production licence and the company has 140,000 acres of exploration concessions in the Cantabrian Basin (100% owned)

MALTA

Leni had held a 10 percent stake in Mediterranean Oil and Gas’s (MOG) exploration block off Malta, but on July 31st 2012 sold that stake to MOG for a nominal $1 plus $19,050 in past liabilities.

In August 2013, MOG signed a $10m deal to sell a 75 percent interest in the block to Genel Energy, with an implied value relating to Leni’s stake of around $9 million.

LGO’s view that it was misled by MOG ahead of its agreement to sell its stake with MOG saying it had addressed the allegations in lengthy and detailed correspondence over a period of four months.

In January 2013 LGO issued proceedings against Mediterranean Oil and Gas plc (MOG) in the High Court of England and Wales alleging misrepresentation at the time of the sale of the Company’s 10% interest in the Area 4 Petroleum Sharing Contract in Malta. In a Case Management Conference before Justice Clarke in May the Court refused MOG’s application for security over costs in the action and ordered MOG to pay LGO’s costs in defending that application. The Court also ordered disclosure of relevant documents and set a timetable to trial in March 2014.

Funding

In June 2013 a 3 year US$10 million debt facility was announced with YA Global Master SPV Ltd with the first US$2 million draw down during that period with a twelve month repayment schedule and a fixed coupon of 9%. Global Master also agreed to increase the debt facility to US$15 million.

The Facility is designed to be paid back in cash from LGO’s oil production operations, but has various options, solely at the election of the Company, to be settled in part or fully in shares. There are no penalties for early repayment and the Facility is designed to be subsidiary to any senior secured debt arrangement.

LGO was working with Meridian SECZ to complete a 5 year US$50 million debt facility which will sit alongside the Global Master facility at this time but this arrangement changed later in 2013. The Company increased its commercial debt by $1.5 million to $2.5 million in late 2013 using its existing US$10 million commercial loan arrangements announced in June 2013.

In December 2013, the Company also raised an additional £600,000 before expenses, by way of a placing of 78,947,369 new ordinary shares at a placing price of 0.76 pence per share with institutions representing sophisticated high net worth investors.

YA Global Master SPV Ltd (YAGM) have also subscribed for a total of 131,578,944 new ordinary shares for a gross consideration of £1 million. Of this amount, £500,000 will be paid back by LGO to YAGM under an Equity Swap Agreement from which LGO is expected to receive £41,667 per month for a 12 month period

The equity swap agreement means that YAGM will only be entitled, but not obligated, to sell approximately 11 million shares per month in small daily increments from 21 February 2014. The final amount of the monthly funds received by the Company under the Equity Swap Agreement will be dependent on the future price performance of the Company’s ordinary shares.

Subsequent to the issuance of these shares the Company will have further drawdowns from the existing US$10 million debt facility will be deployed as necessary to execute the remainder of the 30 well drilling campaign at Goudron and to conduct the necessary studies required to commence secondary recovery using water flooding to access additional oil reserves.

Commercial negotiations initiated in May with the Petroleum Company of Trinidad and Tobago (Petrotrin) concluded in August resulted in an agreed reduction of the overriding royalties paid to Petrotrin.

In return for the reduced royalty payments, LGO undertook to increase the commitment work programme through the drilling of ten additional development wells and one exploration well in the Goudron Block. This work will be carried out over the next 6 years to November 2019. The contract was also modified to clarify the process for extending the duration of the IPSC, with terms for an additional 5 year period to 2024 being mutually agreed and further extensions being possible. The new overriding royalty rates are effective from 1 August 2013 and represent a marked increase in cash net-back from production. LGO intends to reinvest operational cashflow into new capital projects within the field.

In December 2013 the company announced that it secured an additional US$4 million of funding meaning that the previously announced debt package which was arranged with Meridian SEZC is no longer required for the next drilling phase of the Goudron Field development; however, it may be reactivated for funding further acquisitions in Trinidad.

Latest situation

The company said in October that it had achieved net oil production of more than 500 barrels per day from combined operations in Trinidad and Spain and that post-tax profit from operations now exceeds $300,000 per month.

The focus of news is the Goudron field in Trinidad with drilling due to start in February now the necessary environmental approvals have been received.

The last well drilled in the Goudron Field, GY-658, was drilled by Texaco in 1981. Well GY-658 was then produced until 1986 and was recently placed back on pumped production by LGO at a rate of approximately 20 barrels of oil per day.

The new wells to be drilled are targeting known productive intervals in the Goudron, Gros Morne and Lower Cruse sandstones and are conservatively anticipated to produce at initial rates of at least 60 bopd.

The first well, provisionally designated H-18E J-7, lies within an area of the field where unrecovered oil is expected to be present in the Gros Morne and Lower Cruse sandstones. The Lower Cruse at a depth of 2,800 feet sub-sea is the primary target of the well, which will be deepened to approximately 4,000 feet to ensure all productive horizons are intersected. Based on the offset wells; including GY-188 (250 feet to the north-east) and GY-64 (170 feet to the north-west), net oil sand of 250 feet are prognosed in the Gros Morne and a further 100 feet in the Lower Cruse. The second planned well, H-18E H-6, has similar objectives.

Drilling programmes have been prepared and have been submitted to the authorities and each well is expected to take 7 to 10 days to drill. Well evaluation and final completion will be undertaken after the rig has been moved and initial production is planned to commence within 60 days of spudding.

Following the drilling and completion of these additional wells the full implementation of the 30 well field redevelopment programme will, subject to financing, be initiated in 2014.. It is anticipated that the execution of a 30 well development campaign will move the majority of the resources to the proven category and a new competent persons report will be produced in 2014 once new drilling results have been obtained.

Dowgate Capital Stockbrokers has said that LGO is one of the broker’s ‘tips’ for 2014 and analyst Jason Robertson says the company is on the cusp of being taken seriously as an oil producer. “The company’s trophy asset is the 100% owned Goudron field in Trinidad, where an ongoing well reactivation and work-over programme aims to boost production to 90 wells,” “We believe with the work being undertaken at Goudron, production could quadruple to 2,000 bopd by the end of this year, significantly boosting cash flows.” , “Around 90% of production is likely to come from Trinidadian operations. Medium term, the objective is to expand production from Trinidad to achieve total production of 4,000 bopd.”

Summary

Leni Gas and Oil really is penny share heaven with a £19.5 million market cap to boot. It sure has been a complex company to research thoroughly with its various and growing assets in Trinidad and Spain.

The company certainly looks an interesting play with cash flow increasing sharply in the final half of 2013 in contrast to the pretty low levels of production and various mishaps with its assets in the period from its AIM listing in 2007. Institutional investors have certainly been burnt in the last 6 years with placings at 3-6p over this period.

The key question for existing and potential investors will be how successful the drilling campaign will be at Goudron, Trinidad in boosting production from the 500 barrels a day to the hoped 2000-4000 barrels a day.

Cash reserves are tight and the company is reliant on debt financing with several lenders including YA Global Master SPV Ltd (YAGM). An equity swap agreement in place with YAGM means that they can sell around 11 million shares per month from 21 February 2014. Any disappointments or delays at Goudron will be met with a harsh response.

The legal case with MOIL over the Malta sale stake to Genel is ongoing with a trial start of March 2014 with results unlikely before the end of 2014 unless an out of court settlement can be reached. The stake in the Maltese acreage was sold for $1 but could have been worth $9 million and it is unclear one is in the right. Unfortunately legal costs will be a drain but the upside is clear if LGO wins through in the end. Certainly it does sound a bit strange that Leni sells their stake in July 2012 and then suddenly there is a deal with Genel a few weeks later.

Corporate governance is always a fear with these micro cap companies and it was a bit of a surprise to see David Lenigas being company chairman and chairman of the remuneration committee! Though thankfully in the recent compensation changes the company announced he holds no options over the company’s shares.

In mid 2013 all previous existing options to directors were cancelled and the company implemented a new performance based option package for its key directors. For example, Neil Ritson, the Company’s CEO since 2010 was granted 25 million options at 1 pence exercise price which vest immediately; 25 million options at 1 pence exercise price which vest upon total group oil production exceeding 500 bopd for 10 consecutive days; 25 million options at 1 pence exercise price which vest upon total group oil production exceeding 600 bopd for 10 consecutive days; and 25 million options at 1 pence exercise price which vest upon total group oil production exceeding 700 bopd for 10 consecutive days. These options will all expire on 31 July 2018.

Steve Horton, the Company’s senior non-executive director, has had his existing options package cancelled and his options package has been replaced by the granting of 5 million options with an exercise price of 1 pence which vest immediately; 3,333,333 options at 1 pence exercise price which vest upon total group oil production exceeding 500 bopd for 10 consecutive days; 3,333,333 options at 1 pence exercise price which vest upon total group oil production exceeding 600 bopd for 10 consecutive days; and 3,333,333 options at 1 pence exercise price which vest upon total group oil production exceeding 700 bopd for 10 consecutive days. These options will all expire on 31 July 2018.

So Horton and Ritson will be entitled to around 15 million and 100 million options, respectively, at 1p if the production hits 700 barrels per day, which it should do if all goes well in Trinidad. So there is plenty of incentive there for the price to go above the 1p level in coming months.

Leni Gas and Oil have plenty of opportunities in Trinidad to boost shareholder value and certainly the next few months look to be interesting given a fully funded drilling programme. As ever all depends on luck with the drill bit but the workover programme on existing wells should also help production towards the 2000 BOPD level. For those investing sub 1p, the risk/reward ratio looks compelling if management continue to deliver on their recent promises and don’t repeat the blunders of the period following its entry to AIM. Not for widows or orphans but maybe one to place your bets on if you feel so inclined after doing your own research.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.