Tullow Oil – not afraid to Wild Cat drill

Dec 10, 2013 at 11:04 am in AIM by contrarianuk

Tullow Oil – A big cap oil explorer that loves wild cat wells

Tullow is a an independent oil & gas, exploration and production group, quoted on the London, Irish and Ghanaian stock exchanges (symbol: TLW) and is part of the FTSE 100 Index.

What makes Tullow interesting for me is their willingness to drill wells in frontier territories such as the Baring Sea or in Ethiopia, a high risk, high reward strategy but with around a 60% drilling success rate in 2013 not to be sniffed at.

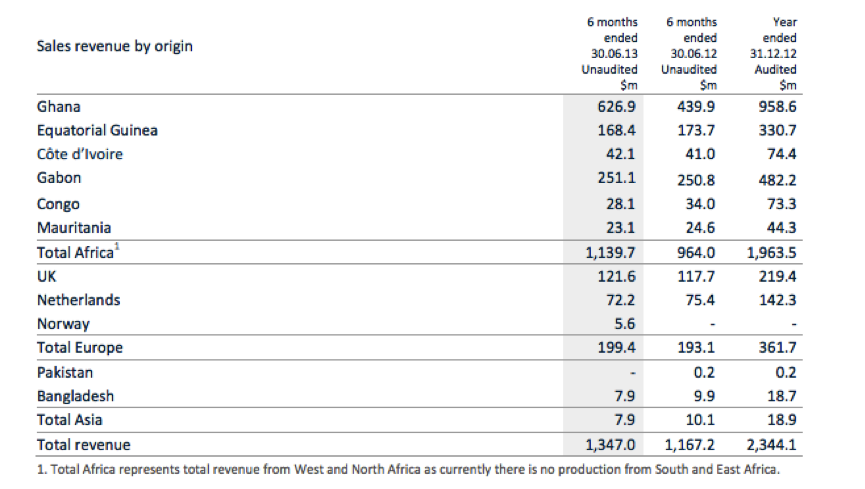

The company’s main interests are managed as three regional business units: West & North Africa, South & East Africa and Europe, South America and Asia, with the Ugandan Jubilee field being the their flagship asset.

The making of Tullow and its West African aspirations started with the discovery of Jubilee. The Jubilee oil field is located in the Atlantic Ocean, 60km offshore Ghana.

It was discovered in 2007 and developed by Tullow. Equity partners include Kosmos, Anadarko, Sabre Oil & Gas, EO group and Ghana National Petroleum Corporation (GNPC).

The Jubilee appraisal and development programme began at the end of 2008 and the Odum, Mahogany-2, Heydua-2 and Mahogany-3 wells were drilled. The tanker vessel Ohdoh was converted for the field and renamed the floating, production, storage and offloading (FPSO) vessel Kwame Nkrumah MV21. Jubilee began production in 2010 and total proven reserves of the Jubilee oil field are around 2 billion barrels . Unfortunately the field was beset by technical problems hindering production in early 2013 and hitting revenues.

Also offshore Ghana, Tullow has the TEN field which is due to deliver first oil in 2016 but with a $5 billion investment requiring farm out partners which are likely to be announced in early 2014.

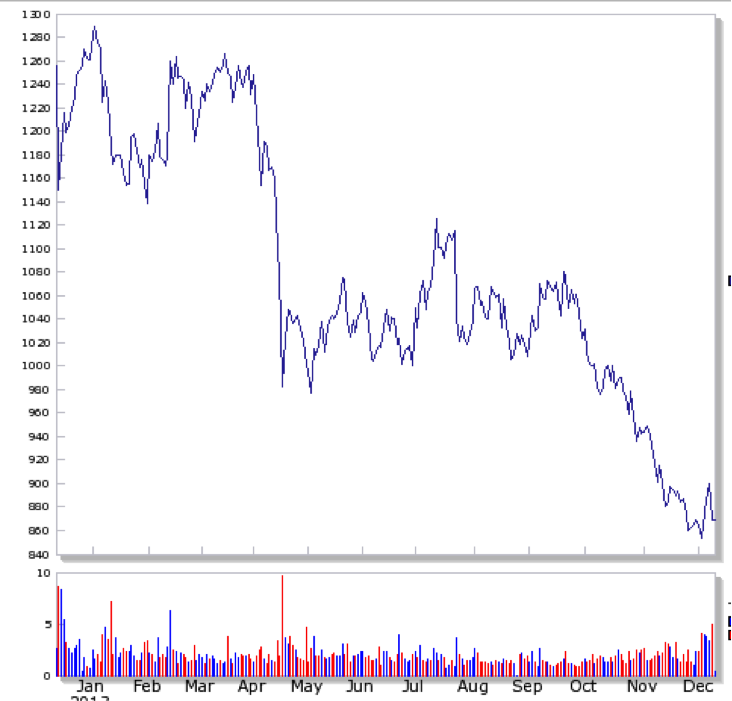

The shares have had a rough 2013 as a result of the Jubilee setbacks, drilling failures and the ongoing tax dispute problems with Heritage oil. This is despite some quite significant new finds in Northern Kenya (potentially making resources close to 0.5 billion barrels) and in the Barents Sea offshore Norway.

In August 2013, Tullow won a court action against Heritage Oil and Gas Ltd, and receiving payment of $345.8 million in August 2013. However, on 20 September 2013, the Court of Appeal granted Heritage permission to appeal the judgment with the appeal hearing expected to take place in May 2014.

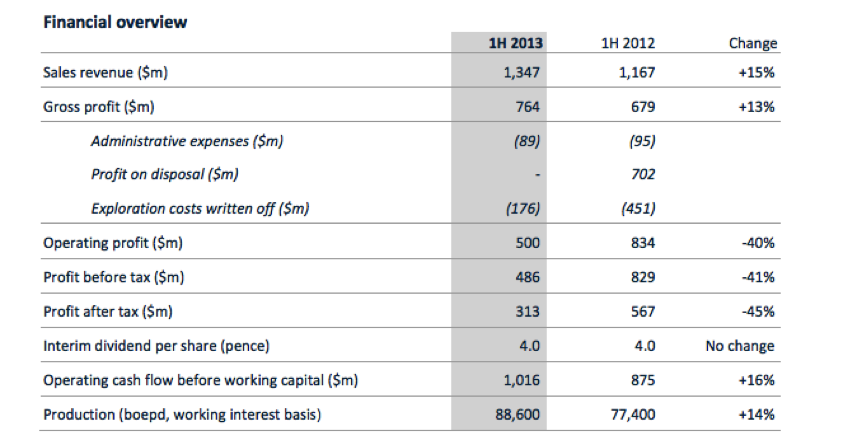

Financial overview first half 2013

The company had 13 exploration wells and 14 appraisal wells drilled in the first half of 2013 with a 63% overall success ratio. They had some major success in the Barents Sea offshore Norway with the Wisting Central light oil discovery. Their Ghana Jubilee field which on track to deliver average 2013 production of around 100,000 bopd.

The company had 13 exploration wells and 14 appraisal wells drilled in the first half of 2013 with a 63% overall success ratio. They had some major success in the Barents Sea offshore Norway with the Wisting Central light oil discovery. Their Ghana Jubilee field which on track to deliver average 2013 production of around 100,000 bopd.

Forecast capital expenditure for 2013 is around $2.0 billion. As of 11 November 2013, net debt was around $1.8 billion and un-utilised debt capacity is US$2.5 billion. On 6 November 2013, Tullow completed an offering of $650 million of 6% senior notes due in 2020 having originally offered $500 million.

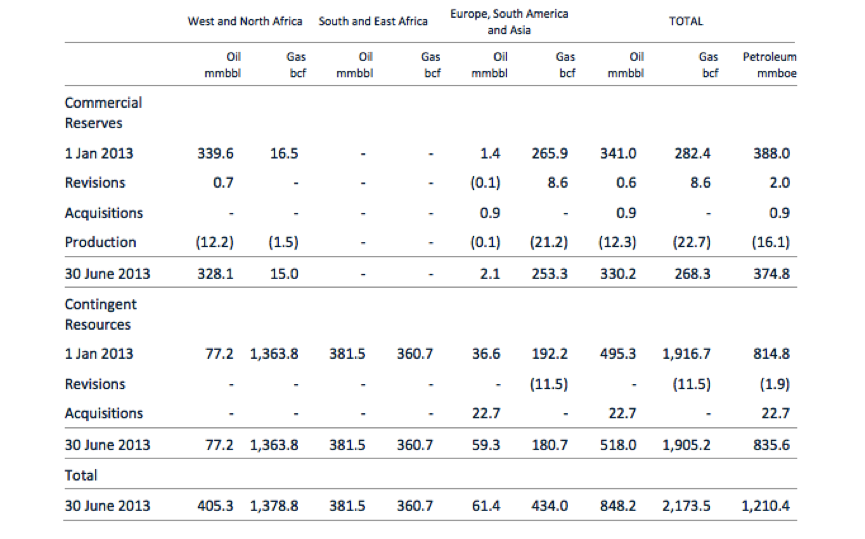

Resources and Reserves

Tullow has a total of 375 million barrels of commercial reserves, with another 836 million barrels of contingent resources.

Summary of recent exploration activity

WEST & NORTH AFRICA

Mauritania

The first well in the offshore Mauritanian basin commenced at the end of August 2013. The first well, Frégate, in the C-7 licence is expected to reach total depth in December 2013.

In the CI-103 exploration block in Côte d’Ivoire, the Paon-2A appraisal well commenced drilling on 24 October 2013.

In Gabon, the Crabe exploration well (KCM-1) in the Kiarsseny Marine licence was completed in October 2013 and has been plugged and abandoned as a dry hole. The rig has now moved to drill the Perroquet well (KPM-1), also in the Kiarsseny Marine block.

SOUTH & EAST AFRICA

Kenya & Ethiopia

Drilling results earlier in 2013 on the Ngamia-1 and Twiga South-1 wells have now produced prospective resoources of around 250 million barrels. The flow testing programme at Ngamia-1 in the Lokichar Basin had a cumulative constrained flow rate totalling 3,200 bpd of 25 to 35 degree API sweet waxy oil with no indication of pressure depletion

In late September 2013, the ekales-1 wildcat well in Block 13-T in Northern Kenya found 60-100 metres of net pay.. On 22nd November, the Agete-1 well on Block 13-T in Northern Kenya also announced an oil discovery, with 100 metres of net pay.

The Amosing exploration well, south of Ngamia-1, and the Etuko-1 well test commenced in November.

All operations in Block 10BB and Block 13T in Northern Kenya were temporarily suspended on 28 October 2013 as a precautionary measure following demonstrations by local people. Operations resumed on 8 November 2013 after successful discussions relating to the operating environment with central and regional government and local community leaders. These discussions led to the signing of a Memorandum of Understanding which clearly lays out a plan for the Government of Kenya, county government, local communities in Northern Kenya and Tullow to work together inclusively over the long-term and to ensure that operations can continue without disruption in the future.

On 9th December, Tullow announced that Tultule-1 on the South Omo Block in Ethiopia was a duster.

Mozambique

In July in Area 2, offshore Mozambique, the Cachalote-1 well and sidetrack discovered 38 metres of gas bearing sandstone in the upper target which was none commercial. In September, the Buzio well was drilled but failed to encounter hydrocarbons. Two dusters.

EUROPE, SOUTH AMERICA & ASIA

Europe

In early September 2013, Tullow made a light oil discovery of 50-60 metres net pay in the Hoop-Maud Basin in the Barents Sea using the Leiv Eiriksson rig, coincidentally the same rig used by Falkland Oil and Gas and Borders and Southern in the South Falklands basin in 2012

In late October 2013, drilling of the Wisting Alternative well was completed but encountered minor oil shows in poor quality reservoir rock.

The Mantra well commenced in November.

South America

In French Guiana, the fourth and final well in the drilling programme, GM-ES-5 commenced on 9 August 2013. Results are awaited.

Outlook for Tullow in 2014

Tullow looks an interesting prospect at £8.61 given their riskier approach to exploration but on a 2014 p/e of 24 assuming earnings per share of 37p next year, it is by no means the cheapest in the sector (12 month range £8.51 – £12. 89).

All depends on Ghana’s Jubilee, a successful farm out on the TEN offshore field and further success in Kenya and the Barents Sea. The key though is the tax dispute win with Heritage oil to be confirmed in May next year at the appeal hearing. With $346 million at stake, this one is the one to watch!

Keeping the Kenyans happy to prevent further shutdowns is also a factor but the company seem to be on top of this.

The company’s proven reserves of 375 million barrels means that at its current market cap of £7.8 billion, each 2P barrel equates to $32 a barrel. Pretty pricey. Contingent resources look significant, but will take time to move to proven resources i.e. further appraisal and development wells and then Competent Persons Reports.

I prefer Premier to Tullow in terms of larger cap oil and gas right now but could be a good bet pre-litigation update with Herigate later next year.

Contrarian Investor UK

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.