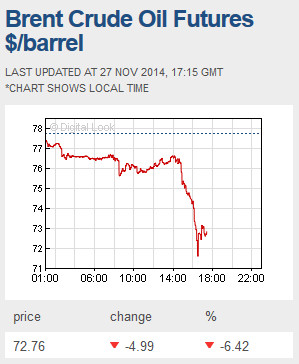

So it looks like OPEC are maintaining their daily output at 30 million barrels a day. Bad news for oil prices with Brent currently down $3 to $74.3 a barrel with WTI crude down $2.4 at $71. The OPEC statement reads as follows, “Recording its concern over the rapid decline in oil prices in recent months, the Conference concurred that stable oil prices – at a level which did not affect global economic growth but which, at the same time, allowed producers to receive a decent income and to invest to meet future demand – were vital for world economic wellbeing. Accordingly, in the interest of restoring market equilibrium, the Conference decided to maintain the production level of 30.0 mb/d, as was agreed in December 2011. As always, in taking this decision, Member Countries confirmed their readiness to respond to developments which could have an adverse impact on the maintenance of an orderly and balanced oil market.”

At these sort of prices high output onshore fields like those in Saudi Arabia which have costs as low as $10 a barrel in some of its largest fields are still highly profitable but the non-conventional shale fields in North America and even the North Sea start looking less economic at $60-70 a barrel. Merrill Lynch recently said“With production costs ranging from $50 to $75/bbl at the well head, a decline in Brent crude oil prices to $85 would likely be a major blow to US shale oil players and lead to a significant slowdown in investment.”

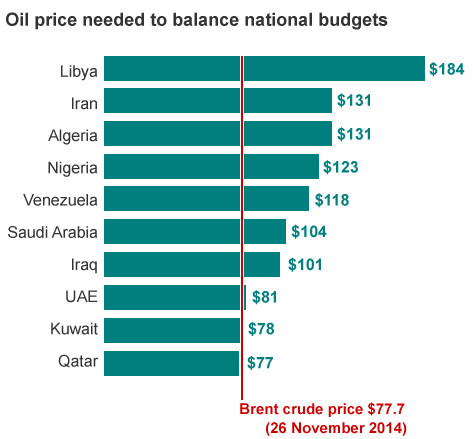

But longer term even Saudi Arabia will want oil prices to move higher with it needing a price of $83 to balance its national budget but with the Saudi central bank having reserves worth $734.7 billion the country’s leadership won’t be panicking any time soon. For operators planning on projects in frontier areas like the Arctic with highly expensive offshore wild catting, a few executives may be having second thoughts in the new era of lower oil prices.

Trade body Oil & Gas UK’s Activity Survey put average unit operating costs (UOC) at £17 ($28.85) per barrel in 2013 but the number of fields with a UOC greater than £30 per barrel doubled in the previous 12 months.Speaking at Oil & Gas UK’s conference in Aberdeen last week, John Pearson, group president, Europe at oilfield services company AMEC, said the average barrel produced in the UKCS, with gas included, is now worth around $60 a barrel, and many of the mature field lifting costs are very close to that.

The oil price fall may be bad for corporate energy profits but ultimately good for the world economy especially for those countries where taxation is a lower proportion of the price of a gallon of fuel e.g. the United States. It seems the Gulf States have a plan and are willing to let other world players like Russia and Venezuela sweat a little.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Brent Crude falls over 4% to less than $75 a barrel

Nov 27, 2014 at 3:35 pm in Market Commentary by contrarianuk

So it looks like OPEC are maintaining their daily output at 30 million barrels a day. Bad news for oil prices with Brent currently down $3 to $74.3 a barrel with WTI crude down $2.4 at $71. The OPEC statement reads as follows, “Recording its concern over the rapid decline in oil prices in recent months, the Conference concurred that stable oil prices – at a level which did not affect global economic growth but which, at the same time, allowed producers to receive a decent income and to invest to meet future demand – were vital for world economic wellbeing. Accordingly, in the interest of restoring market equilibrium, the Conference decided to maintain the production level of 30.0 mb/d, as was agreed in December 2011. As always, in taking this decision, Member Countries confirmed their readiness to respond to developments which could have an adverse impact on the maintenance of an orderly and balanced oil market.”

At these sort of prices high output onshore fields like those in Saudi Arabia which have costs as low as $10 a barrel in some of its largest fields are still highly profitable but the non-conventional shale fields in North America and even the North Sea start looking less economic at $60-70 a barrel. Merrill Lynch recently said“With production costs ranging from $50 to $75/bbl at the well head, a decline in Brent crude oil prices to $85 would likely be a major blow to US shale oil players and lead to a significant slowdown in investment.”

But longer term even Saudi Arabia will want oil prices to move higher with it needing a price of $83 to balance its national budget but with the Saudi central bank having reserves worth $734.7 billion the country’s leadership won’t be panicking any time soon. For operators planning on projects in frontier areas like the Arctic with highly expensive offshore wild catting, a few executives may be having second thoughts in the new era of lower oil prices.

Trade body Oil & Gas UK’s Activity Survey put average unit operating costs (UOC) at £17 ($28.85) per barrel in 2013 but the number of fields with a UOC greater than £30 per barrel doubled in the previous 12 months.Speaking at Oil & Gas UK’s conference in Aberdeen last week, John Pearson, group president, Europe at oilfield services company AMEC, said the average barrel produced in the UKCS, with gas included, is now worth around $60 a barrel, and many of the mature field lifting costs are very close to that.

The oil price fall may be bad for corporate energy profits but ultimately good for the world economy especially for those countries where taxation is a lower proportion of the price of a gallon of fuel e.g. the United States. It seems the Gulf States have a plan and are willing to let other world players like Russia and Venezuela sweat a little.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.