A bit of calm returned to proceedings this week, with even a weak US non farm payrolls number on Friday failing to dent renewed optimism after January’s bear month.

The first 5 weeks or so of 2014 proved to be the fertile correction territory that was so badly needed after the huge gains in global equity markets in 2013. With worries about emerging markets triggering a sell off in currencies, the VIX, the fear index, spiked last week to levels not seen since the 2008/2009 financial crisis.

As I said in my article last weekend, I always believed a sell off would come and this was the time to top up on favoured stocks after the “January sales”. As Buffett once said, “”We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” This week the bulls seem to be firmly back in control, despite Non-farm payrolls for January coming at 113,000 versus expectations of at least 180,000. The decline in the unemployment rate to 6.6% and higher labor force participation rate was the focus rather than the topline miss. Bargain hunters were out in force after Monday’s big sell off signaled capitulation.

Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch said on Friday that he believed that it was the end to the stock-market pullback that began in January, “The “big capitulation out of stocks and into U.S. Treasuries” represents the “end of Jan/Feb correction,” and on emerging markets, “Another $7 billion to $8 billion outflow next week would trigger a contrarian buy signal”

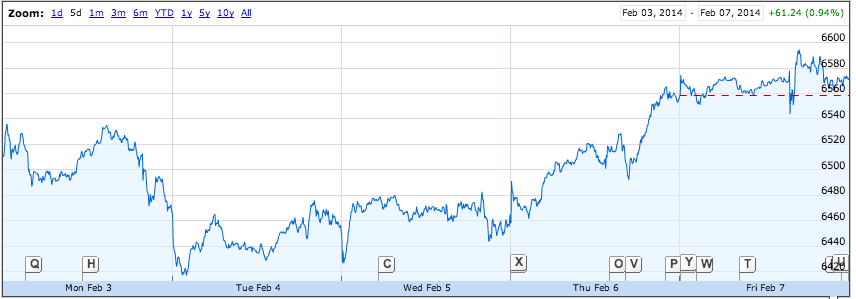

The FTSE 100 finished the week at 6,572 up 0.9% for the week whilst the Dow Jones Industrial Average finished up 0.6% at 15,794 after gaining 165 points on Friday during a volatile session on US non-farm payrolls day. On Monday the Dow posted a 326 point loss which proved to be the low point for the correction, but the Dow Jones is still down 4.7% since the beginning of 2014. The S&P 500 had a gain this week after 3 weeks of losses with a 1.3% rise this week to 1,797.

Average daily volume of 4 billion resulted in the largest average weekly volume since May 2012. For the Nasdaq it was the biggest volume week since October 2011.

The “wall of worry” has somewhat been climbed after the avalanche of bad news from China, Argentina and Turkey meant that investors lost their footing. With a correction of around 6% as of the beginning of this week, it took some of the heat out of the inflated optimism. There are reasons to be optimistic on many measures given the expected growth of the global economy this year and pretty good earnings from plenty of big names including Google, Facebook and others. But with many sectors including consumer discretionary and tech/biotech showing enormous gains it was time for a breather as evidenced by the 21% drop in Twitter shares on Thursday after underwhelming fourth quarter 2013 earnings.

Earnings seem to be delivering particularly from consumer discretionary companies. The blended earnings growth rate rose to 8.1% from the 7.8% rate in the previous week, up from the projected rate of 6.3% at the start of the year.

This week, new Federal Reserve Chair Janet Yellen will give her first monetary policy report to Congress, first to the House Financial Services Committee on Tuesday, and then to the Senate Banking Committee on Thursday.

Of course the end of the week could have been a dead cat bounce before more falls, but many “bargain hunters” seem to be keen to pick up stocks at these levels. February will be an interesting month and I certainly don’t expect the highs to be retested any time soon. Stability would be good for a while if the emerging markets behave themselves!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Equity market correction appears to be over for now as investors dismiss poor US non-farm payroll data and pile back into markets

Feb 9, 2014 at 4:06 pm in Market Commentary by contrarianuk

A bit of calm returned to proceedings this week, with even a weak US non farm payrolls number on Friday failing to dent renewed optimism after January’s bear month.

The first 5 weeks or so of 2014 proved to be the fertile correction territory that was so badly needed after the huge gains in global equity markets in 2013. With worries about emerging markets triggering a sell off in currencies, the VIX, the fear index, spiked last week to levels not seen since the 2008/2009 financial crisis.

As I said in my article last weekend, I always believed a sell off would come and this was the time to top up on favoured stocks after the “January sales”. As Buffett once said, “”We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” This week the bulls seem to be firmly back in control, despite Non-farm payrolls for January coming at 113,000 versus expectations of at least 180,000. The decline in the unemployment rate to 6.6% and higher labor force participation rate was the focus rather than the topline miss. Bargain hunters were out in force after Monday’s big sell off signaled capitulation.

Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch said on Friday that he believed that it was the end to the stock-market pullback that began in January, “The “big capitulation out of stocks and into U.S. Treasuries” represents the “end of Jan/Feb correction,” and on emerging markets, “Another $7 billion to $8 billion outflow next week would trigger a contrarian buy signal”

The FTSE 100 finished the week at 6,572 up 0.9% for the week whilst the Dow Jones Industrial Average finished up 0.6% at 15,794 after gaining 165 points on Friday during a volatile session on US non-farm payrolls day. On Monday the Dow posted a 326 point loss which proved to be the low point for the correction, but the Dow Jones is still down 4.7% since the beginning of 2014. The S&P 500 had a gain this week after 3 weeks of losses with a 1.3% rise this week to 1,797.

Average daily volume of 4 billion resulted in the largest average weekly volume since May 2012. For the Nasdaq it was the biggest volume week since October 2011.

The “wall of worry” has somewhat been climbed after the avalanche of bad news from China, Argentina and Turkey meant that investors lost their footing. With a correction of around 6% as of the beginning of this week, it took some of the heat out of the inflated optimism. There are reasons to be optimistic on many measures given the expected growth of the global economy this year and pretty good earnings from plenty of big names including Google, Facebook and others. But with many sectors including consumer discretionary and tech/biotech showing enormous gains it was time for a breather as evidenced by the 21% drop in Twitter shares on Thursday after underwhelming fourth quarter 2013 earnings.

Earnings seem to be delivering particularly from consumer discretionary companies. The blended earnings growth rate rose to 8.1% from the 7.8% rate in the previous week, up from the projected rate of 6.3% at the start of the year.

This week, new Federal Reserve Chair Janet Yellen will give her first monetary policy report to Congress, first to the House Financial Services Committee on Tuesday, and then to the Senate Banking Committee on Thursday.

Of course the end of the week could have been a dead cat bounce before more falls, but many “bargain hunters” seem to be keen to pick up stocks at these levels. February will be an interesting month and I certainly don’t expect the highs to be retested any time soon. Stability would be good for a while if the emerging markets behave themselves!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.