The market is pretty dull right now, though moving largely upwards. Market volatility is low, valuations are high and for the contrarian investors who have been betting on a significant market correction over the last few months, for now their bets aren’t coming good.

An example of a vocal UK investment bear is Sebastian Lyon. Britain’s equivalent of Nouriel Roubini, nicknamed “Dr Doom”. Though Roubini, ever the pessimist, has been more positive of late saying recently that of many of the risks to the global economy had receded. He pointed to an improving European economy and stronger euro, steadying of the economy in Japan, and a marked improvement in the United States. He praised the Federal Reserve for its unconventional monetary policy which he forecast would last for a few more years, supporting equity markets.

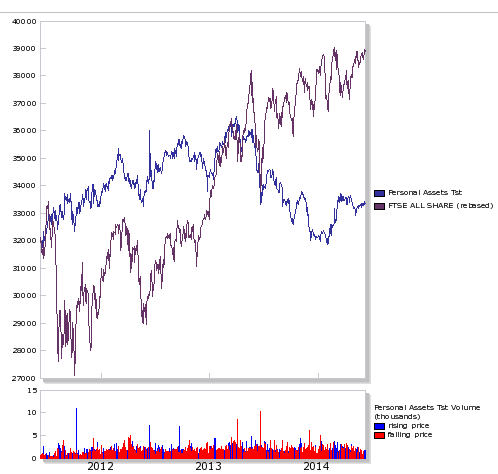

Sebastian Lyon, Chief Executive of Troy Asset Management has had a bearish view on the market for a couple of years, preferring to avoid large holdings in equities at recent valuations. He continues to be wary of risk-assets, and expects a full-scale correction in the foreseeable future and believes investors piling into equities now are making a big mistake. His decision to avoid in his view “expensive stocks” has dragged down his funds including the Trojan fund and Personal Assets Investment trust.

Lyon says: “We are in the midst of an extraordinary and unprecedented monetary experiment which is unlikely to end well,” “Stock markets are back at their all-time highs – in nominal terms, at least – but valuations are overstretched and vulnerable, and we have yet to see the negative consequences of the US’s tapering of QE on markets which have grown addicted to this sweet poison.” “Those piling into equities today may well be locking in very low prospective returns with commensurate high volatility and downside risk.” “Prudence will not always be punished. It is reckless behaviour that is ultimately penalised with permanent losses. Stock market bubbles make investors look foolish either before or after the peak. The last year gives no doubt as to where we stand.”

Will Lyon and the pessimists be right? They could spend a long time waiting for that crash that’s for certain given the Central Bank back stops which for now seem to be iron clad despite the Federal Reserve tapering of their asset purchase programme. Look at what happened last week with the ECB. But remember John Paulson who made $4 billion betting against sub prime debt back in 2007 when everyone else said he was crazy given the strength of the housing boom at the time.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Stock market excitement certainly not on the agenda right now

Jun 10, 2014 at 3:37 pm in Market Commentary by contrarianuk

The market is pretty dull right now, though moving largely upwards. Market volatility is low, valuations are high and for the contrarian investors who have been betting on a significant market correction over the last few months, for now their bets aren’t coming good.

An example of a vocal UK investment bear is Sebastian Lyon. Britain’s equivalent of Nouriel Roubini, nicknamed “Dr Doom”. Though Roubini, ever the pessimist, has been more positive of late saying recently that of many of the risks to the global economy had receded. He pointed to an improving European economy and stronger euro, steadying of the economy in Japan, and a marked improvement in the United States. He praised the Federal Reserve for its unconventional monetary policy which he forecast would last for a few more years, supporting equity markets.

Sebastian Lyon, Chief Executive of Troy Asset Management has had a bearish view on the market for a couple of years, preferring to avoid large holdings in equities at recent valuations. He continues to be wary of risk-assets, and expects a full-scale correction in the foreseeable future and believes investors piling into equities now are making a big mistake. His decision to avoid in his view “expensive stocks” has dragged down his funds including the Trojan fund and Personal Assets Investment trust.

Lyon says: “We are in the midst of an extraordinary and unprecedented monetary experiment which is unlikely to end well,” “Stock markets are back at their all-time highs – in nominal terms, at least – but valuations are overstretched and vulnerable, and we have yet to see the negative consequences of the US’s tapering of QE on markets which have grown addicted to this sweet poison.” “Those piling into equities today may well be locking in very low prospective returns with commensurate high volatility and downside risk.” “Prudence will not always be punished. It is reckless behaviour that is ultimately penalised with permanent losses. Stock market bubbles make investors look foolish either before or after the peak. The last year gives no doubt as to where we stand.”

Will Lyon and the pessimists be right? They could spend a long time waiting for that crash that’s for certain given the Central Bank back stops which for now seem to be iron clad despite the Federal Reserve tapering of their asset purchase programme. Look at what happened last week with the ECB. But remember John Paulson who made $4 billion betting against sub prime debt back in 2007 when everyone else said he was crazy given the strength of the housing boom at the time.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.