Shanghai Composite index last 12 months

The Chinese Shanghai Composite index has had an incredible rise over the last few months. Today it closed down 5% at 2,856 after rising as high as 3,090 at one point. The index is up 39.5% for 2014, 24% in the last month and 32% in the last 12 months helped by Chinese retail investors piling into the market causing a rise of bubble like proportions. The rise over the 3000 level was the highest point in three and a half years. Trading volumes have been huge with turnover reaching $128 billion a day, close to the record of December 2013.

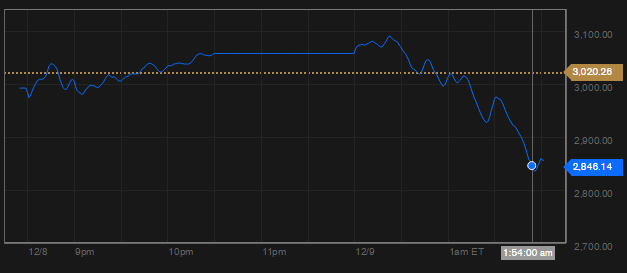

Shanghai composite December 9th 2014

Chinese stocks have been rising sharply since April when the Bank of China loosened monetary policy which was then further boosted by efforts to improve access to Chinese stocks by foreign investors. Recently the China Securities Regulatory Commission warned investors about the risks of investing with significant margined share purchases. The outstanding value of stock purchases through borrowed money rose to a record 575 billion yuan as of December 5th.

It looks like Chinese investors have gotten a little carried away with the stock market euphoria. Is today’s fall a minor blip in the upward trajectory or a more serious pull back? With so much share purchases on margin, it wouldn’t take too much of a fall to trigger an avalanche of margin call selling by retail investors.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Shanghai Composite finally falls a little after stellar rise

Dec 9, 2014 at 11:17 am in Market Commentary by contrarianuk

Shanghai Composite index last 12 months

The Chinese Shanghai Composite index has had an incredible rise over the last few months. Today it closed down 5% at 2,856 after rising as high as 3,090 at one point. The index is up 39.5% for 2014, 24% in the last month and 32% in the last 12 months helped by Chinese retail investors piling into the market causing a rise of bubble like proportions. The rise over the 3000 level was the highest point in three and a half years. Trading volumes have been huge with turnover reaching $128 billion a day, close to the record of December 2013.

Shanghai composite December 9th 2014

Chinese stocks have been rising sharply since April when the Bank of China loosened monetary policy which was then further boosted by efforts to improve access to Chinese stocks by foreign investors. Recently the China Securities Regulatory Commission warned investors about the risks of investing with significant margined share purchases. The outstanding value of stock purchases through borrowed money rose to a record 575 billion yuan as of December 5th.

It looks like Chinese investors have gotten a little carried away with the stock market euphoria. Is today’s fall a minor blip in the upward trajectory or a more serious pull back? With so much share purchases on margin, it wouldn’t take too much of a fall to trigger an avalanche of margin call selling by retail investors.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.